Armenia: Very strong growth in 2022 but uncertainty amid the war in Ukraine and tensions with Azerbaijan

Highlights

- Very strong growth in 2022 thanks to Russian money inflows and transit trade to Russia.

- A positive outlook for the business environment risk.

- A sharp improvement of liquidity indicators but a stable outlook given the high levels of tension with Azerbaijan.

- The strong improvement of macroeconomic indicators is deemed to be partly cyclical and partly structural.

- A stable outlook for MLT political risk for now.

Pros

Cons

Head of State

Head of Government

Population

GDP per capita

Income group

Main export products

A positive outlook for the business environment risk

Following the invasion of Ukraine and the severe sanctions imposed on Russia, the business environment of Armenia was downgraded to category F/G, as the expected contraction of the Russian economy was expected to have a highly negative impact on the country’s business environment. After all, Armenia relies on energy imports and on Russia for trade, investment and as the main source of remittances.

However, the predictions did not materialise. On the contrary, the dram (AMD) appreciated against the US dollar (see graph above representing AMD against USD, where a decrease signifies appreciation). Real GDP was very strong in 2022 and is estimated to have reached almost 11% in 2022.

The strong resilience of the economy is explained by various factors, notably the large influx of Russians in Armenia and related large inflows of money from Russia that boosted domestic consumption. Moreover, as shown in the graph below representing Armenia’s current account receipts, exports of goods, services and net private transfers increased sharply in Q2 and Q3 2022. The high increase in services is related to tourism receipts, while net private transfers are likely to be explained by money inflows from Russia. The increase in goods exports may be due to trade transit to Russia, even though – according to official figures – re-export remains limited.

Looking forward, the outlook for the business environment risk is positive as real GDP growth is expected to decelerate compared to 2022, but remains at about 4% this year. That being said, the business environment remains hindered by the relatively high lending rate, limited access to credit and the risk related to the institutional framework, despite recent improvements in World Bank governance indicators for the rule of law and control of corruption.

A stable outlook for the ST political risk

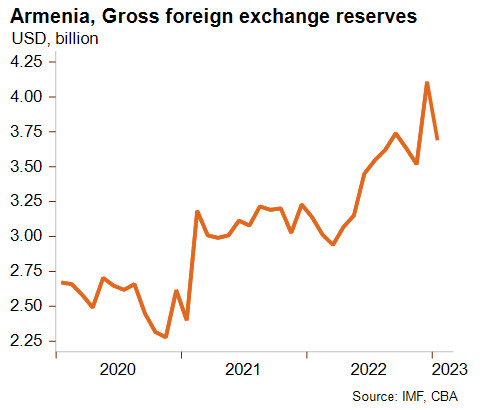

Despite the sharp rise in energy costs, Armenia’s current account balance turned into a surplus in Q1 and Q2 2022 and gross foreign exchange reserves (see graph below) increased sharply despite a recent drop.

Despite the significant improvement of Armenia’s liquidity and the IMF precautionary Stand-by Agreement, the outlook for the short-term political risk remains stable. This is largely explained by the continuing high levels of tension with Azerbaijan around Nagorno-Karabakh. In December, Azerbaijan implemented a blockade on the only road linking Armenia to its enclave, and as a result large shortages of goods and medicines are being reported in Nagorno-Karabakh. This deteriorating situation is due to multiple factors, notably the lack of Russia’s tangible support for Armenia as well as the rising importance of Azerbaijan as a key gas supplier for the EU.

Tensions between the two neighbours around the disputed territory date back to 1991, when the region, dominated by Christian Armenians, declared its independence from Azerbaijan (which is predominantly Muslim). This was followed by an armed conflict between Armenia and Azerbaijan that ended only due to a UN ceasefire agreement in 1994. Negotiations on the status of the Armenian-supported breakaway region of the Republic of Nagorno-Karabakh remain in deadlock, despite mediation from Russia and Western powers. In 2020, tensions flared up to a brief open war that ended with a fragile Russian-brokered ceasefire. Given the complexity of the situation, tensions are likely to remain high in the coming years, so any concession to Azerbaijan would be highly unpopular in Armenia and could lead to a resurgence of domestic protests that call for the resignation of the reform-minded Prime Minister Nikol Pashinyan. However, the recently announced EU civilian monitoring mission is likely to prevent tensions from spiralling into renewed conflict.

MLT political risk

Tensions with Azerbaijan and a strained relationship with Turkey – despite recent improvements – are factors weighing on the MLT political risk, along with the high external indebtedness and associated debt services. On the positive side, monetary and fiscal policies remain prudent, and since January 2021, the central bank has gradually increased its policy rate to stem inflation pressures (see graph below, showing the annual inflation rate and the central bank refinancing rate). As a result, inflation is now on the decrease. Meanwhile, the fiscal rule framework should help the authorities to keep their public finances under control.

Looking ahead, the economic boom witnessed in 2022 is unlikely to be repeated in 2023 as it is partly related to the large influx of Russian citizens. The improvement of other macroeconomic indicators (such as public debt, external debt, current account balance and inflation) is therefore not expected to be repeated this year. That being said, if the improvement proves to be more long-lasting than currently expected, Credendo will be inclined to upgrade its MLT political risk rating to reflect Armenia’s heightened solvency.

Analyst: Pascaline della Faille - P.dellaFaille@credendo.com