Ukraine: Macroeconomic stability restored… but beware of the temptation of reform reversal

- Domination of legislative and executive power by Zelensky’s populist party… now, it remains to be seen how it will use it.

- Tensions de-escalated thanks to Zelensky’s commitment to revive peace talks with Russia.

- Lower internal and external imbalances amid sound fiscal and monetary policies.

- Drastic improvement of financial risk since 2014 amid lower external debt and debt service ratios.

- Upgrade of MLT political risk to category 6/7.

Domination of legislative and executive power by Zelensky’s party

President Zelensky and his newly created party – the Servant of the People party – won a landslide victory in the presidential and legislative elections with a vague policy agenda. Now it remains to be seen how this populist and divided party – which has very close links to the oligarch Ihor Kolomoisky (a former owner of Privatbank, which was nationalised in December 2016, as part of central bank efforts to clean up the banking sector because the owners failed to recapitalise it) – will implement its ambitious agenda aimed at improving growth prospects and fighting corruption.

Very recently, in March, President Zelensky has reshuffled its government amid allegation that the former government, appointed in August 2019, was not moving fast enough to implement reforms. Mr Honcharuk, the former Prime Minister, has been replaced by Denys Shmygal. Even if the new Prime Minister has pledged to continue constructive work with the IMF, the recent government’s reshuffle raises question about the willingness of Ukraine to pursue reforms.

The results of the elections have not changed the close link between oligarchs and politicians that has marked the politics of post-independence. The political scene thus risks remaining marked by a lack of reforms and to a lesser extent by a reform reversal amid strong vested interests and deep division within the ruling party. As a result, Ukraine’s population, foreign backers and investors may again be frustrated by the lack of progress, among other things in fighting corruption and improving the judiciary system. In this regard, it should be noted that any step aimed at favouring Ihor Kolomoisky is likely to damage relations with the IMF and its Western backers. However, the risk is rather limited as IMF staff have reached agreement with the authorities on the policies to underpin a new 3-year, SDR 4 billion (about USD 5.5 bn) arrangement under the Extended Fund Facility. This agreement is subject to approval by IMF management and by the Executive Board, and the effectiveness of the arrangement will be conditional on the implementation of a set of prior actions.

Foreign relations still marked by the unresolved conflict in Donbass

The armed conflict in Donbass remains at a standstill. President Zelensky has committed to reviving peace talks with Russia, including, among other things, an exchange of prisoners and the partial withdrawal of troops. A four-party Normandy-format summit (along with France and Germany) took place in December 2019. Looking ahead, little improvement is to be expected as an upsurge in fighting has been witnessed recently.

Following the Euromaidan events of 2013-14, the annexation of Crimea and the conflict in Donbass, Ukraine shifted its foreign policy preferences to the West, aiming for closer ties with the EU and NATO. The Association Agreement with the EU was implemented in 2017. Looking ahead, the West’s support is unlikely to be unconditional given the West’s fatigue with the lack of progress in reforms aimed at fighting corruption and improving governance. The decision to continue with the Nord Stream 2 project, which reduces Ukraine’s importance in terms of Russian gas transit to Europe, is a clear sign that the EU’s commercial interest prevails over some geopolitical considerations. It would deprive Ukraine of its gas transit fees but also reduce its bargaining power with Russia. Contracts between Russia and Ukraine, signed in 2010, regulating the transit of Russian gas to Europe expired in December 2019. At the last moment, Ukrainian and Russian officials agreed on a new five-year “ship or pay” contract allowing gas transit to Europe, thus settling their dispute.

Strong recovery after a deep downturn in 2014-2015

Ukraine’s economy was hit hard by the Euromaidan events, the armed conflict in Donbass and the annexation of Crimea by Russia. Indeed, the economy contracted by 6.6% in 2014 and 9.8% in 2015 (see graph 1). Since then, real GDP growth is back in positive territory and is expected to reach 3% this year. That being said, this growth projection is likely to be revised downward as a result of the outbreak of coronavirus, which could intensify a global economic downturn.

In the coming years, real GDP growth is expected to continue to grow by about 3% per annum, assuming that the economy is not hit by a new domestic and/or external shock. The weak legal framework, pervasive corruption, dominance of oligarchs and inefficient state-owned enterprises continue to be a drag on growth. Moreover, downside risks arise from the fallouts from the coronavirus, the trade tensions (cf. impact on prices and demand), even if US/China trade tensions are easing in the short term, and a change in global financial conditions. Indeed, in Ukraine, investments (of almost 20% of GDP) are partly financed by external savings as national savings are not sufficient to finance domestic investment.

