Energy crisis: fuelling a systemic crisis in Europe

Event

In Europe, the war in Ukraine is having consequences for the gas market both via lower gas supplies and surging gas and electricity prices. Russian gas supplies have indeed been cut by approximately 80% since the start of Russia’s invasion of Ukraine. Russia’s decision this month to indefinitely cut off supplies through the critical Nord Stream 1 pipeline has intensified worries across Europe about an energy shortage this winter. As a result of reduced availability and fears of further disruptions, natural gas prices in Europe are surging to record highs and are about ten times higher than their pre-war level. This pushes all other international gas prices upwards, though not as high as in Europe, translating into a deteriorating competitiveness gap between Europe and the other world regions, in particular the USA and Asia

Impact

Russian gas deliveries to Poland, Bulgaria, Finland, Denmark and the Netherlands have already been stopped and deliveries to Germany, Italy, France and other countries have been reduced. While existing gas infrastructures have up to now been able to absorb those cuts for the impacted countries, larger disruptions could leave some countries unsupplied and partially fragment the European market. Indeed, transmission of gas within Europe is subject to technical bottlenecks. It takes time to reverse flows in pipelines, for example. Central European countries (Czech Republic, Slovakia and Hungary) are the most at risk of shortages since those countries rely heavily on Russian gas. Furthermore, their main alternative routes go through differently constrained countries (Germany and Italy) where bottlenecks in transmission exist and could limit the inflows. The cost to supply those markets in case of a complete shut off of Russian deliveries would be extremely high.

While gas prices will remain very high and volatile for some time, their actual level will depend on political decisions – such as the implementation of a price cap – at country and EU levels, further evolution of Russian supplies and winter conditions.

Because of the impact on electricity prices, the directly affected sectors will be those whose production is much dependent on gas and electricity as feedstock and/or end use. Those sectors are the metals (such as steel, aluminium and zinc), fertilisers, chemicals, construction materials (such as cement and glass), agriculture, agri food, oil refining, paper and textile sectors and the power generation sector relying on gas.

Production cuts have already been observed on the European continent as a result of those high gas prices. This is particularly the case in the steel sector in which nine steel plants in the EU had fully or partially paused steel production at the end of July 2022. As of early September, fifteen steel plants have suspended or plan to suspend steel production. Most of the production halts were initiated by ArcelorMittal, according to market estimations. In addition to higher energy costs than in the rest of the world, decreasing their competitiveness, EU steel plants suffer from weak demand, which can partly be explained by the slowdown in China. If the energy crisis deepens, the coming winter could deliver the fatal blow to the European steel industry.

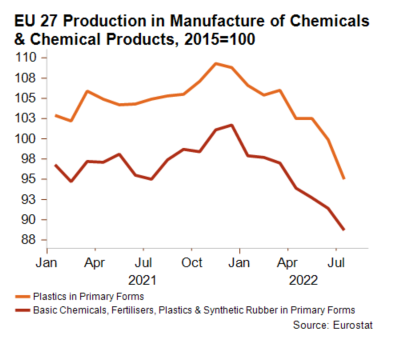

Similarly, the fertilisers sector is also experiencing significant cuts, as natural gas is a commonly used feedstock to produce two nitrogen based fertilisers – ammonia and urea – in large quantities. Additionally, a by-product of ammonia production is CO2, which is used as an input to give the sparkling appearance to beers and soft drinks, in surgical procedures in hospitals and for slaughtering animals. Ammonia is also used for the production of AdBlue, the exhaust cleaning fluid used to reduce pollution and allow diesel trucks and buses to keep operating with more stringent environmental rules. In Germany, the largest AdBlue producer stopped production a few weeks ago and recently announced that it was almost running out of stock, possibly impacting the road transport sector. In addition to a reduction in agricultural yields, all those other sectors are affected by the repercussions in the fertilisers supply chain. The chemical sector in general is experiencing a drop in production in the EU since the beginning of the year.

The client industries of the directly affected sectors will secondarily be impacted through higher input costs and possible shortages of materials. In that regard, the construction, automotive, machinery and equipment and transport services sectors are the most vulnerable.

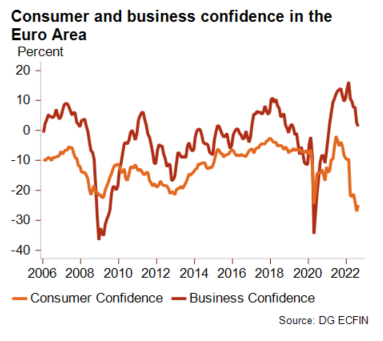

With high energy prices fuelling inflation through increased costs in supply chains and second round effects in wages, consumer confidence has dampened and all sectors directly depending on consumer expenditures (retail, hotel and catering, tourism, consumer electronics) are also projected to be affected through lower demand. Business confidence is on a downward trend as well.

Analysts: Florence Thiéry – f.thiery@credendo.com; Matthieu Depreter – m.depreter@credendo.com