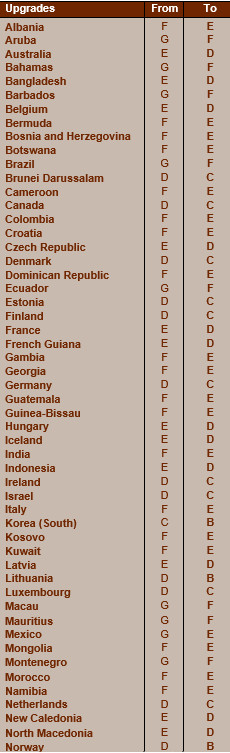

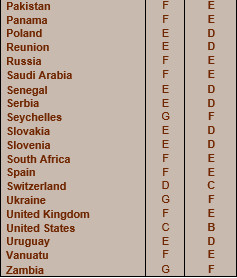

Business environment risk: A wave of upgrades fuelled by the improving economic outlook

In the framework of its regular review of business environment risk classifications, Credendo has upgraded a great number of countries. This follows last year’s wave of downgrades amid the sharp Covid-19 impact worldwide and today’s gradually improving economic outlook for many countries. This is mainly explained by stronger commodity prices, a slowly weakening Covid-19 impact and a rebound in the economic activity.

Business environment risk (main changes)

- Italy: upgrade from F/G to E/G

As for many countries of the Eurozone, Italy’ business environment risk rating has been upgraded. This upgrade reflects the recovery of the economy on the back of the improving health situation and the continuing easing of coronavirus containment measures. The rebound of the economy was actually stronger than expected in the first part of the year, when containment measures were progressively lifted, and thanks to the fact that the withdrawal of support measures was very gradual. Guarantees wholly or majority owned by the government allowed the increased indebtedness of companies and bank credits to remain safe and of good quality. While supply bottlenecks are weighing on the manufacturing sector (even though in a smaller extent than in other Eurozone countries, like Germany for example), high-frequency indicators and business surveys indicate that the momentum is expected to continue.

- Czech Republic: upgrade from E/G to D/G

The Czech Republic’s business environment risk rating has been upgraded from category E/G to D/G. After a sharp drop in real GDP last year, a strong rebound is expected in 2021 (4.2%) and in 2022 (4.3%). The recovery of the Eurozone’s manufacturing activity (among others in Germany, Prague’s largest trade partner) is supporting the export-oriented economy. The evolution of the exchange rate is also favourable. The Czech koruna appreciated against the euro, after a sharp depreciation, and is back at its pre-crisis level. The lending rate, which is another factor in the assessment of business environment, is on the rise as the central bank raised the interest rate from 0.75% to 1.5% to stem inflation pressure. Looking ahead, the Covid-19 pandemic and its related containment measures remain a threat, reinforced by the country’s relatively low vaccination rate (lower than the European average).

- Poland: upgrade from E/G to D/G

Poland’s business environment risk rating has been upgraded from category E/G to D/G on the back of favourable real GDP growth prospects. Poland has been very resilient to the Covid-19 crisis, with a real GDP contraction of 2.7% – a moderate reduction compared to its regional peers. Real GDP growth is expected to be high this year and next year (4.6% and 5.2% respectively) and could even be further boosted by the implementation of the Next Generation EU fund. That being said, the current political tensions between Polish politicians and the EU institutions could result in delays (rather than cancellation) in the transfers of EU funds to Poland. Another factor influencing business environment is inflation. High energy prices combined with strong consumer demand have fuelled the inflation, which is expected to reach 4.2% this year before decreasing to 3.3% next year. Looking ahead, the low vaccination rate – about a half of the population is fully vaccinated, a low rate compared to other EU countries – could cap economic recovery if new containment measures were to be re-imposed.

- Russia: upgrade from F/G to E/G

Russia’s business environment risk rating has been upgraded to reflect the ongoing economic recovery and the relative stabilisation of the exchange rate in 2021, although depreciation pressures, partly driven by geopolitical tensions and risk of further sanctions, persist. After a contraction of 3% last year, real GDP is expected to grow by about 4% this year amid higher commodity prices, the ease of the OPEC + oil production ceilings and higher consumer demand. The very sound macroeconomic policies adopted by the Russian authorities continue to play a key role in maintaining macroeconomic stability. For example, the central bank reacted promptly by increasing its benchmark interest rate to 6.75% (from 4.25% in the end of December 2020) to stem inflation pressures (+6.7% in August 2021). Looking ahead, the Covid-19 pandemic continues to represent a threat to the economy with only a third of the population vaccinated and the winter season approaching.

- South Africa: upgrade from F/G to E/G

South Africa’s business environment risk rating has been upgraded from category F/G to E/G. Following a sharp recession of 7% in 2020, the expected economic rebound in 2021 (4% GDP growth) has been stronger than initially expected. Higher international commodity prices have encouraged export revenues and supported a stronger and relatively stable rand in 2021. Outsized unemployment, power shortages and the ongoing pandemic risk are expected to continue to weigh down on domestic demand. Given the large socio-political obstacles, it will be very challenging for the current government to tackle the structural problems that have remained largely unaddressed over the past decade. Nevertheless, the recovery plan focuses on attracting investments, job creation and power supply and is fully underpinned by the commitments made to the IMF under the Rapid Financing Instrument of July 2020.

- Mauritius: upgrade from G/G to F/G

Mauritius’s business environment risk rating has been upgraded from category G/G to F/G. The country was classified in the highest risk category due to the severe economic impact of the Covid-19 pandemic on the island’s business cycle. It witnessed an economic crunch of 15.6% in 2020, while lower capital inflows and the sudden stop in tourism exerted serious pressure on the currency. The improving international economic climate is driving the 2021 recovery (3.6% GDP growth), even though tourism inflows are expected to remain subdued in the medium term. In 2022, economic growth is expected to reach 5.9%. The country will remain vulnerable to the economic trends in its major trading partners, especially the European markets.

Many countries in Latin America and Asia have been also upgraded. Find more information in our recent publication on Latin America and in our upcoming publication on Asia.