Change in sources of current account receipts

The structure of the Ukrainian economy has been affected by the events of 2013-2014. Previously, the eastern provinces were an economic powerhouse (with heavy industry, including coal mining, ferrous metallurgy, engineering and machine-building) and were a net contributor to the central budget. Crimea was less important (accounting for less than 5% of Ukraine’s GDP) and was a net recipient of fiscal transfers from the central government.

When looking at the composition of current account receipts, the change in the structure of the Ukrainian economy is clear. Whereas manufactured exports accounted for 41.1% of current account receipts in 2013, this dropped to 31.4% in 2018. The share of food – mainly grain produced in the western part – has increased from 18.9% to 25.1% of current account receipts. The share of tourism receipts (Crimea was a key tourist destination) dropped from 5.6% to 2% in 2018. The share of labour income rose significantly from 7.4% to 15.2% as the well-skilled labour force migrated abroad to find work. The share of ICT services also increased from 2.8% in 2014 to 4.7% in 2018 as Ukraine is developing its ICT industry. The share of transport services slightly decreased from 9.3% to 8%. It should be noted that gas transit revenues are recorded in the balance of payments as a transport service. Given the ongoing building of pipelines in the Baltic Sea (Nord Stream 2) and via Turkey (TurkStream), Russia should become progressively less dependent on the Ukrainian route to sell its gas to Europe in the years to come (even if it cannot do without it altogether).

While current account receipts have recovered compared to the low level reached in 2016, they are still below their pre-crisis level. On the positive side, current account payments have dropped more rapidly than receipts, which has resulted in a narrower current account deficit than before 2014. This is a positive factor as in the past the large current account deficit was one of the economy’s main weaknesses.

In 2018, net FDI inflows were sufficient to cover about more than half of the current account deficit. The rest was financed by portfolio inflows and other debt-creating means. Looking ahead, given that the current account deficit is expected to remain at the same level, Ukraine is expected to remain reliant on portfolio flows and other financing sources (coming, among other things, from official creditors such as the IMF, the WB, the USA and the EU). In this context, the authorities should maintain good relations with their Western backers – which is not evident given the division within the ruling party and the close link to oligarchs (cf. Privatbank). Moreover, Ukraine has a very bad track record when it comes to reform implementation and IMF programmes (cf. past programmes that went off track). Last but not least, the recent cabinet reshuffle has increased uncertainty regarding the policy direction that the country wants to take. This happens in a global context where global financial conditions are deteriorating amid the spread of coronavirus and its negative impact on the economy. As a result, access to international market is likely to be more complicated in 2020 than it was in 2019. This is highlighted by the exchange rate (vis-à-vis the USD), which appreciated in 2019, and is now under pressure (year-to-date).

Sound monetary policy

The sound monetary policy has helped to reduce inflation, which peaked at 43.3% (eop) in 2015 (partly driven by a significant exchange rate depreciation), to 4.1% in December 2019, i.e. close to the central bank’s 5% target. The National Bank of Ukraine (NBU) also played a key role in restoring financial stability with an overhaul of the banking sector. This included the closure of a large number of weak banks and interventions (recapitalisation and nationalisation) in other banks (among which Privatbank). The banking sector is now in better shape with a positive net foreign asset position (since 2019), higher capitalisation and enough deposits to finance its lending (since 2019). That being said, non-performing loans remain high. Moreover, the banking sector is increasingly exposed to central government and access to credit is relatively difficult and expensive (average lending rate of 19.1% in November 2019), which partly explains the high commercial risk (C on a scale from A to C) along with the difficult institutional framework.

