Uganda: Oil field development should lead to improved economic fundamentals

Highlights

- Large oil reserves were discovered in Uganda in 2006.

- Production is expected to start in late 2025.

- Oil production is expected to have significant positive effects on economic growth and Uganda’s fiscal and external position.

- Delays to the start of oil production are a distinct possibility and would push back the onset of these positive effects.

-

Climate change impact, cuts in official aid and regional instability are downside risks.

Pros

Cons

Head of State & Head of Government

Population

GNP per capita

Income group

Main export products

Oil in the Lake Albert basin to be exploited soon?

In 2006, Uganda's oil and gas sector saw significant developments, as exploration led to the discovery of several oil fields in the Lake Albert basin, including the Mputa, Kingfisher, and Tilenga oil fields. After appraisal, Uganda's crude oil reserves are estimated at 6.5 billion barrels, of which 2.2 billion are considered recoverable. According to the IMF, this makes Uganda's oil reserves the fourth largest in sub-Saharan Africa, after Nigeria, Angola, and South Sudan. The development of these reserves is progressing through the Kingfisher and Tilenga projects. Oil is projected to start flowing in late 2025, although delays are possible.

Oil production expected to have multiple positive impacts

Uganda has weathered the Covid-19 pandemic well, and economic growth is expected to remain robust. Uganda’s medium-term prospects are supported by the onset of oil production at the end of 2025. While the country would not become a major oil exporter, oil production is expected to boost growth and improve the fiscal and external positions.

Public finances

The IMF considers Uganda to have a moderate risk of external and overall public debt distress.

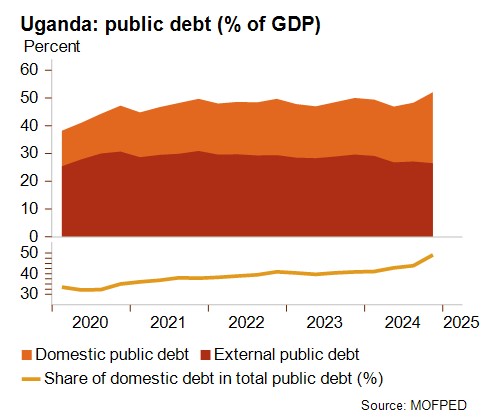

The country’s public debt reached about 54% of GDP in 2024. The public debt to public revenue ratio was above 350% for 2024, since public revenues are relatively modest. As shown on the graph below, the share of domestic debt – denominated in local currency – has increased recently. This development has mixed effects: while domestic debt is more costly than external debt and therefore pushes up the public interest payments on revenue – estimated to be around a quarter of public revenue – it avoids exposing the government to currency risk. Looking ahead, the fiscal situation is expected to improve, notably boosted by the onset of oil production. As a result, the fiscal balance is expected to turn into a surplus and public debt is expected to decrease.

Sharp improvement in the current account balance expected

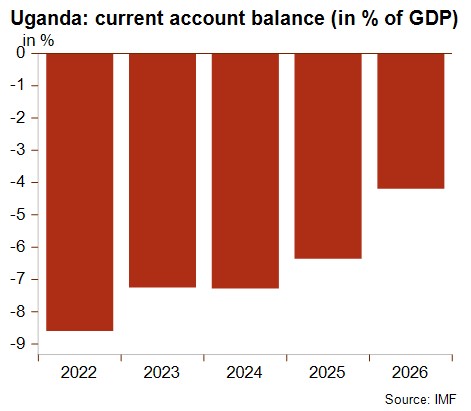

Uganda’s current account deficit remains elevated. The country’s current account receipts are increasing, due to rising coffee exports and high gold prices, as well as recovering remittances and tourism receipts. However, these factors are not enough to offset the increase in imported goods, largely reflecting rising oil project-related imports. Despite this, it should be noted that imports are mostly financed by foreign direct investment (FDI), rather than through external debt, thus mitigating some liquidity and solvency risk.

As shown on the graph, the current account balance is also expected to improve markedly once Uganda starts exporting oil and benefits from decreased imports related to oil infrastructure investments.

