Bangladesh: US import tariffs threaten Bangladesh’s crucial garment sector

Event

The threat of sharply higher US reciprocal import tariffs is hanging over Bangladesh’s economy like a sword of Damocles. The introduction of these tariffs has been paused until early July, leaving space for negotiating a bilateral trade deal. Meanwhile, political uncertainty amid the political transition process continues to harm the business environment and investor confidence, clouding the future economic outlook.

Impact

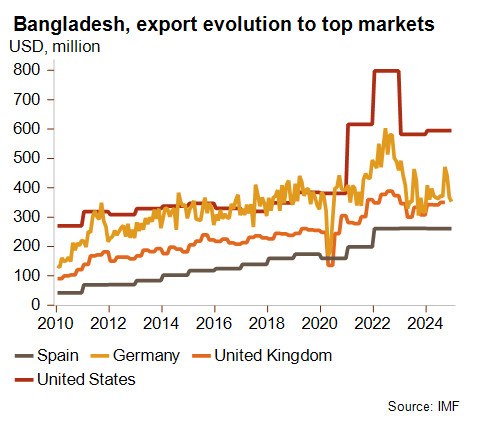

The pause in the introduction of US reciprocal tariffs – justified by the US trade deficit vis-à-vis Bangladesh, even though a universal 10% tariff is left in place – has been received with much relief in Dhaka after US importers had already started to pause orders. Indeed, the US market accounts for more than 15% of Bangladeshi exports and is the first destination of Bangladesh’s key garments sector. The garment industry is the country’s most important employer (4 million people employed), economic sector, exporting sector (90% of total exports) and by far the largest source of current account revenues (56% of total current account revenues). So it is no exaggeration to say that what is at stake is of fundamental importance for this garment-reliant economy.

It is at great risk from the US trade war, not only directly but also indirectly through the global economic slowdown, which is further hitting foreign demand for garments. Therefore, the interim government’s immediate priority will be to offer sufficient concessions to meet US requirements and obtain the biggest possible tariff reduction. When looking at the first list of US reciprocal tariffs, Bangladesh was imposed a very high tariff of 37%, which is more than textile and garment competitors India (27%) and Pakistan (30%), but less than Cambodia (49%) and Sri Lanka (44%), and obviously much less than China (145%). Final tariffs – on Bangladesh but also on other players in the garment sector in Asia and Africa – will matter a lot in a sector that is characterised by fierce competition and low-cost and low-margin operations. In view of tariff negotiations, several proposals are currently on the table. Dhaka might significantly increase imports of cotton (Bangladesh is the world’s second-largest importer), other agriculture resources (wheat, soyabeans, etc.) and US LNG, and could offer duty-free access to many US goods, aimed at reducing Bangladesh’s bilateral trade surplus. At the same time, Dhaka has been tightening its ties with China as a way to secure future financing and investments in a difficult economic environment.

Indeed, this trade shock is occurring in a difficult political and socio-economic situation. The ongoing political transition is expected to end between the end of 2025 and mid-2026, when elections will be held. However, pressures from the BNP opposition party to bring elections forward are growing. On top of that, high uncertainty continues to harm investor confidence and social unrest has become frequent in the garment sector on the back of difficult working conditions, factory closures and weaker Western demand. Therefore, a failure to get much lower US tariffs could have wide negative effects on the garment-reliant economy, raising liquidity and balance of payments risks. Social instability would also gain further traction as a result of potential large job losses and further deterioration of working conditions.

In this uncertain and risky trade context, which is likely to maintain the economy in a fragile situation, the outlook is negative for all country risk ratings.

Analyst: Raphaël Cecchi – r.cecchi@credendo.com