Mexico: Ongoing Covid-19 pandemic and government policies are hurting private businesses

- Mexico experienced a severe economic contraction of 8.5% in 2020, while a weak recovery can be expected this year.

- Bankruptcies in the private sector are forecast to rise due to the Covid-19 pandemic and government policies.

- Public finances deteriorated but to a lesser extent than in most Latin American countries.

- Many of Mexico’s states are heavily indebted and their capacity to honour payments is likely to be compromised in the coming months.

- Country risk ratings remain unchanged.

Latin America’s second-largest economy experienced a deep recession in 2020

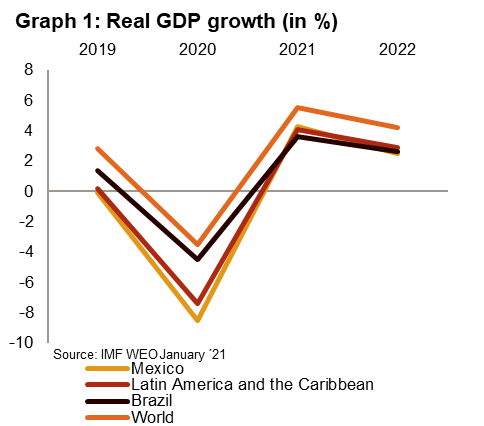

Like most Latin American countries, Mexico faced a deep recession over the past year, and the latest update from the IMF (January 2021) forecast a severe contraction of -8.5% in 2020 for Mexico. Furthermore, it is worth noting that Mexico experienced a deeper contraction than the average regional GDP growth of -7.4%, while the region was the world’s worst performing last year. This poor economic growth performance might come as a surprise, since Mexico – along with Brazil – implemented some of the least stringent restrictions when tackling the Covid-19 pandemic. However, alongside the ongoing health crisis and the consequential confinement measures, other factors have clearly had a negative impact on economic activity in Mexico. Firstly, the multiple changes to the rules of the game for investors has led to high uncertainty and falling investments for the country’s economy, and generally, lower investments lead to lower economic growth. Examples are manifold: scrapping plans for an airport and a brewery which were partially built, cancelling electricity auctions, rewriting gas pipeline contracts, as well as new labelling requirements for processed food manufacturers. Secondly, the ongoing austerity programme in Mexico is dampening economic growth, because unlike the route taken by many other countries, the Mexican government’s response to the economic slowdown has been fiscal austerity.

A weak recovery awaits for 2021

As graph 1 illustrates, an economic recovery of 4.3% and 2.5% is expected for Mexico in 2021 and 2022, respectively. This is quite weak given the deep recession last year and a weak performance compared with the world’s expected average real GDP growth rate. Furthermore, this recovery will be mostly due to the impact of a sizeable stimulus package in the USA, which implies higher economic growth in the USA and better exports for Mexico and stronger remittances. That said, the outlook is clouded by the high levels of uncertainty looming due to potential new Covid-19 waves, and in early January Covid-19 cases were vastly on the rise in Mexico, indicating a second wave. Though the country has been relatively quick to start its vaccination programme (launched late December 2020), as it stands it still hasn’t secured enough vaccinations for the entire population, leaving it vulnerable to more waves. On top of that, the efficacy of vaccines (against the Brazilian variant, for example), availability and the pace of rollout both in the USA and in Mexico could encounter setbacks, hurting economic activity in the coming months.

Bankruptcies in the private sector likely to rise

Measures to stem the Covid-19 outbreak, mainly involving localised lockdowns and restrictions, are hurting many businesses in Mexico. On top of that, government support for the private sector is extremely limited. Mexico has only spent an additional 0.7% of GDP on tackling the Covid-19 crisis – comprising mainly of loans to poorer households – compared to 8% of GDP in Brazil and an average of 4% of GDP for emerging markets. Furthermore, the government of President Andrés Manuel López Obrador is making decisions that could hurt the private sector even further: it favours a greater state role in the economy and won’t hesitate to revise contracts and impose new rules and controls. Examples of such policy decisions include a tax collection drive targeting large companies, a plan to ban the outsourcing of jobs and a 15% minimum wage increase in 2021. For these reasons, further bankruptcies and job losses can be expected in Mexico’s private sector in the coming months.

Public finances deteriorated but to a lesser extent than in most countries

Public finances have also been hurt by the pandemic, though to a much lesser extent than in most countries. According to the latest IMF report of October 2020, public debt stood at a moderate 53.7% of GDP at year-end 2019, and is likely to have risen to about 65.5% of GDP at year-end 2020, mainly as a result of severe economic contraction and depreciation of the Mexican peso (widening the fiscal deficit to about 5.8% of GDP in 2020). The public debt level is expected to remain around 65% of GDP in the coming years, an elevated but not unsustainable level, while fiscal deficits are expected to be relatively small in the coming years (-3.4% of GDP in 2021) and their impact on debt vis-à-vis GDP will be offset by the expected GDP growth. That said, payment troubles may unfold in certain state governments, given that most measures offered to date to mitigate the negative effects of Covid-19 on the private sector are being implemented directly at state government level. Many of Mexico’s states, however, are heavily indebted, and their capacity to honour payments is likely to be severely compromised in the coming months.

Political risk ratings remain unchanged

Mexico’s MLT political risk score has remained in category 3/7 for over a decade, and the country’s modest risk rating reflects its moderate external debt and debt service ratios, small current account deficit, deteriorating but sustainable public finances, poor economic growth in recent years and the country’s economic diversification, despite its great reliance on the US economy. The short-term political risk rating is in category 2/7, driven by the adequate level of foreign exchange reserves and relatively low levels of short-term external debt. Despite a challenging global environment, the outlook remains stable for both risk ratings.

Analyst: Jolyn Debuysscher – j.debuysscher@credendo.com