Vietnam: Successful economic story to continue beyond a contained Covid-19 pandemic

- A controlled pandemic is fuelling impressive economic resilience.

- A strong demand for medical and electronics products and increased public investments have supported the economy.

- Country risks have not deteriorated and risk ratings are unchanged.

- External shocks, state banks and public finances are the main risks.

- Trade tensions and shifting supply chains are benefiting Vietnam.

A rare winner amid the Covid-19 crisis

Vietnam has been one of the few highly resilient countries during the unprecedented Covid-19 shock. The swift, strict and very effective containment of the virus after the outbreak in neighbouring China largely explains this. An early travel ban, testing and wide-scale contact tracing on top of the containment measures have helped keep the virus under control. Therefore, while most countries were severely hit and hindered by the economic impact of the virus, Vietnam’s economy continued to operate at a good albeit slower pace despite an initial high level of business disruption. This resulted in exceptional economic performances for the country in a year of record global recession hitting advanced as well as emerging economies in all the world’s regions. For Vietnam, the global demand slump was more than offset by the strong global demand for medical products, electronics and computers resulting from the Covid-19 crisis. Hence, exports of goods grew last year. This occurred while Vietnam was already emerging as a winner from US trade sanctions against China, as highlighted by the jump in FDI and exports (to the USA) prior to the Covid-19 crisis. Moreover, increased public investments in infrastructure also played a significant role in supporting economic activity. A more accommodative monetary policy – including the State Bank of Vietnam’s policy interest rate cut from 6% to 4% – brought an extra stimulus. On the other hand, the export of services collapsed, notably as a result of the global halt in tourism, private transfers tumbled, and private consumption and FDI slowed, thus weighing on total annual GDP growth.

The risk outlook is positive

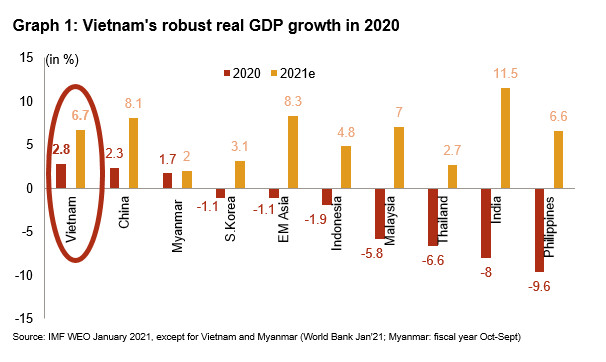

Vietnam remains largely immune to the further waves of the virus that are currently affecting many parts of the world. Hence, the authorities will take time to vaccinate the population, which means that anti-Covid measures could still be in place for many months to come. Meanwhile, the authorities are confidently looking ahead to continue the country’s economic success story, which has been characterised by average growth of 6.8% in the past two decades. An impressive outcome in the Covid-19 context lies in the fact that Vietnam’s economic and financial risks have not increased. Even though GDP growth reached its lowest level (+2.8% according to the World Bank Global Economic Prospects of January 2021) since the mid-1980s, it was in positive territory in 2020 – unlike for most of the country’s peers in the region – and is expected to accelerate strongly this year and next towards 6.5%-7%.

