Business environment risk: A wave of gradual upgrades, mainly in Europe

In the framework of its regular review of business environment risk classifications, Credendo has upgraded 59 countries and downgraded 4 others. Nearly half of the upgrades consists of a wave of rating improvements in Europe, where recession fears have receded amid a slightly less severe energy crisis. In other regions, high oil prices (MENA region), tourism recovery and peaked inflation have contributed to improve the economic outlook.

- Business environment risk

- All countries from the Eurozone: one-notch upgrade

Abating energy-related risks (in terms of prices and availabilities) and a net rebound inleading indicators and economic sentiment surveys in the beginning of this year have diminished the prospect of a recession in the Eurozone, a risk which led us to downgrade many countries of the region last September. Indeed, mild winter temperatures combined with efforts from households and companies to reduce their consumption, and the severe lockdowns in China, have dampened fuel demand and allowed prices to go down significantly. Gas stocks also remained above historical averages in the region. Even though core inflation (i.e. all goods excluding energy, food and beverages) is still rising, lower energy prices have permitted producer prices to decline, which is a very positive factor for the European industry.

However, the lagged impact of the tighter monetary policy and higher interest rates, in a context of still high (albeit decelerating) inflation, will weigh on the economic activity, justifying still cautiousness in our risk assessment. Risks are indeed titled to the downside with the recent financial turmoil posing some threats to financial stability. In case of a complete turmoil, driven by contagion through the European banking sector, which is not our baseline scenario, a recession of the region would then become the most likely scenario.

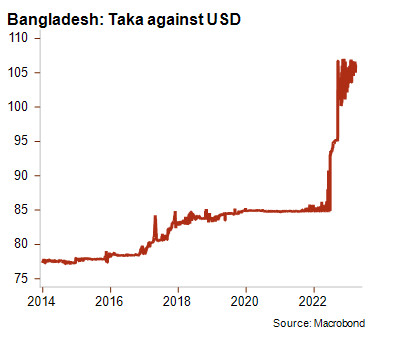

- Bangladesh: downgrade from category E/G to F/G

The country continues to face depreciating pressures on the taka amid a deep current account deficit. Commodity imports remain expensive and weigh on the country’s external accounts and foreign exchange reserves. Since the central bank let the taka float in September 2022 to save foreign exchange reserves and boost exports, the taka has lost 12% against the US dollar. The foreign exchange reserve crisis eased after the country received an IMF support in the end of January (after reaching a deal for a cautious 42-month loan of USD 4.7 billion) aimed to maintain macroeconomic stability. Still, in a region where two economies – Sri Lanka and Pakistan– are in deep crisis, the external environment remains very challenging, particularly due to high fuel and food prices, higher borrowing costs and a weakened western demand which is harming Bangladesh’s crucial garment exports. Therefore, the difficult economic momentum, visible through a weak taka, high inflation (above 8% in February), slowing growth and the absence of tangible improvement expected in the near term, has led Credendo to the downgrade Bangladesh’s business environment risk from E/G to F/G.