Egypt: The continuation of economic reforms is improving macroeconomic fundamentals

- President al-Sisi has placed himself firmly in control of the country.

- Still high public discontent from a difficult socioeconomic situation is weighing on the MLT political risk.

- Significant economic reforms under the supervision of a USD 12 bn IMF programme.

- Weak public finances, and further consolidation needed amid very high interest payments, resulting in still large deficits.

- A strongly improved liquidity situation since the decision to float the Egyptian pound.

In the last few years the economic situation in Egypt has improved due to the implementation of economic reforms under the auspices of the current IMF programme. This has led to an improvement in public finances, made an end to the chronic foreign exchange shortages, led to a recovery in economic growth and resulted in a large inflow of foreign investments and it was also one of the driving factors of the strong recovery of Egyptian exports. Taking into account these long-lasting improvements, Credendo upgraded its medium-/long-term political risk rating from category 6 to category 5 in May this year. Nevertheless, high public discontent arising from a difficult socioeconomic situation is still weighing on the MLT political risk outlook.

The political situation reflects a return to the old regime

Abdel Fattah al-Sisi has been ruling Egypt for almost five years. He came to power after Mohammad Morsi was ousted by the military in July 2013 amid street protests against his reign. Since coming to power Mr al-Sisi has placed himself firmly in control of the country. Opposing parties have been significantly weakened as the Muslim Brotherhood (MB) has been left voiceless. al-Sisi was officially elected as President in 2014 after securing 97% of the vote and won again in 2018 by the same percentage. The adoption of the constitution in April this year further consolidated his power as it increased his control over the judiciary and could allow him to stay in power until 2030. The political situation thereby marks a return to the old regime as was the case under the Mubarak presidency.

Egypt enjoys strong support from other countries. While relations with the EU and USA were initially strained after Morsi’s ousting, they have since recovered. The relationship with the USA has improved, especially since the Trump administration was elected. Since the dismissal of Morsi, Egypt has also benefited from a strong improvement in relations with the GCC countries (notably Saudi Arabia, the United Arab Emirates and Kuwait). This is explained by these countries’ aversion towards the MB, which is seen as an ideological competitor (particularly by the regime in Riyadh). As a sign of their support the Gulf countries have also provided the country with significant financial aid.

The IMF programme has led to a return of economic and improved macroeconomic stability

In the last few years Egypt has gone through a significant economic transition under the supervision of a USD 12 bn IMF programme. The programme was a necessity as the country was facing an imminent balance-of-payments crisis given the strong pressure on foreign exchange reserves. While in the years 2007-10 gross foreign-exchange reserves stood at around 7 months of import coverage, they dropped to just below 2 months of import coverage in summer 2016 when talks with the IMF were launched. Given that at that time Egypt still had a fixed exchange rate, this was a very low level. The result was that there were significant foreign exchange shortages. The IMF programme was approved by the IMF board after the Egyptian government secured USD 5-6 bn in bilateral financing, dropped the previously fixed exchange rate regime and started to cut fuel subsidies. The floating of the exchange rate and the reduction of fuel subsidies were very sensitive measures that in the past were considered to be too sensitive to touch. It is worth taking into account that in the five years before, two previous agreements with the IMF collapsed due to lack of political will to implement bold reforms in a context of already high social tensions.

Adherence to the three-year IMF programme has been good and significant structural reforms have been implemented. Currently Egypt has completed four out of five reviews. The programme is due to end in November 2019. The main uncertainty is whether the reforms will continue after the IMF programme ends (although no sharp reversal of key reforms is expected). While the Egyptian authorities are unlikely to request another IMF loan, a technical assistance programme or precautionary standby agreement is likely. This would be good news as it imposes a framework to continue the pace of reform.

Since the start of the IMF programme, real GDP growth has recovered. While in the period 2011-14 growth was around 2.6%, it has risen slowly, reaching 5.3% last year. In the coming years the IMF predicts that growth will reach around 6%. One of the strong drivers of growth has been recovering exports, as they have benefited among other things from the currency devaluation in 2016 that followed the move to a floating exchange rate and greater stability. Whereas before the devaluation, foreign exchange shortages were observed, the floatation of the currency was a game changer. Indeed, it strengthened reserves, which are currently sufficient to cover around 5.9 months of imports. Recognising the steady improvement of the liquidity situation, Credendo upgraded its short-term political risk classification from category 5 in 2015 to category 3 in December 2018.

Key fiscal consolidation efforts

Fiscal consolidation has been important for Egypt as public finances deteriorated strongly in the years following the Arab Spring. This was driven by large primary deficits and high interest payments. The primary deficit peaked in 2013 when it reached 6.3% but was still 3.5% of GDP in 2016, and given the high interest payments the overall deficit was 12.5% in 2016 around the time the IMF programme started. Under the consolidation the primary deficit has moved close to equilibrium. At the same time the overall budget remained around 9.8% of GDP at the end of 2018 as interest payments remained high and swallowed a whopping 54.4% of the total public revenue (excluding grants) in 2018.

