Senegal: Within a challenging environment, the MLT risk outlook remains stable

Highlights

- Economic growth prospects remain strong, driven by hydrocarbon production coming on stream.

- Regional liquidity levels are under sustained pressure amid restrained access to financial markets.

- Debt and deficit ratios are expected to be positively impacted by the jump in export revenues.

- The President’s attempts to circumvent the constitution raises political tensions.

Pros

Cons

Head of State

Head of Government

Population

GDP per capita

Income group

Main export products

Senegal’s economic performance continues to be among the most resilient in the region

Senegal’s macroeconomic fundamentals are strong compared to many regional peers, thanks to its traditionally stable political environment and recovering inflow of export revenues from private transfers, tourism, phosphate, gold, agricultural products (mainly nuts, cotton and fish) and more recently oil and gas. For years, public investments were the main driver of economic growth, under the "Emerging Senegal" Plan. In 2022, inflation reached 9.7%, the highest level seen since the early 1990s, largely due to food and energy price hikes resulting from the global turbulence in the aftermath of Russia’s invasion of Ukraine and a disappointing local harvest. Despite a small contraction in industrial production and a cut in public investment spending, real GDP growth remained strong in 2022 (4.7%) and is likely to accelerate to 8.3% in 2023, profiting from the onset of oil and gas production, recovering tourism revenues and industrial production, together with softened inflation expectations (5% in 2023). For 2024, GDP growth is expected to reach double digits driven by hydrocarbon production and long-term growth prospects should remain solid at 5%. Consequently, Senegal will continue to be one of the strongest economic performers in the region.

WAEMU liquidity levels are under increasing pressure following the war in Ukraine

Senegal is a member of the West African Economic and Monetary Union1 (WAEMU) and uses the common CFA franc as its currency. Membership of the WAEMU helps mitigate liquidity risks and promotes relative monetary stability. Reserves are pooled at the regional central bank (BCEAO), the currency is pegged to the euro and conversion of the CFA franc to the euro is guaranteed by the French Treasury. For some years now, several Member States have wanted to discontinue the current system as they see the union as a limitation for macroeconomic policy options and a form of neo-colonialism. At the end of December 2019, the ‘eco’ was officially announced as the future common regional currency for the 15 ECOWAS Member States, replacing the CFA franc. Various reforms have been implemented already; the requirement to deposit 50% of the pooled reserves with the French Treasury, for example, has been abolished. However, due to great divergence with regard to the form of the future currency, together with the severe economic impact of Covid-19 and recent global turbulence, the introduction of the eco has been postponed repeatedly and is not expected before 2027.

Liquidity pressure and falling gross foreign exchange reserve levels are currently significant risk factors in many parts of the world, and the WAEMU is no exception. Due to the worsened terms of trade (mostly net fuel- and food-importing Member States) and lower capital inflows (less favourable global financial conditions), foreign exchange reserves fell by 20% in 2022 (see graph below). Moreover, the depreciation of the euro – to which the CFA franc is pegged – against the US dollar contributed to a wider regional current account deficit in 2022, with higher import costs. However, the reserves import coverage should be adequate according to the IMF, at 4.5 months of imports. As of early 2023, foreign exchange reserves started to stabilise again, yet worsening international financing conditions weigh on financial access and could create more liquidity pressure over the course of the year.

Hydrocarbon investments should structurally raise current account revenues

Senegal has been struggling with structural double-digit current account deficits for years, and this year, the deficit is expected to be about 10% of GDP. As capital inflows are likely to be subdued amid a continuing deterioration of the global financial conditions, it could still leave a limited financing gap on the external balance of payments, leading to liquidity pressure and falling foreign exchange reserves. Looking forward, thanks to rising export revenues (oil and gas) and declining imports (completion of import-intensive hydrocarbon investments), the current account deficit should converge towards 4%–5% of GDP as of next year, while the lower current account deficit should be fully financed by FDI and a rise in portfolio investments. As a result, Senegal’s foreign exchange reserves are expected to gradually recover again in the medium term.

