Country Risk Updates, Short-term political risk

In the framework of its regular review of short-term (ST) political risk classifications, Credendo has upgraded three countries (the Gambia, Kuwait and Senegal) and downgraded five countries (Comoros, Dominica, Kazakhstan, Swaziland and Zambia).

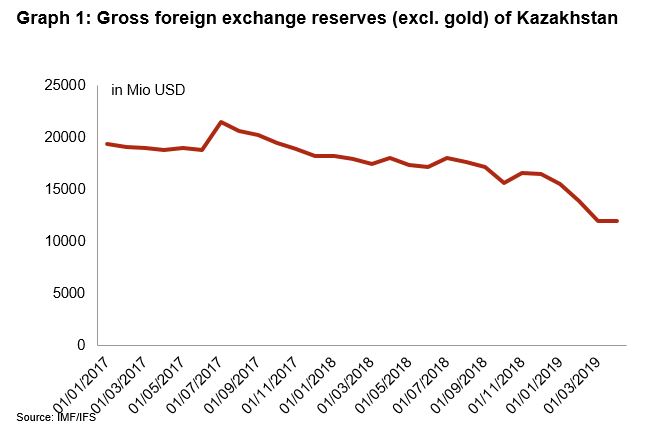

Kazakhstan: downgrade from 2/7 to 3/7

The gross foreign exchange reserves of Kazakhstan (excluding gold) decreased by almost 30% between December 2018 and April 2019 (cf. graph) and cover only 2 months of imports. As a result of this deterioration of liquidity, Credendo downgraded its short-term political risk to category 3/7 from category 2/7. This still favourable category reflects the lower level of foreign exchange reserves but also the positive facts that the short-term external debt is very low and the current account balance is in surplus.

The Gambia: upgrade from 6/7 to 5/7

Besides the democratic post-Jammeh transition, the government of President Barrow has made great strides in improving fiscal integrity and macroeconomic stability over the past year. The country’s liquidity position is gradually recovering thanks to higher tourism returns and aid inflows. As a result, gross foreign exchange reserves reached almost 4 months of import cover in February 2019, coming from less than 2 months in the end of 2016. Together with the limited short-term external debt levels, the bolstered liquidity incited an upgrade of the short-term risk classification from 6 to 5. Nonetheless, the Gambia’s export base remains confined (reliant on tourism and remittances), leaving the country with a structural current account deficit of about 10% of GDP. To finance its large development needs (currently focused on trade infrastructure projects), donor support continues to be a leading financial source. In order to improve the financial position of the government that is still in default today, the assurance of debt relief continues to be pivotal and weak state-owned enterprises need further reforms. These elements are central requirements for a new IMF financial arrangement that would help the country cater its large financial needs over the coming years.

Zambia: downgrade from 4/7 to 5/7

Zambia’s risk profile has been gradually deteriorating since the shift to a more autocratic and reckless policy-making after President Lungu came to power in 2015. Ever since, the government has been borrowing heavily for a series of debt-financed infrastructure projects which have pushed up public indebtedness towards unsustainable levels. At the same time, Zambia is exposed to the international copper market volatility, as it makes up for almost 60% of total export revenues. The copper sector is currently confronted with severe tax increases and government seizure attempts to meet the government’s large financial needs. As a result, export returns came under pressure and economic growth projections moderated. In addition, capital outflows have accelerated over the past months as investors are losing confidence. Consequently, foreign exchange reserves buffers held at the central bank dropped to 1.3 months of import cover in February 2019, while an adequate liquidity position requires a minimum of 3 months of import cover. Therefore, Credendo downgraded Zambia’s short-term political risk classification from category 4 to 5.