Road freight transport: Weakened European sector remains subject to further disruptions due to Covid-19

A significant drop in transported volumes and freight rates as a result of the pandemic

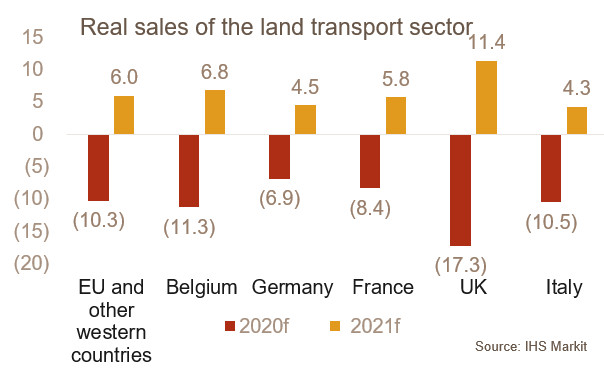

Like many sectors, that of road freight transport has been significantly and negatively impacted by the Covid-19 outbreak, at global level and in Europe in particular. In fact, the sector-related information supplier Ti Insight forecast at the end of last year that the European road freight sector would contract by 6.8% year on year in 2020 in real terms (holding prices and exchange rates constant). In nominal terms (holding only exchange rates constant), the figure changes to 8.3%. The greatest disruption occurred during the first wave of the pandemic in spring 2020 but the sector somehow recovered from the summer, with the lifting of border closures and the return of business activity and household consumption. However, the same source reports that this was short lived as the virus spread for a second time and many countries in the region were forced to implement new guidelines, partially closing economies once more. They forecast that the impact through the year will be greater for international than for domestic transport, with activity contracting by 8.0% compared with 6.2% for 2020. Domestic transport was particularly badly affected in Italy. According to IHS Markit, sales in the land transport sector (which also includes freight and passenger rail transport in addition to road transport) in the EU and other Western European countries contracted by 10.3% in 2020, in real terms (see graph below). A difference according to the transported products can also be observed, with the trade in pharma and ICT products having remained sustained through last year. As regards the positive impact that the e-commerce expansion could have brought, it seems that the sector has not benefitted from it as it would have required a change of fleet for most companies.

The pricing components of European road freight have also been altered by the pandemic. Some factors have driven higher prices, such as border disruptions, a particular issue causing significant queues and time delays at borders for trucks, often priced in the freight rates. Nonetheless, the overall effect has been to push prices down as the economic shock and fall in demand has led carriers to offer lower prices. The impact of lower prices can be observed in the financial results of logistics companies for the first nine months of 2020, with DHL Freight seeing, for example, an 8.7% fall in revenues despite volumes only falling by 0.9%. The lower freight rates were partly compensated for in profits by lower diesel prices, in particular in the first half of the year.

A short-term outlook still subject to many uncertainties

In the short term, the outlook will remain very much dictated by the evolution of the pandemic, concerns regarding the new variants and possible further lockdown measures until the vaccine has been broadly administered. Even though the European Commission and EU countries have taken action to mitigate the impact of the pandemic on the transportation sector in order to ensure the quick and continuous flow of goods across the EU and the fact that up to now the manufacturing sector has been resilient through the second wave, the recent introduction of testing for truck drivers entering France from the UK shows that barriers of all types remain possible. Whereas a recovery is expected in 2021, the sector is unlikely to recoup the sales volumes lost in 2020.

Diesel prices, which are an important driver of the health of the sector, are expected to remain fairly low as long as the pandemic is unfolding – which is positive for the sector – even though they should be on average a bit higher than the average price of last year.

Logistics companies dealing with the UK will obviously have to adapt and bear the costs of Brexit, principally consisting in a heavier administrative burden, even though the agreed deal between the EU and the UK recognises the validity of each other’s licences and permits and includes full transit rights. However, for British transporters, an additional limitation will come from the fact that only one drop-off and one pick-up from inside the EU and two pick-ups and drop-offs when crossing EU Member States will be allowed, representing a downgrade from EU membership when UK trucks could do three pick-ups inside an EU country before going back to the UK.

Also, in Central and Eastern Europe especially, wages of truck drivers, which are another major component of road freight costs, have risen as a result of the recent (pre-Covid) strong economic expansion and represent a drag for the sector.

In the medium to long term, the sector in European countries will become more and more constrained by environmental regulation. Various instruments could be used in the future to force a cleaner road transport sector, representing additional costs for the sector. They include increasing road tolls and their coverage, deploying clean fuels for transport, deploying intelligent transport systems, sharing best practices (including eco-driving) and encouraging the use of more energy-efficient transport modes, in particular collective transport or shared assets between firms.

To conclude, while Covid-19 has had a noticeable impact on the activity of the road freight transport sector in 2020, the new virus strains, possible related new lockdown measures and the drag on activity and demand from the manufacturing sector and households until the vaccine has been broadly administered remain a major source of uncertainty and risk for the sector.

Analyst: Florence Thiéry – f.thiery@credendo.com