Senegal’s IMF Stand-by programme of June 2021 ended in January 2023, and negotiations with the Senegalese government for a new IMF-supported programme began in April 2023 to help address the most immediate financial needs. A strong consecutive supportive response from the IMF towards the WAEMU’s economic and financial challenges will help to ease near-term liquidity pressure, while total external debt and debt service ratios remain in sustainable territories and are projected to come down from 2024 as current account receipts are expected to increase.

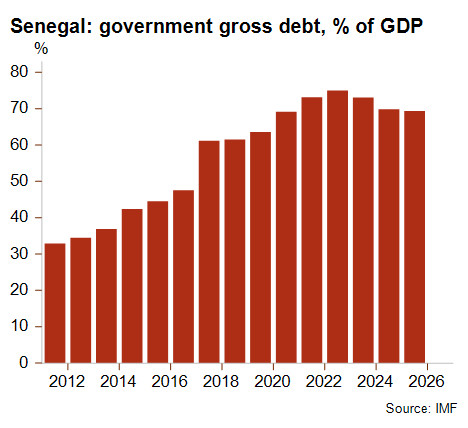

Steady rise in public debt stock of the past decade set to be reversed

After a decade of heavy government borrowing, Senegal’s public debt to GDP doubled from 33% of GDP in 2011 to 73.2% in 2021. In 2022, public finances took a hit, with a higher wage bill and costly energy subsidies (4% of GDP) resulting from soaring global energy prices. Accordingly, the fiscal deficit remained high in 2022 at about 6% of GDP, pushing up the public debt stock. The rise in export revenues anticipated this year, together with gradual fiscal consolidation, should nevertheless positively impact fiscal account projections – the fiscal deficit is expected to reach a manageable 4% again from 2024, pulling the public debt stock below 70% of GDP again from next year. Public revenues to GDP have been rising gradually and should grow beyond 20% from 2024. The IMF classifies Senegal as being at ‘moderate risk of debt distress’, down from being at ‘low risk of debt distress’ for several years2. Together with higher global interest rates, tighter financing conditions in the regional bond market will further muddle financial access, in the knowledge that about one third of Senegal’s public debt is financed regionally.

Political tensions on the rise in spite of stable institutions

High youth unemployment, corruption and inequality continue to fuel sporadic social unrest. Moreover, political tensions in Senegal have been high since President Macky Sall’s attempt to circumvent the constitution and contest for a third term in February 2024. However, the legislative elections in July 2022 resulted in significant gains for the opposition, leaving the ruling party with a tight majority of only one seat, which might be a presage reflected in the lowering odds for Macky Sall to secure another term at the next presidential election. Recent arrests of journalists and crackdowns on the opposition have been raising concerns over looming authoritarianism, and should the ruling government use more of these tactics in the run-up to the elections, violent unrest and demonstrations are to be expected. The coming year will be pivotal for Senegal to endorse its legacy of strong and democratic institutions.

Despite important risks identified in the short term, the medium-term outlook for Senegal remains stable

As in most West African coastal nations, Senegal is exposed to security risks related to spillovers of jihadist violence from Mali and Burkina Faso. Risks from climate change disasters and food insecurity are also important threats. Additionally, Senegal is exposed to disruptions in international supply chains due to the war in Ukraine and tightening global financial conditions. This will complicate refinancing opportunities and could generate more liquidity stress – the pressure on the WAEMU’s liquidity level is probably the most imminent risk for the region in the short term.

Senegal’s MLT political risk classification has been stable and in category 5/7 for almost two decades, and the outlook remains unchanged. In 2023 and 2024, economic and financial indicators are expected to gradually improve on the back of easing inflation and a lowering twin deficit thanks to accelerating GDP and export growth. As a result, debt ratios should decline over time, although this year’s debt services will be more elevated due to adverse financial conditions. Moreover, forecasts remain volatile given the uncertain geopolitical outlook and generally weaker global economic prospects this year.

Analyst: Louise Van Cauwenbergh – l.vancauwenbergh@credendo.com

1 WAEMU Member States: Benin, Burkina Faso, Côte d'Ivoire, Guinea-Bissau, Mali, Niger, Senegal and Togo.

2 There are currently no longer any African LICs (low income countries) at ‘low risk of debt distress’.