Armenia: Upgrade of MLT political risk classification amid lower financial risk and lower risk of conflict with Azerbaijan

Highlights

- Following years of tension and conflict in Nagorno-Karabakh, Armenia and Azerbaijan are currently negotiating a peace agreement.

- Strong growth is expected despite ongoing economic slowdown.

- Moderate public debt and decreased external debt.

- Moderate liquidity.

Pros

Cons

Head of State

Head of Government

Population

Per capita income

Income group

Main export products

Significant reduction in tensions between Armenia and Azerbaijan

Over a very long period, relations between Armenia and Azerbaijan have been strained by their dispute over the Nagorno-Karabakh region dominated by Christian Armenians, which in 1991 declared its independence from the predominantly Muslim Azerbaijan. This was followed by an armed conflict between Armenia and Azerbaijan that ended with a UN ceasefire agreement in 1994. Since then, negotiations on the status of the Armenia-supported breakaway Republic of Nagorno-Karabakh had remained in a deadlock, despite mediation efforts from Russia and Western powers.

Following years of tensions and conflict in Nagorno-Karabakh, including a military conflict and a blockade of the region by the Azeri army, Azerbaijan’s military took control of the region in September 2023. At the end of September, Azerbaijan’s President, Ilham Aliyev, dissolved the previously unrecognised Republic of Nagorno-Karabakh, and as a result most ethnic Armenians left the region and relocated to Armenia, leading to a massive influx of refugees and putting Prime Minister Nikol Pashinyan under intense pressure. These recent developments imply that Azerbaijan is now in full control of the region.

Moreover, the risk of conflict in Nagorno-Karabakh has been drastically reduced. Given the significant difference in military capability between Armenia and Azerbaijan, Armenia is unlikely to retaliate and attempt to regain control of the region. In addition, Armenia can no longer rely on Russia’s military support due to the ongoing war in Ukraine, which has led to the country distancing itself from Moscow and looking to get closer to the West in the future. Recently, the government approved a bill to launch the process of applying for EU membership. The decision to join the EU would need to be approved through a referendum. However, any move towards the EU carries risks, as Moscow is likely to retaliate.

Last but not least, Armenia and Azerbaijan are currently negotiating a peace agreement that – once reached – would further decrease tensions between both countries, including around the Nakhchivan region – a landlocked autonomous territory of Azerbaijan. However, a key impediment to the peace agreement relates to Azerbaijan’s request for a change in Armenia’s constitution, which contains a statement that Nagorno-Karabakh is an integral part of Armenia. A constitutional referendum is planned for 2027. Along with improvements in the relationship between Armenia and Azerbaijan, relations with Türkiye are also improving.

Strong economic growth is expected despite ongoing slowdown

Since coming to office following the Velvet Revolution in 2018, PM Pashinyan has embarked on systemic reforms aimed at eradicating corruption, fostering the high-tech sector and developing the agriculture sector. This has resulted in an improvement in the country’s Corruption Perception Index published by Transparency International. Moreover, the IT sector has developed and its significance as a source of current account receipts has increased (to 6.9% in 2023), while more traditional sources of current account receipts – such as private sector transfers and compensation of employees – have decreased (to 6.2% and 3.9% of total current account receipts in 2023, respectively). Overall, Armenia’s current account receipts are more diversified today than they were a decade ago.

The economy benefited from the war in Ukraine, which resulted in significant inflows of funds from businesses and migrants and rerouted exports. Consequently, real GDP growth has been very strong over the past three years. Looking ahead, even if a slowdown is underway, the economy is expected to perform well, with long-term real GDP projections close to 5%.

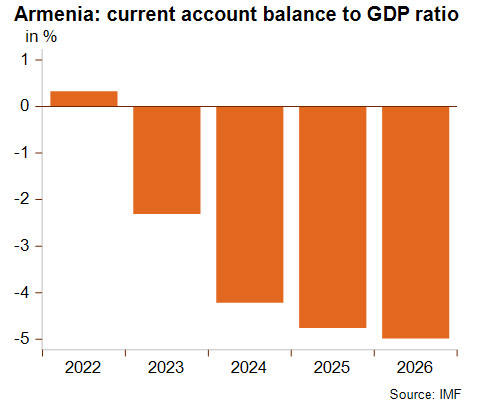

Amid a normalisation in tourism and private transfers, the current account deficit has widened to 4.2% of GDP in 2024 and is expected to be close to 5% of GDP in the coming years as the positive effects from the war in Ukraine phase out. Looking ahead, reliance on Russian gas remains a risk given the ongoing rapprochement with the EU. In the past, reductions in gas prices were used by Russia to gain concessions such as participation in the Russian-led Eurasian Economic Union and ownership in key assets, and as a result, Russia owns strategic infrastructure such as the gas distribution network.

Moderate public debt and improved financial risk

Public finances are currently sustainable, with a moderately high central government debt (slightly above 50% of GDP). A little more than half of public debt is owed to external creditors. As shown on the graph, a large share of external debt is owed to multilateral creditors, largely under concessional terms, followed by bilateral creditors and private creditors, as Armenia was able to issue bonds on the international financial market. This means that Armenia is exposed to changes in global financial conditions. On the plus side, the financial situation has improved drastically amid a decline in the external debt-to-GDP ratio and an improvement in the net international investment position (which remains negative). Moreover, debt service is also moderate, but is expected to increase with Eurobond maturities due in 2029 and 2031.

Moderate liquidity

Even if the level of foreign exchange reserves is moderate and fluctuates (as shown in the graph), the risk of the imposition of exchange controls is partly mitigated by the precautionary IMF Stand-By Arrangement. That said, the short-term political risk is classified in category 4/7 as the current account deficit is expected to widen. Moreover, the large levels of bilateral trade with Russia expose the entities that help to circumvent Western sanctions on Russia to the risk of being targeted by sanctions from the West.

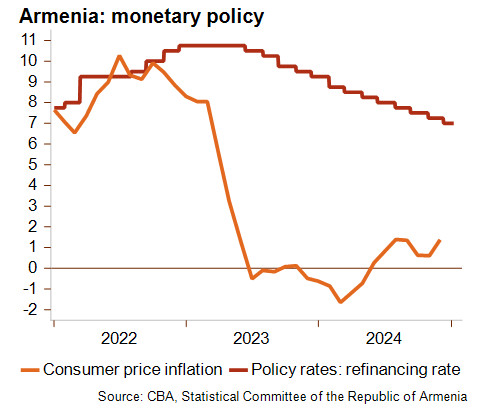

The exchange rate of the dram was relatively stable in 2024 and has recently depreciated against the USD. Following a period of elevated inflation (shown in the graph), this figure then dropped sharply, and despite a recent rebound, it remains well below the central bank’s target of 4%. This did however allow the central bank to gradually reduce its interest rates, which had a positive impact on the lending rate and access to credit. The business environment classification in D/G is supported by a favourable economic outlook, a relatively stable exchange rate and an environment of low inflation, but is hindered by the institutional framework and a geopolitical environment that could increase exchange rate volatility at any time.

Upgrade of MLT political risk classification

Credendo decided to upgrade the MLT political risk – which represents the solvency of a country – to category 5/7 from category 6/7. This decision was motivated by various factors notably related to the improvement of the financial situation and a decrease in risk related to the political situation. The country is now negotiating a peace agreement with Azerbaijan, and given the significant achievements so far, a renewed conflict between the countries seems highly unlikely.

Analyst: Pascaline della Faille - P.dellaFaille@credendo.com