Mexico: Sharp monetary tightening could tip over the US and Mexican economy into recession next year

Event

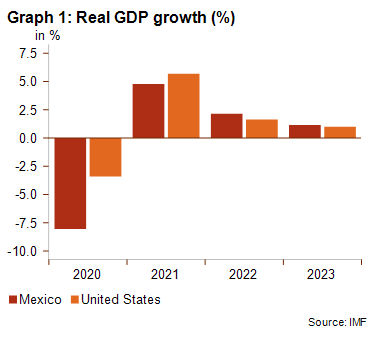

The Mexican economic growth is sluggish. After a deep recession in 2020 and a rather weak recovery in 2021, real GDP growth is estimated at only 2.1% for this year (see red bars in graph 1). Moreover, the economic growth is expected to slow down further next year to around 1%, in line with the economic growth of its biggest trade partner, the USA (see orange bars). As a result, the Mexican economy is unlikely to recover (in real terms) to pre-Covid levels before 2024. Moreover, the risk of recession is rising in Mexico. Sharp monetary tightening by the Fed could tip over the US economy into recession next year and drag down the Mexican economy with it. If this happens, Credendo will likely downgrade the business environment risk rating (D/G).

Impact

The economic performance of the USA, which is not only by far Mexico´s biggest importer but also a huge source of investments and remittances, can only partly explain the rather disappointing economic growth figures for Mexico. Like many Latin American countries, Mexico has been confronted with quickly rising inflationary pressures since 2021 (see graph 2). The Central Bank of Mexico reacted with rapid monetary tightening to anchor inflation expectations (managing runaway inflation expectations is a historic challenge in Latin America). Tightening of the monetary policy, however, hampers economic growth. For Mexico specifically, other elements, such as security risks, are at play as well. The country has seen intensifying territorial conflicts over the control of drug-trafficking routes to the USA in recent years. Another important element are the multiple changes of the rules on investment, which have been spooking domestic and foreign investors since President Andrés Manuel López Obrador came into office in December 2018. Though FDI inflows have been gradually increasing in the past 3 years, they are still well below the average FDI inflows seen during President Nieto’s term (2012-2018). The government of President López Obrador clearly favours a greater state role in the economy and won’t hesitate to revise contracts and impose new rules and controls. That being said, the majority of the most controversial policies focused on sectors that are historically characterised by high levels of public-sector involvement, particularly energy and public infrastructure. The manufacturing sector, for example, has remained largely untouched. Nevertheless, in case of a recession, more government involvement in the economy is likely, especially as López Obrador´s presidential term ends in 2024 and a second presidential term is not allowed in Mexico. A last important element is climate change. Climate change has worsened droughts and consequential water shortages over the summer in 32 states. Though rainfall is expected to improve drought conditions in the coming months, these last ones are set to become a regular problem in many states. Because of this, firms could feel pressure from the government to offer solutions, as happened recently to beverage companies in affected regions. Tropical storms are also becoming more extreme due to climate change and are regularly hitting the coastal areas and affecting local areas and companies.

Mexico’s MLT political risk rating has remained in category 3/7 for over a decade. The country’s good risk rating reflects its moderate external debt and rather low debt service ratios, sustainable public finances, poor economic growth in recent years, and economic diversification despite its great reliance on the US economy. The ST political risk rating is in category 1/7, driven by the adequate level of foreign exchange reserves and relatively low levels of short-term external debt. Despite a challenging global environment, the outlook remains stable for both risk ratings.

Analyst: Jolyn Debuysscher – J.Debuysscher@credendo.com