Business environment risk

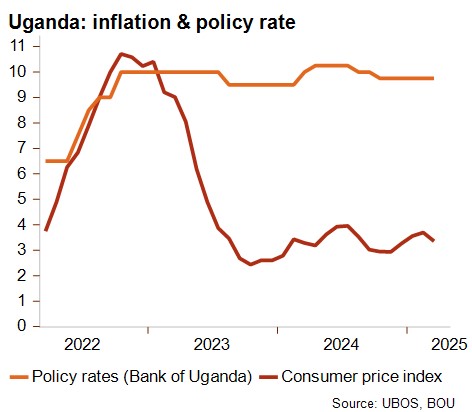

Credendo’s business environment risk rating assesses macroeconomic factors, such as economic growth, which can affect the payment capacity of all debtors in a country. Following a sharp increase in inflation (see graph below), Uganda’s central bank reacted promptly by raising its policy rate. Inflation went down sharply in the first half of 2023 and has been relatively stable at around 4% since then. Interest rates, however, have remained elevated, resulting in high borrowing costs which weigh on the business environment risk.

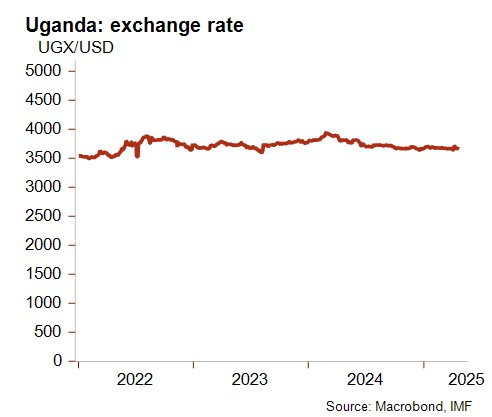

The Ugandan shilling has appreciated against the US dollar in the last year and is close to its strongest exchange rate since March 2023. The exchange rate against the US dollar has generally been stable in the last couple of years, with relatively limited movements in either direction.

Institutional factors also play a role in assessing the business environment risk, with several such factors taken into account. Perceived corruption in particular remains an issue; the World Bank’s governance indicators rank Uganda 170th out of 205 countries for ‘Control of Corruption’.

Taking all these elements into account, Uganda’s business environment risk rating is currently at category E/G.

Possible delays to the start of oil production and other downside risks

Considering the significance of the onset of oil production for various aspects of the economic situation, project delays represent a clear downside risk, depending on their extent. The two parts of the project that are of particular concern are the proposed oil refinery in Hoima and the East African Crude Oil Pipeline (EACOP). EACOP will transport crude oil from Uganda's Lake Albert oilfields to the port of Tanga in Tanzania, and as such, development of the pipeline also depends on the situation in Tanzania. The EACOP has encountered substantial opposition from environmental groups and financial institutions because of concerns regarding its effects on local communities, wildlife and climate change. Despite these obstacles, the project continues to advance, with completion anticipated by 2026.

There are several other downside risks and negative elements to be aware of. One of these risks is large fluctuations in oil prices. Once production has started, a large drop in oil prices would in turn have an impact on the magnitude of the different improvements outlined above. The “resource curse” is another risk for Uganda. The curse refers to the fact that countries rich in natural resources, such as oil, often experience less economic growth, lower rates of democracy, and poorer development outcomes compared to countries with fewer natural resources.

In addition, there is the Anti-Homosexuality Act (AHA), and its fallout. The act criminalises consensual same-sex conduct with penalties up to life imprisonment and includes the death penalty for "aggravated homosexuality". It was signed into law in 2023 and caused the World Bank to suspend all new public financing to Uganda in August of that year. Other international partners, such as the Democratic Governance Facility (DGF), have also withdrawn their support. In addition, the USA removed Uganda from the African Growth and Opportunity Act (AGOA) in January 2024, though the impact on exports was limited, reflecting the small share of US exports in total exports. Recent cuts to the USAID budget will also impact Uganda, particularly the health sector, with 2000 medical workers already laid off.

Climate shocks are also a risk, especially given Uganda's reliance on agriculture. Frequent floods and droughts, combined with high poverty levels, heighten this vulnerability.

Finally, the instability in the east of the Democratic Republic of the Congo (DRC) poses security and humanitarian challenges for Uganda. The country’s position is ambiguous: it has officially been in the DRC to help the government fight against Islamist militants since 2021 and has recently sent reinforcements, upping troop numbers to around 5,000, but it has also been accused by the UN of backing the M23 rebels, which Kampala denies.

Outlook

Uganda’s MLT political risk rating – which represents the solvency of a country – is currently classified in category 6/7. The outlook is positive given the expected improvement of the macroeconomic situation driven by the onset of oil production. The timeline for the start of that production is somewhat uncertain however, with some sources considering late 2026 likelier than late 2025. Uganda’s short term political risk rating – which represents a country’s liquidity – is currently classified in category 5/7.

Analyst: Jonathan Schotte – j.schotte@credendo.com