Bhutan: Improved macroeconomic fundamentals contribute to upgrade of MLT political risk classification

Structural internal stability

Bhutan is a peaceful Himalayan country run by a constitutional monarchy with an active democracy. The current government won a strong majority at the latest elections in January 2024. The Buddhist kingdom is organised around key happiness and sustainability principles and boasts strong institutions. This contributes to a high level of internal stability in society, especially as the fight against poverty has been very successful. The main social issue lies in high youth unemployment as slow GDP growth has been leading to net emigration. Externally, Bhutan continues to face an unsettled boundary dispute with China.

Hydropower and ongoing economic diversification

After two years of contraction, GDP growth has been accelerating since FY22 (ending in June). It is expected to reach 7.2% in FY25 and an average of 6% in FY26-29. Strengthening hydroelectricity generation and exports to top trade partner (86% of Bhutan’s exports) and fast-growing India, tourism – which is back at pre-Covid levels – and expanding capital spending will support future economic activity.

![]()

Bhutan’s economy remains reliant on hydropower but the authorities want to broaden the low economic base by diversifying it, notably via the five-year plan (FY25-29) aimed to help Bhutan graduate to high-income status by 2035. This plan notably includes the future Gelephu Mindfulness City, which – with the status of a special administrative region in southern Bhutan – aims to attract FDI in infrastructures, technology and finance services while adhering to sustainability and ESG aspects. Benefiting from its cool location and carbon neutral energy production, the country has also been investing greatly in crypto-assets mining (mainly bitcoins). Although it will bring future revenue, crypto mining will have to be managed cautiously given the volatility of assets revenue and competition with electricity demand for the industry and households.

This risk was highlighted in FY22-23 when investments in crypto-mining machines triggered balance of payments pressures. Together with weaker hydropower exports – given the higher use of domestic electricity for crypto mining operations – these contributed to the sharp decline in foreign exchange reserves to their historic low import cover. However, prospects are brighter as electricity exports are expected to surge with new dams planned to be completed. Despite the FDI boost to imports-related capital spending in FY25, the wide current account deficit is forecast to come down to lower levels as from FY26. This would allow foreign exchange reserves, which have recovered a bit thanks to higher exports and remittances, to strengthen and reach strong volumes again as from FY27. This expected narrowing of external imbalances is necessary to keep away pressures on the ngultrum’s exchange rate peg to the Indian rupee. The peg is justified by very tight trade, economic and financial links with large neighbour India.

Heavy external debt drives MLT political risk

Bhutan’s MLT political risk is dominated by its financial risk. Indeed, large investments in hydropower projects have led to high external debt ratios. Nonetheless, thanks to stronger current account receipts, the external debt-to-current account revenue ratio is on a downward trend and forecast to drop from 370% in FY21 to less than 250% by FY27. More fundamentally, high external debt is largely mitigated by the fact that it is essentially owed to the Indian government (in charge of the construction and financing of the projects), primarily denominated in Indian rupee (pegged to the local currency and thus limiting exchange risks) and guaranteed by electricity sales to India. With a mainly concessional external debt, debt service is sustainable and expected to remain around 10% of current account receipts in the next years.

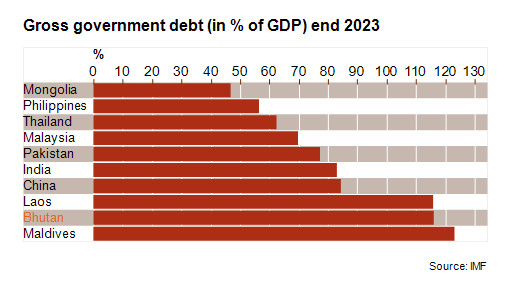

External debt is mostly public. Hence, with a level expected to remain above 100% of GDP and above 550% of government revenue in the MLT, Bhutan has the second largest public debt in Asia.

Rising public debt (resulting from new hydropower loans) and interest payments (at a low 7.8% of revenues in FY24) will constrain the future fiscal policy in case of shocks. Those include vulnerability to climate change – in spite of Bhutan’s climate neutrality – through the importance of hydropower and agriculture. However, the fiscal deficit is expected to remain contained to less than 4% of GDP on average by FY29, whereas hydropower should help increase government revenues over time.

MLT risk rating upgraded to 5/7

At the end of last year, Credendo upgraded Bhutan’s MLT political risk rating to category 5/7 from category 6/7. Indeed, despite the double shock and impact from Covid-19 and the war in Ukraine, Bhutan’s macroeconomic fundamentals – particularly its external debt ¬– have shown overall improvement compared to some years ago. Moreover, high internal stability, rising hydropower exports forecast to improve the balance of payments and strengthen liquidity, and government plans for economic diversification are likely to contribute to a positive outlook for Bhutan.

Analyst: Raphaël Cecchi – r.cecchi@credendo.com