European aluminium sector in a critical situation

Highlights

- The price of aluminium has once again reached a peak.

- The sharp increase in energy prices – main production cost –, strong demand and a drop in production growth in China are the main causes.

- Consequences for downstream mills could be severe.

- Tensions on the Ukrainian border are not helping.

- While aluminium is an essential metal for the economic transition, part of European production is threatened.

Strong price increase

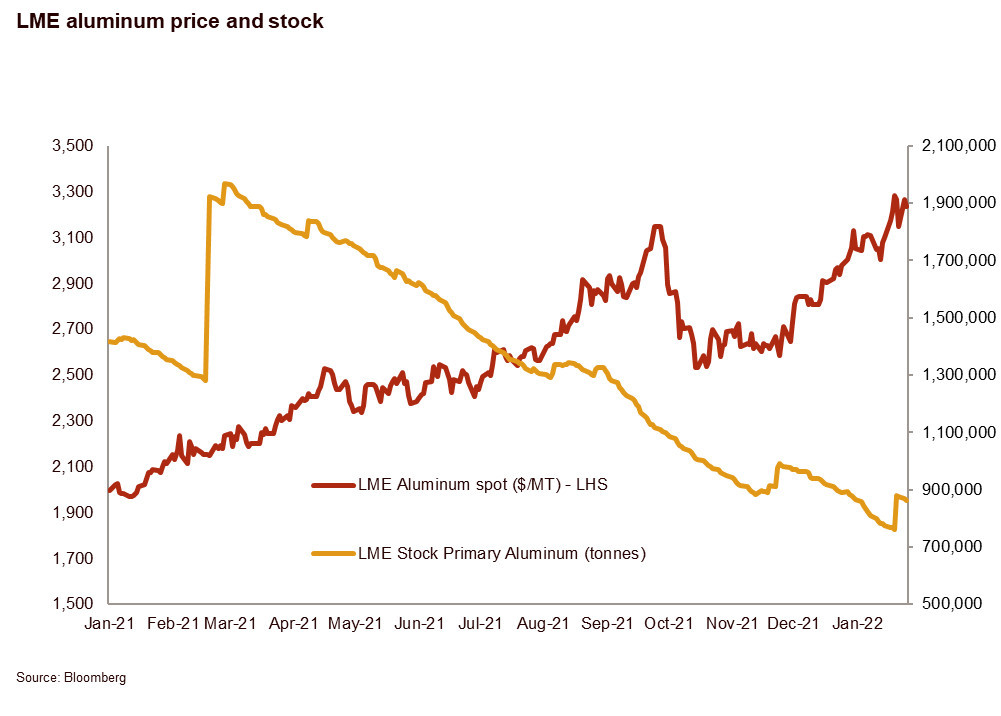

The price of European aluminium has increased by about 15% since the start of 2022, exceeding its historic high of October 2021. This is an increase of more than 60% compared to January 2021. While this might sound like good news for aluminium producers, it is not at all. Indeed, not only strong demand, but also – and above all – the drop in production in Europe and China is pushing prices up, while aluminium inventories are historically low. Production mainly dropped because energy prices have risen sharply in 2021. Additionally, in China, the desire to reduce air pollution for the Winter Olympics, as well as to reduce carbon dioxide emissions – 5% of which are coming from the aluminium industry – is limiting the growth of aluminium production for 2022. China finds itself forced to import aluminium on a massive scale to compensate for the domestic shortage.

Significant cost pressure

As energy represents a high proportion – more than a third – of production costs, the sharp increase in the price of gas has a huge impact on companies’ profitability, especially in Europe where the price of natural gas has increased by almost 550% from December 2020 to December 2021, according to the World Bank.

As a result, European aluminium producers find themselves faced with a difficult choice. Either they close their smelters or they reduce their production, even if it means producing at a loss. This last option is the choice made by the largest smelter in Europe at the end of December 2021. Indeed, Aluminium Dunkerque Industries France has announced that it will lower its production of primary aluminium. In Galicia (Spain), Alcoa has decided to completely close its primary aluminium smelter – the second largest in Europe – for two years (until the end of 2023). However, it will continue to resmelt aluminium for its clients in the pharmaceutical and food industry. In Romania, it was announced at the end of December that the production of the Alro smelter would be cut by 60%, blaming unsustainable energy prices. In Slovakia, production at the Slovalco smelter (owned by Norsk Hydro) will be reduced to 60% of its capacity (down from 80%).

Impact on the downstream mills

All these cuts in the production of primary aluminium will therefore have an impact on downstream mills. Since they need primary aluminium, this does not bode well for them. Mills with an integrated production of primary aluminium should suffer less from this drop in European production, but will still be significantly impacted by electricity costs.

Additional risk linked to Russia-Ukraine tensions

The current tensions between Russia and Ukraine are already taken into account in the price of European gas. However, in the event of Russian aggression against Ukraine, Europe could lose critical energy supplies. In addition, American and European sanctions would be expected against Russia, which is a commodity powerhouse and the second-largest aluminium producer in the world after China. And like in 2018, when RUSAL was hit by sanctions, new sanctions would seriously disrupt the European aluminium sector. While the aluminium value chain (bauxite and alumina) has already been strongly impacted by electricity shortages, new barriers to trade could be a fatal blow to the European industry.

Conclusion

To conclude, the demand for aluminium is expected to increase sharply in the future, considering that it is an essential metal for the transition to a greener economy. Non-European foundries are therefore benefiting from this surge in aluminium prices. However, the overall growth in production volume is limited or even at risk, due to energy prices, but also due to the desire to reduce carbon dioxide emissions. While we need aluminium to lower these emissions in the future, we are currently slowing down the production of aluminium to avoid emissions. The paradox of our times...

Analyst: Matthieu Depreter – m.depreter@credendo.com