Tunisia: Weak macroeconomic fundamentals will continue to weigh on near and medium-term prospects

Highlights

- Tunisia’s economic and liquidity prospects have improved this year.

- However, Tunisia’s short- and medium-term economic prospects remain subdued.

- Tunisia’s economic woes are compounded by its very high external debt levels and very weak public finances.

- With these challenges projected to persist over the medium term, Credendo has maintained its ST and MLT political risk classifications.

Pros

Cons

Head of State

Head of Government

Population

GNP per capita

Income group

Main export products

Tunisia’s economic and liquidity prospects have improved this year. After years dominated by concerns about the country’s ability to meet external obligations, confidence in the country has increased. Still, despite these welcome developments, the North African country’s short- and medium-term prospects remain mired by substantial challenges and deep macroeconomic vulnerabilities.

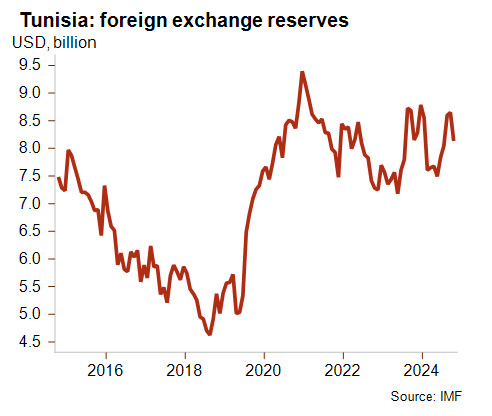

In 2024, Tunisia is set to finally recover real GDP levels on a par with its pre-pandemic levels. So far, the country’s economic recovery has been very sluggish, and it has trailed behind its North African peers. As a point of comparison, all neighbouring countries (excluding politically unstable Libya) had already managed to recover or exceed their pre-pandemic real GDP levels two years ago. The modest real GDP growth of 1.6% forecast for this year is driven by the strong performance of the buoyant tourism sector, along with private transfers. These are the country’s top sources of foreign exchange revenues, which have also helped to keep foreign exchange reserves at adequate levels. Moreover, the country has so far been able to meet its external obligations, such as the large USD 850 million Eurobond that matured last February.

Difficult socioeconomic conditions and weak macroeconomic fundamentals will continue to weigh on Tunisia’s near and medium-term prospects

The country’s short- and medium-term economic prospects remain subdued. For 2025, real GDP growth is projected at 1.6%, and over the medium term real GDP growth is projected to remain lacklustre, averaging less than 1.5% of GDP. Tunisia has experienced stagnant economic performance in general since the Jasmine revolution, amid political instability and under-investment. Meanwhile, recent external shocks such as the Covid-19 pandemic and the war in Ukraine have exacerbated the situation.

Tunisia’s economic woes are further compounded by its high external debt levels and very weak public finances. In fact, improving its fiscal and financial standing is and will remain a pressing challenge for the country. Following years of recurrent fiscal deficits (forecast at 6% of GDP in 2024), Tunisia has accumulated high debt levels, estimated at 83.7% of GDP for 2024. In 2025, to contain fiscal pressures, authorities are planning to introduce various reforms such as increasing taxes on high-income individuals and some corporates, but they are still refraining from reforms identified by the IMF as crucial to improving macroeconomic stability, such as reforming the subsidy system and structurally decreasing the wage bill. Instead, the government has denounced such measures as triggers for social unrest given the current socioeconomic hardships that Tunisia is experiencing. Under these circumstances, however, fiscal pressures are likely to persist.

The very weak public and financial standing increases the risks for the country’s economic prospects

As Tunisia has been curtailed from global financial markets and negotiations with the IMF have stalled, the country’s financing possibilities have become limited. In these conditions, authorities are increasingly relying on the domestic banking sector to finance public shortfalls. These trends could weaken the domestic banking sector and crowd-out the private sector, further damaging growth prospects. Moreover, there is also an increased risk that authorities will resort to more unorthodox measures. They are already drifting from standard economic policies, for example in February they used foreign exchange reserves to meet financial obligations. In addition, a new draft bill introduces the requirement to consult with the government for monetary policy and foreign exchange rate policy setting; if adopted, this new bill will weaken the central bank’s independence.

Considering persistent vulnerabilities and the very limited progress on improving macroeconomic stability, Credendo has maintained Tunisia’s current ST and MLT political risk classifications in category 6/7.

Analyst: Andres Hernandez Cardona – a.hernandezcardona@credendo.com