Despite the Covid-19 pandemic and external shocks, Tanzania enjoys strong economic growth and relatively low inflation

Highlights

- The political situation in Tanzania is relatively stable, as illustrated by the peaceful transition after the unexpected death of the former president.

- Current President Hassan has been trying to improve relations with foreign investors and the IMF.

- The current account deficit is expected to widen given the rising oil prices and continued infrastructure-related imports.

- The elevated level of external debt as a percentage of export revenues remains a concern.

- Stable outlook for Credendo’s political and business environment risk ratings.

Pros

Cons

Head of State and Government

Population

GDP per capita

Income group

Main export products

Peaceful transition after the unexpected death of the former president

The political situation in Tanzania is relatively stable, bearing in mind that former Vice-President Samia Suluhu Hassan was recently sworn in as President in March 2021, only a couple of days after the unexpected death of President John Magufuli (most likely after contracting Covid-19). Since then, President Hassan has been consolidating her position within the ruling Party of the Revolution (Chama Cha Mapinduzi (CCM)), within which the power is highly centralised and was held firmly by President Magufuli. The party dominates the political scene in Tanzania as it controls around 97% of the elected seats in the National Assembly. President Hassan is expected to remain in power until 2025 and serve out the remainder of Magufuli’s presidential term. Looking ahead, she is a likely candidate for the next presidential elections in 2025.

Improving relations with foreign investors and the IMF

President Hassan has been trying to improve government relations with investors, which were strained severely under former President Magufuli. The new regime has appointed business-friendly ministers and appears willing to improve the current dispute settlement mechanisms to attract new foreign investors. President Hassan is appealing to the donor community and foreign investors to fund diverse projects, ranging from improving public administration to transport infrastructure and LNG projects, which are possible thanks to Tanzania’s vast offshore gas resources. Relations have also improved with the IMF, as evidenced by the approval of emergency financing in 2021 following years of conflicts under former President Magufuli, who blocked the publication of the IMF Article IV Consultation Report due to criticism from the IMF over unpredictable macroeconomic policies and unreliable statistics.

Strong growth despite the ongoing Covid-19 pandemic

Economic growth in Tanzania has been strong over the past two years, with real GDP growth averaging 4.8% despite the Covid-19 pandemic and lower levels of tourism due to international travel restrictions – prior to the pandemic, the tourism sector accounted for almost a third of current account revenues. In 2022, economic growth is expected to remain strong: according to the IMF World Economic Outlook (April 2022), forecasts for real GDP growth stand at 4.8% for 2022 (see graph 1). This growth is mainly supported by the agricultural sector and public investment, and the return of tourism revenues is expected to drive growth even further in the current year. Downside risks to this forecast naturally relate to the Covid-19 pandemic, given the low vaccination rate of only 3% of the total population – and vulnerability to weather events such as droughts. The conflict between Russia and Ukraine has no direct impact on the country, as it has limited trade with each one. Since Tanzania is a net food exporter, the country’s foreign exchange position will benefit from higher food prices, while higher energy costs will have a negative impact. A global economic recession due to geopolitical tensions, although this is not the current baseline scenario, could affect the country, particularly if it affects regional trade partners and/or China.

Inflation likely to rise, but forecast to remain moderate

Tanzania has also been experiencing relatively low inflation over recent years (see graph 2), and one important element has been the stable exchange rate of the Tanzanian shilling to the US dollar. Indeed, although the Tanzanian shilling is free floating, it has tracked the US dollar very closely since 2019. Nevertheless, as in many other countries, annual inflation (standing at 3.7% in February 2022) is likely to rise given the increase in international oil prices, especially since Tanzania is a net oil importer. That being said, a rapid rise in inflation matching that seen in other countries worldwide is currently not on the cards, given the stable exchange rate and adequate domestic food supply that is largely shielding the country from the rising international food prices.

Public finances remain relatively healthy

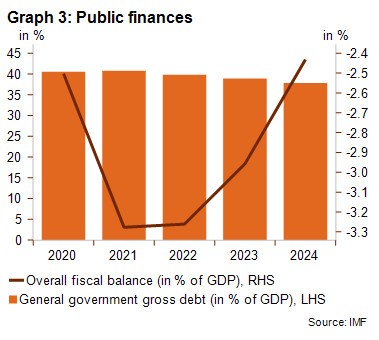

Tanzania’s public-sector debt vis-a-vis GDP is relatively moderate. The ratio is expected to remain relatively stable in the coming years, despite fiscal deficits due to expected robust real GDP growth (see graph 3). The fiscal deficits are projected to be financed primarily through domestic borrowing, which includes the rollover of debt, external non-concessional borrowing and grants and project-related financing. The Tanzanian government also intends to finalise the sovereign credit risk rating process, which will facilitate access to global financial markets through Eurobond issuances.

Current account deficit expected to widen in view of rising oil prices

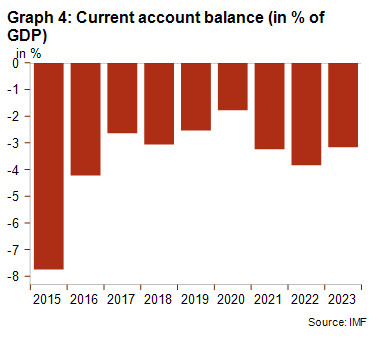

Over the past decade, Tanzania has been running structural current account deficits amid high infrastructure-related imports. Since 2016, however, the current account deficit has narrowed significantly to around -2.5% of GDP on average (see graph 3), with historically lower oil prices and an increase of gold revenues – the main source of export revenues, accounting for a third of current account revenues in 2021 – as the main explanations. In 2022, the current account deficit is expected to widen to -4.3% of GDP given that the expected increase in tourism, food and gold revenues will most likely still not offset the rising international oil prices. Furthermore, President Hassan remains committed to large infrastructure projects such as a hydropower project, railway infrastructure and an LNG terminal, continuing the high levels of infrastructure imports. Historically, the current account deficits have been funded through FDI inflows and external borrowing, a trend which is expected to continue, and therefore the nominal external debt of Tanzania is on the rise. Although the ratio of gross external debt to GDP has only deteriorated gradually, and is likely to remain broadly stable as nominal GDP is rising fast, the issue is related to the fact that the increase in external indebtedness has not been matched by a comparable increase in current account receipts. Moreover, in the context of a rising US interest rate, access to non-concessional external financing is likely to become more difficult and costly.

Stable outlook for Credendo’s political and business environment risk ratings

The business environment risk rating was recently upgraded (category D/G), and its outlook is stable. Business environment risk is supported by the strong economic growth, a relatively stable exchange rate and low inflation, and the short-term political risk rating also remains stable. The risk classification was upgraded in September 2021 (to category 3/7) due to the rising and adequate level of foreign exchange reserves of around five and a half months of import cover in January 2022, and the sustainable short-term external debt to current account revenues ratio. That being said, a deterioration of financial conditions, for example due to monetary tightening in the USA or the worsening of geopolitical tensions, could pose risks. The medium-to-long-term political risk rating is stable (category 6/7) after a downgrade last year, although the elevated level of external debt as a percentage of exports remains a concern – though the expected increase in tourism revenues and projected strong agriculture and gold exports should contain the ratio in the medium term.

Analysts: Jolyn Debuysscher J.Debuysscher@credendo.com and Jonathan Schotte J.Schotte@credendo.com