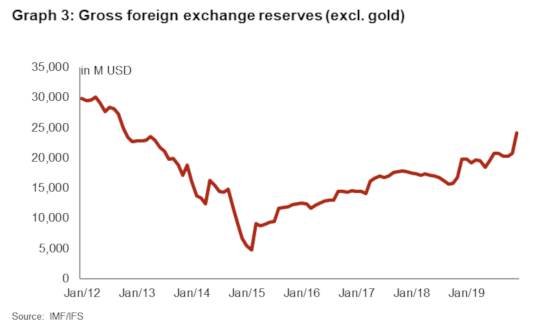

In February 2014, the NBU abandoned the de facto fixed exchange rate and switched to a flexible exchange rate regime. This important measure has eased pressure on foreign exchange reserves and current account imbalances. As a result, and following the economic stabilisation, gross foreign exchange reserves have increased and covered 3.5 months of imports in December 2019 but are just not sufficient to cover the short-term external debt. The improvement of liquidity since 2014 has been marked by various upgrades of ST political risk (which represents a country’s liquidity) by Credendo from category 7/7 to 6/7 in August 2016, 5/7 in December 2017 and 4/7 in September 2019.

The central bank has also continued to liberalise foreign exchange regulations. Since the Law on Currency and Currency Operations came into force in July 2018, various foreign exchange market restrictions have been cancelled (including limits on repatriation of dividends) without putting any pressure on gross foreign exchange reserves. On the contrary, between July 2018 and December 2019 (see graph 3), gross foreign exchange reserves increased by more than 40%. This is explained by the large portfolio inflows in the context of refinancing a large debt repayment due in 2019 (this also highlights that Ukraine is increasingly exposed to changes in global financial conditions). That being said, the financial risk has clearly improved on the back of a continued decline in external debt and debt service.

Improved public finances

After a sharp increase from 40.5% of GDP in 2013 to a peak of 81.2% in 2016 (see graph 4), public debt is on a clear downward trend and expected to have reached less than 60% of GDP in 2019 thanks to positive growth and fiscal consolidation. Indeed, whereas the primary balance (fiscal balance before interest payments) was in negative territory in the period 2004-2014 (driven by loose fiscal policy, large pension and wage increases and generous energy subsidies), it has been in surplus since 2015. Relative to the GDP, the authorities have successfully decreased their expenditure on “social benefits” by cutting subsidies and implementing tax and pension reforms. That being said, the period 2015-19 was also characterised by reform reversals and an IMF programme going off track. For instance, an increase in gas tariffs (wholesale prices for household use) was planned firstly on 1 November 2018 and secondly on 1 May 2019, before becoming completely market-determined as from January 2020. However, the May 2019 increase did not take place.

Despite this improvement, the main risks weighing on public finances are reform reversals, the adoption of populist measures, the large debt repayment due in the period 2020-2021 and the fact that a large part of the debt is denominated in foreign currency (and thus vulnerable to exchange rate shock). Last but not least, the large number of state-owned enterprises (SOEs) continues to represent contingent liabilities in this country where, although decreasing, some SOEs represent a drain on public finances and where limited progress has been made in terms of governance and privatisation.

Upgrade of MLT political risk by Credendo

Since 2014, when Credendo downgraded its ST and MLT political risk to category 7/7, macro-economic stability has been restored. Indeed, the sound fiscal and monetary policies and exchange rate flexibility have resulted in a sharp reduction in Ukraine’s internal and external imbalances. The inflation rate is back to single-digit territory. The banking sector is in better shape with a net positive foreign asset position and high(er) capitalisation. Public debt has decreased significantly, driven by a rebound in real GDP growth and fiscal consolidation. The flexible exchange rate regime in place since 2014 has contributed to the easing of pressure on foreign exchange reserves and the narrowing of the current-account deficit. The financial risk has also drastically improved amid lower external debt and debt service ratios.

On the political side, Zelensky’s populist party dominates legislative and executive power, which should enable it to implement its ambitious agenda aimed at improving growth prospects and fighting corruption. On the external side, the situation has stabilised with a firm annexation of Crimea by Russia. The armed conflict in Donbass remains at a standstill. That being said, President Zelensky’s commitment to revive peace talks with Russia is contributing to the de-escalation of tensions and some improvement in Donbass. However, the relationship between Ukraine and Russia is likely to remain characterised by mistrust. Ukraine is likely to continue pursuing good relations with the West. This relationship is, however, likely to be marked by frustration on both sides.

Taking into account the improved macroeconomic situation, Credendo has decided to upgrade Ukraine’s MLT political risk to category 6/7, which accurately reflects the great vulnerabilities arising from the poor track record in reform implementation, the risk of policy reversal, the still large repayments due in 2020-2021, the large share of public debt denominated in foreign currency, the reliance on capital flows and thus exposure to a change in global financial conditions.

Analyst: Pascaline della Faille – p.dellaFaille@credendo.com