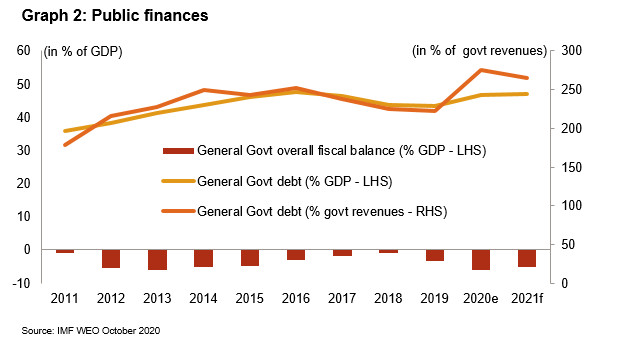

External debt ratios remain low and debt service has barely increased, whereas the current account surplus is persisting despite some narrowing. Post-Covid-19 prospects are positive for those risk factors on the back of a global economic recovery. Macroeconomic resilience and strong forecasts are also likely to support currency stability in the future. There is less satisfaction with public finances, a structural weakness. Yet, their deterioration has been very limited as the authorities, constrained by the lack of fiscal space, launched a small stimulus, managing to prevent the fiscal deficit exceeding 6% of GDP in 2020 and keeping public debt at an estimated 46.6% of GDP (43.3% in 2019). The decline in government revenues to lower levels (under 18% of GDP) is nevertheless problematic given the higher public debt – with a dominant external share – and interest payments and will necessitate maintaining a cautious fiscal stance. That being said, the risk related to Vietnam’s public finances remains moderate. Moreover, in the medium term, strong GDP growth, recovering revenues and contained expenditure could fuel a gradual decline in public debt and fiscal deficit.

The fragile banking sector is another risk, especially given the situation of credit-to-GDP ratio rising further above 100% and low capital buffers for state banks. High debt in real estate and the sharp balance sheet deterioration for the companies hit hardest by Covid-19 – particularly in the services sector –could affect banks through a wave of defaults and rising bad loans. Therefore, the government is planning some recapitalisation of state banks.

Trade tensions and the impact of Covid-19 on supply chains bringing benefits

Vietnam faces downside risks, mainly external. Its highly open and export-led economy is much exposed to external shocks. In the short term, a prolonged Covid-19 pandemic will continue to hinder economic performances whereas the global rise in protectionism will certainly move on in the long term and potentially harm the Vietnamese economy. That being said, the latter has until now been benefiting from the changing trade environment and ongoing global supply chain reorganisation. First, the US trade war against China is here to stay and will thus allow Vietnam to continue to benefit from trade diversion away from China. Also, unlike Trump’s threats of trade sanctions motivated by a sharp widening of the US bilateral trade deficit and alleged currency manipulation, Biden’s administration could ease pressure on a regional ally. Second, Covid-19 has shaken global supply chains, which could benefit Vietnam in the long term, as it is seen as a stable investment location for business relocation in South-East Asia. Third, Vietnam signed two major FTAs in 2019-2020 that will boost its trade and FDI inflows: one with the EU in 2019, followed by the Regional Comprehensive Economic Partnership (RCEP), namely the world’s largest FTA, signed in mid-November by the ASEAN countries, China, Japan and South Korea among others. Over the past few years, Vietnam has become a magnet for the biggest multinationals such as Samsung and Apple, which are attracted in particular by strong growth prospects, a low-cost workforce and an investment-friendly climate, to set up large manufacturing sites. The rise of Vietnam’s economy in the value chain and integration of higher technology will move forward.

Continuity in government policies and stability in Credendo’s risk ratings

Developments in terms of health and economy in 2020 have allowed the CPV (Communist Party of Vietnam) to cheer during the 13th and 5-yearly National Congress, which ended in early February. 76-year-old CPV Secretary General Nguyen Phu Trong remained the country leader as he was re-appointed for a third mandate amid a major reshuffle of the Central Committee and leadership. The general political direction for the coming years was confirmed, with the economy and its continued liberalisation as a key priority and guarantor of the stability of the one-party regime. Therefore, political stability and policy continuity are here to stay and help make Vietnam an attractive place for foreign investments. However, the future will not necessarily be a long quiet river. Lack of public transparency remains an issue, and the tightening of freedoms in general has increased during the pandemic, whereas land protests are regular risks to local social stability. In addition, climate change, principally intensifying floods, and rapid population ageing are major challenges for the country. On the external front, tensions with a more assertive China in the South China Sea will remain the dominant albeit so far managed risk and mean a tightening of defence ties with the USA.

During the Covid-19 pandemic, Credendo has kept its political risk ratings unchanged. The ST political risk rating is likely to remain at a solid 2/7 thanks to resilient liquidity. Record foreign exchange reserves allow coverage of more than 3.5 months of imports and three times a stable level of short-term external debt. The MLT political risk rating has a positive outlook at 4/7. An upgrade cannot be ruled out beyond the Covid-19 pandemic if related uncertainty largely vanishes, the global economic situation normalises and Vietnam’s strong economic momentum resumes.

Analyst: Raphaël Cecchi – r.cecchi@credendo.com