Business environment risk: Three countries upgraded, five downgraded

In the framework of its regular review of business environment risk classifications, Credendo has upgraded three countries and downgraded five others.

- Business environment risk

| Upgrades | From | To |

| Brunei Darussalam | C | B |

| Macau | D | C |

| Samoa | F | E |

| Downgrades | From | To |

| Canada | C | D |

| Israel | B | C |

| Kuwait | D | E |

| Nigeria | E | F |

| Tanzania | D | E |

- Israel: downgrade from category B/G to C/G

Israel is experiencing an economic slowdown in 2023, following an outstanding two-year rebound from the Covid-19 shock. The slowdown has come amid weaker external demand and monetary tightening by the Bank of Israel – that raised its policy rates to the highest levels in more than a decade. Indeed, Israel has been confronted with inflationary pressures but also with the depreciation of the shekel driven, among other factors, by the turmoil caused by the controversial judicial reform pursued by Prime Minister Netanyahu’s government. Nonetheless, given the solid macroeconomic fundamentals of the country, the new business environment classification C/G still reflects only a moderate risk.

- Kuwait: downgrade from category D/G to E/G

The Gulf Cooperation Council (GCC) region is experiencing a significant slowdown compared to the extraordinary economic performance in 2022. Kuwait's slowdown, however, is more marked than other countries in the region. In line with regional peers, Kuwait is facing the tightening of global and domestic financial conditions and oil production cuts under OPEC+ agreements. Additionally, Kuwait’s business environment is impacted by political paralysis that is hindering crucial reforms in the country (e.g. debt law and economic diversification). Nonetheless, given its dependency on the hydrocarbon sector, the country's new business environment risk classification E/G is supported by persistently high oil prices.

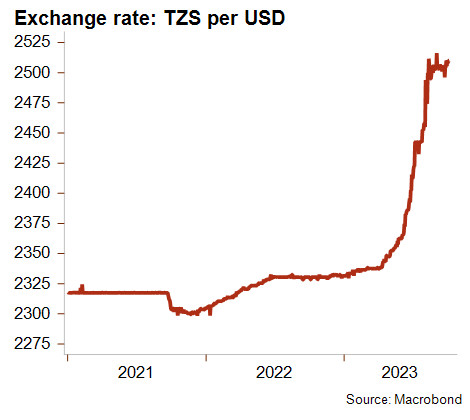

- Tanzania: downgrade from category D/G to E/G

The Tanzanian shilling has recently hit an all-time low against the US dollar. The exchange rate depreciated in the last couple of months, after having been relatively stable for the last few years. This could be a sign of increased flexibility with regard to the exchange rate. If this is the case, this would be a positive development for Tanzania’s foreign exchange reserves, which have been under downward pressure recently. In the short term however, the exchange rate depreciation will likely add to inflationary pressure.

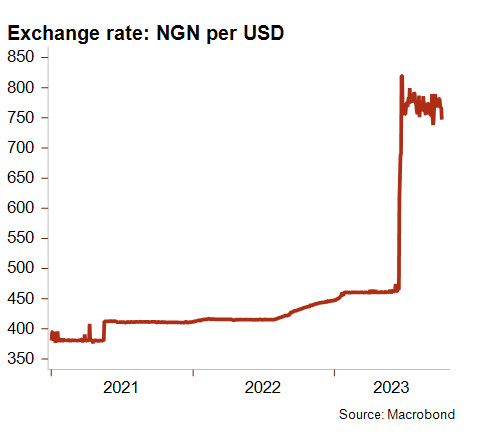

- Nigeria: downgrade from category E/G to F/G

President Tinubu started rolling out sweeping and unpopular market reforms quickly after he was inaugurated in May 2023. The abolishment of the multiple exchange system and liberalisation of the naira exchange rate mid-June 2023, caused a collapse of the naira and the currency lost more than half of its value against the USD. The exchange rate stabilised somewhat in July and currently fluctuates around 760–780 NGN per USD. Despite the serious challenge of dealing with the inflationary consequences of the depreciation, over time the reform should have positive consequences for Nigeria’s financial stability and investment environment. In addition, Nigeria’s destructively expensive and notoriously corrupt fuel subsidy system was cut. This led to a serious hike in pump prices, which further accelerated the rise in inflation. The short-term impact is painful here as well, yet the long-term fiscal gains should be positive. Inflation reached 25% end-August 2023, after inciting continuous moves of monetary policy tightening, with the latest policy rate hiked to 19% early September 2023. Due to depressed domestic spending and eroded business confidence, economic growth is expected to remain slow at around 3% this year and the next. As a result, Nigeria’s business environment risk classification was increased by one notch to F/G.