China: Modest policy stimuli highlight increased focus on sustainability

Event

After several months of sluggish recovery, the Chinese economy has recently given some fresh signs of stabilisation and slight improvement. With its recent modest policy stimuli, Beijing confirms that priority has moved from quantity to sustainability. Still, real GDP growth is expected to be roughly around 5% this year. The short-term macroeconomic outlook remains nevertheless challenging due to domestic and external downside risks, which could also affect growth in 2024.

Impact

Since the abrupt post-Covid reopening of the economy in December 2022, and so far this year, the Chinese economy has produced a rather weak performance. Main indicators have been low over the past months, from manufacturing industry and exports to retail sales and property market. As a result, China has been swimming against the global tide in terms of deflation risks (i.e. with consumer price inflation close to 0 since April). This situation is explained by domestic and external headwinds. Domestically, the Chinese economy has to navigate through structural hurdles and low confidence among economic agents. The real estate crisis is a major issue given its large weight and contribution to the domestic economic activity. In spite of relaxed government constraints on lending and regulations, downturn continues with falling prices and sales and the slow start of new constructions. No significant improvement is expected soon, at best some stabilisation. This is harming consumer confidence as property is the dominant investment of household savings. On top of that, youth unemployment has reached record high levels, above 20%, further depressing consumer demand.

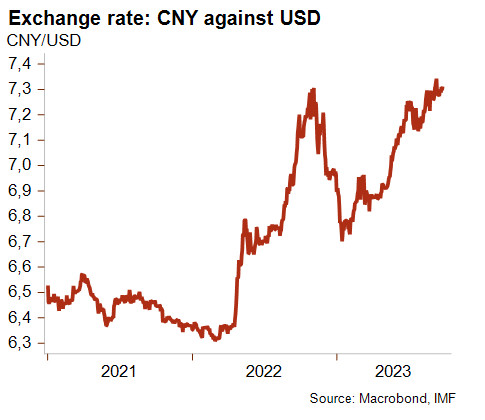

The authorities also have to deal with the country’s huge debt burden (currently above 300% of GDP), which they want to rein in to safeguard financial sustainability. Therefore, a government support consisting of a broad range of small monetary and fiscal stimuli – particularly targeting the real estate and households – seems to be the most the authorities are ready to offer to boost the economy and prevent the deflation trap. Recently, among others, they have cut the bank reserve requirement ratio, mortgage payments and interest rates for housing loans, and granted tax relief to families. They have also taken measures – such as reducing the amount of foreign exchange banks are required to hold as reserves – to support the Renminbi (RMB, or Chinese Yuan CNY) which is suffering from increased investor defiance due to China’s economic difficulties, US economic sanctions and a derisking trend away from China in some global supply chains. In this context, favourable to capital outflows, the RMB has been facing sharp depreciating pressures this year (-8% against the US dollar since the end of January), bringing it to its lowest level since the end of 2007, i.e. prior to the global financial and economic crisis. Recent policy support, albeit limited, has showed the Central Bank’s determination to limit the size of the depreciation.

Externally, after an export boost during the pandemic, Chinese exports have fallen amid weaker global demand and trade, and high geopolitical tensions. Although some sectors (e.g. electric cars, hi-tech) will continue to benefit from a stronger demand, the near-term outlook is negative and unlikely to improve in the coming months. Some recent signs have shown that the situation might at best stabilise or slightly improve. In that regard, a recovery in consumer and business confidence will be key, as domestic demand has to substitute for exports and public investments as growth drivers given the difficult global economic context and high indebtedness of local governments. Meanwhile, around 5% of real GDP growth is expected this year. However, this decent rate will probably decelerate in the coming years, maintaining the Chinese economy on its slowing path as it has been the case since 2011. The latest developments might therefore just highlight an inevitably weaker long-term growth trajectory towards maximum 3 to 4% in the medium term. Despite China’s economic and financial strengths and its broad economic and political network worldwide, multiple negative factors (e.g. heavy debt, ageing population, low productivity, geopolitical tensions, climate change, political interference in the economy, communist party’s priority for national security) will increase uncertainty and constrain future economic performance. In this difficult but slowly stabilising economic context, Credendo’s ratings for China’s short-term political risk (1/7) and business environment risk (D/G) are expected to remain unchanged in the near term.

Analyst: Raphaël Cecchi – r.cecchi@credendo.com