Oman: Upgrade from category 6/7 to 5/7 for medium- to long-term political risk

Highlights

- Oman is inverting the negative macro-economic trends that have characterised the country since the 2014 oil shock.

- Fiscal consolidation efforts and high hydrocarbon prices are benefiting the fiscal and external balances.

- The current outlook faces downside risks; a global slowdown could drive the oil price down, once again impacting the economy.

- Moreover, in the medium term the reliance on the hydrocarbon sector remains an important vulnerability for the country.

Pros

Cons

Head of State

Head of Government

Population

GDP per capita (PPP)

Income group

Main export products

Upgrade of the MLT political risk rating from category 6/7 to 5/7

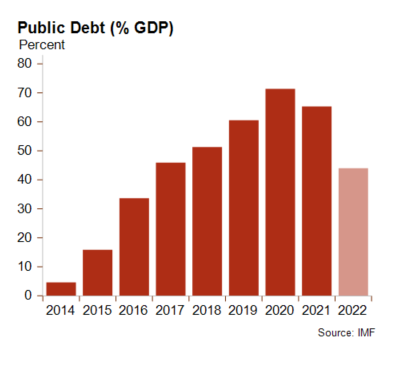

Oman’s MLT political risk rating was downgraded four times in the 2013-2020 period, moving from category 2 to category 6. Given the country’s reliance on the hydrocarbon sector, the 2014 oil crash led to a rapid deterioration of financial and economic indicators. Between 2014 and 2019, the authorities failed to implement significant reforms to adapt to the lower oil prices and this led to recurrent twin deficits from 2015. The financing of these deficits resulted in a rapid deterioration of public finances and external debt. For instance, public debt levels ballooned from 4.6% of GDP in 2014 to 60.5% in 2019. The Covid-19 pandemic shock and the oil market turmoil further exacerbated Oman’s weak economic situation. However, a turnaround is ongoing, as a result of fiscal consolidation efforts and supported by high hydrocarbon prices among other factors. The near-term outlook remains positive as current pressures related to the war in Ukraine are expected to drive high oil prices and the authorities have shown commitment to implementing fiscal reforms. For these reasons, Oman’s MLT classification has been upgraded from category 6/7 to category 5/7.

Gradual economic recovery from the Covid-19 pandemic shock

The containment measures limiting social contact coupled with the fall in oil prices and supply cuts under the OPEC+ agreement significantly impacted Oman. As such, real GDP contracted by an estimated 2.8% in 2020. From 2021, however, the country began a gradual economic recovery driven by the recovery in oil prices and oil production. The non-hydrocarbon economy is also estimated to have started to recover, supported by the moderate vaccination rates (62% of the population have received at least one dose of the Covid-19 vaccine) and the global recovery. The current business environment is positive for the country as demand pressures and supply bottlenecks – driven in part by the war in Ukraine – are driving oil and gas prices to multi-year heights. Thus, the country’s economy is projected to grow by 5.6% in 2022, fully recovering in real terms from the Covid-19 pandemic shock. The medium-term outlook also remains positive, supported by the implementation of Oman Vision 2040, which aims to diversify the economy and support job creation. It is worth noting, however, that the current outlook faces substantial downside risks. Notably, a global slowdown and a slowdown/contraction of major economies (China, USA, EU) could drive oil prices down, once again impacting the Omani economy and possibly the reform agenda timeline.

Since last year public finances have started to improve on the back of high hydrocarbon prices and fiscal consolidation efforts

Oil prices are currently above Oman’s fiscal break-even oil price (estimated at USD 73/barrel for 2022), improving the country’s fiscal prospects. Additionally, in 2020 the Omani authorities launched a medium-term fiscal plan aiming to reduce public debt. The plan includes a reduction in public spending (e.g. a cut in the civil service wage bill, subsidies, etc.) and reforms aiming at increasing non-hydrocarbon public revenue (e.g. the introduction of VAT in 2021). Accordingly, the overall fiscal balance deficit narrowed significantly in 2021 to 2.5% of GDP from 5.6% in 2019 (prior to the Covid-19 shock). For 2022, a primary fiscal balance of 7.2% of GDP and an overall fiscal balance of 5.6% of GDP are projected – the first surpluses since 2013. Therefore, public debt levels are also on a declining trend and are projected to fall significantly in 2022 from 65% of GDP in 2021 to 44% of GDP supported by the authorities’ commitment to use oil revenues to reduce public debt levels. Under the conditions of sustained fiscal reform and high oil prices, public debt levels are projected to fall to 28% of GDP by 2025 and public interest payments are expected to remain moderate in the medium term. There is, however, a risk that high oil revenues and subsequent high fiscal revenues could lessen the urgency of fiscal reforms in the short term and tempt authorities to delay key reforms.

High gas and oil prices are benefiting Oman’s external balances

In 2021 Oman’s current account deficit narrowed to 3.7% of GDP – the lowest level since the 2014 oil shock. The near-term outlook remains positive for the country, given the multi-year high oil prices, previous investments in expanding hydrocarbon production, and the gradual increase in production under the OPEC+ agreement. Oman is also set to benefit from the increased price of liquefied natural gas (LNG). Accordingly, for 2022 Oman is projected to run a current account surplus of 5.9% of GDP, thus inverting the negative trend that has characterised the country since the 2014 oil shock. Current account surpluses, however, are expected to gradually decrease in the medium term as oil prices and demand are projected to fall. Foreign exchange reserves have also increased significantly and are currently at an adequate level. The positive momentum is nevertheless clouded by downside risks. As Oman imports 65% of its wheat from Ukraine and Russia, it is very vulnerable to the disruption of agricultural markets caused by the war. Currently, the high hydrocarbon revenues are expected to offset the impact of the food market disruption, but a fall in hydrocarbon prices and a prolonged conflict could cloud the country’s near-term outlook. Furthermore, the reliance on the hydrocarbon sector, despite having a positive impact in the short term, remains a key vulnerability in the medium to long term. Oman is considered to be particularly exposed as the country is estimated to have lower oil reserves compared to other oil exporters in the region.

Analyst: Andres Hernandez Cardona – a.hernandezcardona@credendo.com