UAE: Improved outlook amid ongoing economic diversification

Economic resilience and improved prospects despite multiple shocks

The United Arab Emirates (UAE) has shown substantial resilience to a large variety of shocks, such as major oil shocks (2014 oil price shock, 2020 Russia-Saudi Arabia oil price war), the Covid-19 pandemic and the latest conflict outbreak in the Middle East. Moreover, despite the important challenges to decrease its economic dependence on the hydrocarbon sector, both the short-term and the medium-term economic outlooks remain robust and rosier for the UAE than for other GCC peer countries.

The UAE’s economic outlook improved significantly compared to pre-pandemic years. Following a deep real GDP growth contraction of 5% in 2020, the economy rebounded rapidly and has displayed solid performance ever since. In 2024, despite headwinds related to the Middle East wars and OPEC+ production cuts, the country’s real GDP is estimated to have expanded by 4%. Economic growth has been supported by relatively high oil prices and by non-hydrocarbon sectors, such as tourism and financial services, as the country progresses in its diversification plans. Additionally, an easing of current downside pressures, expanding oil production under the OPEC+ agreement and natural gas production should lead to a robust economic growth in 2025. Indeed, the business environment is favourable for the UAE, as attested by the latest PMI readings, signalling an economic expansion. Indubitably, the low-inflation environment, the stable exchange rates given the peg to the US dollar, and the stable and strong institutional framework are supporting the current business environment risk classification in category B/G. Still, in the short-term, the Emirates faces risks that domestic and global financial conditions remain tighter for longer amid possible inflationary US trade policies.

Strong macroeconomic fundamentals amid strong liquidity and robust external and fiscal positions

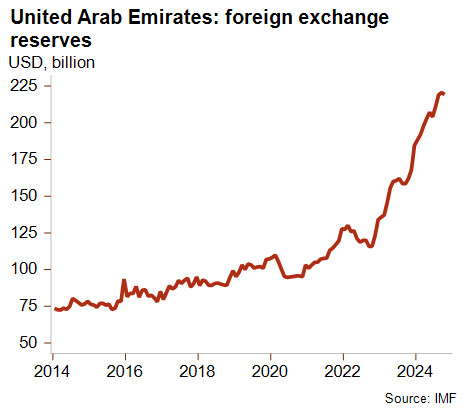

Liquidity risks remain very limited. Since 2021, the Emirates has benefitted from large current account surpluses, driven by multi-year high oil prices above the UAE’s external break-even prices (estimated at USD 38.4 per barrel in 2024). In this context, the country has accumulated large foreign exchange reserves, covering more than adequately its monthly import and short-term external debt needs.

The medium-term economic outlook remains positive, with real GDP growth projected to average 4.7%, that is significantly higher compared to the stagnant 1.1% on average of pre-pandemic years. Additionally, the external and fiscal positions are very healthy. Indeed, the Emirates has accumulated assets in large sovereign wealth funds, which mitigate the financial risk arising from the moderately high external debt-to-GDP ratio. Under current projections, despite a gradual decrease, oil prices should continue to support large overall fiscal and current account balance surpluses and, therefore, an (net) accumulation of external assets. In that context, public and external debts should remain relatively stable. These factors support the current MLT political risk classification in category 2/7.

Outlook still subject to downside risks

Still, the economic outlook faces significant downside risks. Despite its overall insulation from the fallouts of the recent Middle East conflicts, geopolitical risks represent an important risk. Even if they do not have any direct material impact on the UAE, regional tensions represent a risk, as they could spook investors, lead to a drop in tourism and/or a decrease in trade flows, negatively impacting the ongoing economic diversification projects. Moreover, while it is true that economic diversification is advancing faster in the UAE than in many other regional peer countries (such as Kuwait and Qatar), the country remains quite reliant on the hydrocarbon sector, as oil revenues still account for an important share of public revenue and current account receipts. Hence, the UAE remains vulnerable to major oil shocks. Last but not least, challenges could be compounded if the global shift to renewable energy sources was to accelerate.

Analyst: Andres Hernandez Cardona – a.hernandezcardona@credendo.com