Brazil: Continued Covid-19 pandemic and its impact will mitigate economic recovery in 2021

Event

The Brazilian economy is showing contrasting signs as it is still suffering from the pandemic’s impact. On the one hand, the Brazilian economy recovered strongly in the third quarter of 2020, by 7.7% quarter-on-quarter (albeit still contracting by 3.9% on a year-on-year basis). On the other hand, the sharp rebound in Covid-19 cases since November will affect the fourth-quarter data. As for 2021, the persisting impact of the pandemic and uncertainties around the vaccine roll-out will cloud the economic recovery. The government’s national vaccination plan is expected to start as of next February and aims to vaccinate the whole population by the end of 2021.

Impact

As the world’s third most-affected country, with 6.9 million cases and more than 180,000 deaths as at mid-December, Brazil’s health and economic crisis is not over yet. GDP growth is forecasted to drop by 5.8% this year and to rebound by 2.8% in 2021.

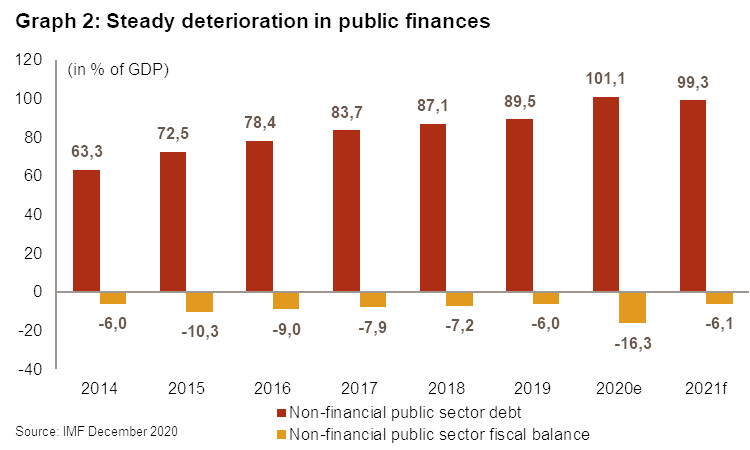

This scenario could be optimistic as the Covid-19 shock will remain a dominant risk next year too. Indeed, the vaccination programme will only take place gradually and benefit 25% of the population by the end of the first half of 2021. Logistics and vaccination resistance, including President Bolsonaro’s scepticism, will be major hurdles hindering an effective and rapid vaccination campaign. Moreover, a seemingly ongoing second wave of Covid-19 cases is likely to hit the economy again in the coming months after a strong recovery in the third quarter. Another downside risk comes from the withdrawal of the huge fiscal package, which has largely contributed to mitigating the size of the recession seen in many other Latin American countries. The fiscal stimulus, which has notably granted cash transfers to around 30% of the population, will not be extended in 2021. Indeed, the fiscal cost is immense as it could widen the fiscal deficit to 16% of GDP, and public debt to 100% of GDP, i.e. one of the highest levels among emerging countries. A return to the public spending cap and fiscal reforms will sharply reduce the fiscal deficit. However, in the short term, it could be difficult to achieve economically as long as the Covid-19 crisis continues, and politically as welfare payments to informal workers and poor people have been the main factors supporting Bolsonaro’s popularity. That’s why, with the virus resurging and presidential elections scheduled for 2022, Bolsonaro will probably temporarily extend some cash transfers at more moderate levels, and also take some fiscal measures to ease market concerns about fiscal sustainability, reduce borrowing costs and pressure on the Brazilian real. Given the further deterioration in public debt and higher long-term government bond yields, Brazil has increasingly issued cheaper short-term debts to meet financing needs, which will increase fiscal and debt rollover risks next year. For sure, Brazil’s dire public finances will remain a major risk in the coming years and harm the growth potential.

The forecasted moderate economic recovery in 2021 is also explained by the labour market situation with 10 million of net job losses reported between January and November, and an unemployment rate above 14%. This will widen the already high social inequalities and increase instability risks as from 2021. The slow improvement in employment will weigh on private consumption whereas corporate investments are likely to remain cautious in a still uncertain economic climate. On the positive side, global demand is likely to be more favourable to Brazil’s economy in 2021. A stronger China, Brazil’s first export market, is likely to increase its commodity demand and thus support international prices, and possibly investments as well. Moreover, the sharp US recovery in the second or third quarter could also make for an external economic boost. This will only occur gradually though. Brazil’s foreign policy will also matter economically. Accelerated Amazon deforestation has raised investors’ concerns and reputational risk, whereas the EU and the US under Biden’s rule are expected to put more pressure on linking climate and trade policies. Therefore, at some point, Bolsonaro might have to make policy adjustments to avoid isolation and risks of boycotts hitting the large agribusiness industry.

In the current economic context, Brazil’s commercial risk rating is in the highest risk category (C/C). This is explained by the deepest recession in three decades, a deterioration of the corporate payment track record (which could worsen further next year when economic support is withdrawn) and the flexible Brazilian real being at historic lows against the US dollar after a massive depreciation (-43% between January and October before a marked rebound as from November) notably as a result of large capital outflows. Currency pressure is likely to fall gradually over the next year when the Covid-19 shock wanes and if the government takes measures to address fiscal risks.

The Central Bank’s interest rate is expected to stay at an all-time low of 2% – which is lower than inflation that was above 4% in November and thus means real interest rates are negative – well into 2021, and bank lending is expected to be boosted as the risk is real that a sustained recovery will be delayed. Hence, the rating outlook is stable in the near term and could improve in the second half of 2021. The short-term political risk rating, taking into account the country’s external liquidity, is at 3/7. This reflects Brazil’s good liquidity position supported by ample foreign exchange reserves and a sharply reduced current account deficit (from 2.8% of GDP in 2019 to 0.3% expected in 2020) fuelled by a sharper contraction in imports vis-à-vis exports. The outlook could evolve from stable to positive in the next 12 months.

Analyst: Raphaël Cecchi – r.cecchi@credendo.com