The high fiscal deficits have pushed up the public debt-to-GDP ratio, which rose to almost 98% at the end of 2016, while it was already 74.6% of GDP in 2012. For a country like Egypt this is a very high level. Since then it has dropped somewhat, to 92.6% of GDP at the end of 2018, but expressed as a share of the total public revenue (excl. grants) it reached almost 540% at the end of 2018, which is a high share and which also indicates that the country has relatively limited public revenue. The IMF predicts that if Egypt adheres to the foreseen budget cuts, debt-to-GDP levels will drop to around 80% of GDP by 2022. This will require still significant consolidation, however, as the government mainly plans to reduce fiscal expenditure as public revenue as a share of GDP is projected to remain constant. The already implemented consolidation is a factor with a strong positive impact on the MLT political risk outlook.

External balances continue to highlight possible vulnerabilities

The evolution of current account receipts highlights one of Egypt’s main vulnerabilities: its strong reliance on tourism and private transfers as a source of foreign exchange receipts. After the terrorist attack on a Russian aircraft in 2015, tourism receipts dropped significantly. At the same time, private transfers dropped, due to lower remittances from Egyptians working in the Gulf countries. As both combined accounted for around 55% of total current account receipts, this led to a current account deficit of around 6% of GDP in 2016 and 2017. However, given the strong recovery of tourism, private transfers and goods exports, the current account deficit decreased to 2.4% of GDP at the end of 2018. Additionally, the Suez Canal is a major source of income for Egypt as it represents around 9% of total current account receipts. Although it is a relatively stable source of foreign exchange receipts it could slow with a slowdown in world trade. In the past, current accounts have been funded mainly through external borrowing. However, since 2015 there has also been an uptake in foreign investments, and additionally after the devaluation there has been a strong inflow of portfolio investments.

Deteriorating public finances, combined with the depreciation of the currency, have pushed up external debt levels in absolute and relative terms. Between 2013 and 2016 the total external debt-to-current-account-receipts ratio increased from around 85% to almost 150% and rose further in 2017. In 2018 we saw a decrease again on the back of a strong rise in total export receipts. At the end of 2018 the external debt-to-current-account-receipts ratio stood at around 150%. As total exports are projected to rise further in the coming years the ratio is expected to continue to decrease in the medium term. Even though the external debt has risen, the debt service has remained manageable. The projected decrease of the external debt-to-current-account-receipts ratio and the still low debt-service ratio are two of the factors driving the improved MLT political risk outlook.

Still high public discontent from a difficult socioeconomic situation is weighing on the MLT political risk

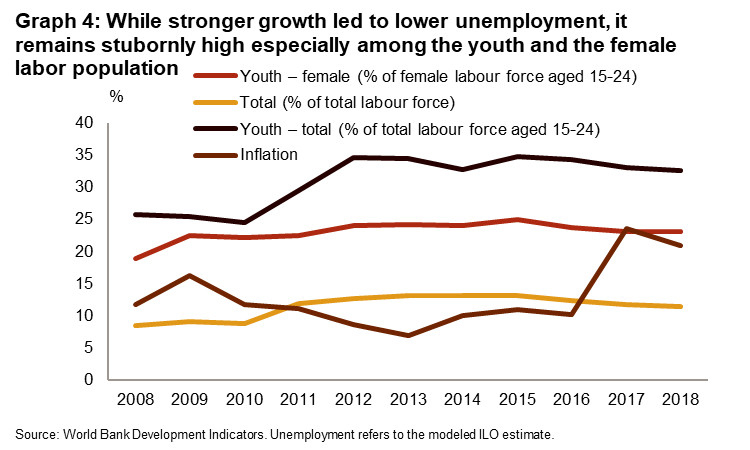

Public discontent in Egypt remains high for three main reasons. First of all the economic difficulties that were an important driver of the Arab Spring protests in the first place have not been resolved. Unemployment rose strongly in the years following the Arab Spring (see graph 4). Even if unemployment has been decreasing in parallel with the growth recovery, it remains high and is still higher than in 2010. Other important drivers of the protests such as deteriorating public services, rampant corruption, and energy, food and water shortages (and prices) very much remain issues today.

Related to this is the second reason: inflation remains relatively high. The rise in inflation was initially triggered by the devaluation of the exchange rate in the course of 2016. It was worsened by the reduction of energy subsidies and the introduction of a VAT tax. These measures led to 29.8% inflation at the end of 2017, but since then we have seen a steady reduction, to 14.4% at the end of 2018. Over time inflation is projected to decrease steadily given the central bank’s prudent monetary policies, and it is currently forecast that inflation will revert back to single digits by 2020. Thirdly, the reforms to consolidate public finances have increased the economic hardship for a section of the population. While under the IMF programme measures have been taken to protect the poorest in Egypt against the impact of subsidy cuts, among other things, still a large part of the population is effectively impacted by such measures. Therefore, the socioeconomic situation remains one of the most important drivers of the MLT political risk.

Analyst: Jan-Pieter Laleman – jp.laleman@credendo.com