Short-term political risk: Seven countries downgraded

In the framework of its regular review of short-term (ST) political risk, Credendo has downgraded seven countries and upgraded one country.

- Burundi: downgrade from 6/7 to 7/7

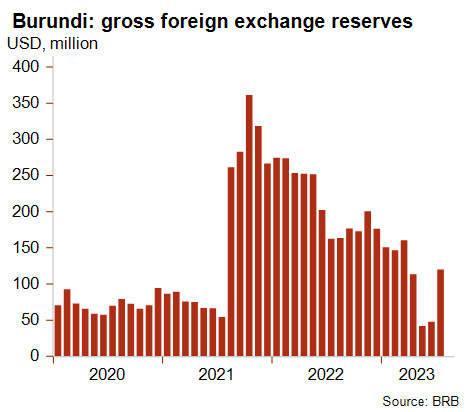

Credendo has downgraded Burundi’s short-term political risk to category 7/7, thereby reversing the upgrade of September 2022. At that time, the main drivers were the improved liquidity caused by an increase in gross foreign exchange reserves and the lifting of EU and US sanctions that had been in place since 2015. Gross foreign exchange reserves increased due to an IMF allocation of USD 147.6 million in August 2021, followed by USD 76.2 million under the Rapid Credit Facility (RCF) in October 2021. However, as seen in the graph below, foreign exchange reserves have been declining since their peak in October 2021.

On 17 July 2023, the IMF’s Executive Board approved a 38-month arrangement under the Extended Credit Facility (ECF) with access to about USD 261.7 million. Allocations under both the RCF and ECF in July 2023 had somewhat improved the situation, but even at that time, reserves only covered a single month of imports. They have continued to decrease since then to reach a meagre USD 59.7 million mid-September (about two weeks of imports). The additional liquidity provided by the IMF will likely prove insufficient. Burundi’s poor liquidity is also explained by the country’s short-term external debt situation, huge current account deficit and lack of access to global financial markets.

- Iraq: downgrade from 6/7 to 7/7

Given the heightened risks, Credendo has gone off cover for Iraq as the political situation is no longer deemed acceptable. Iraq is in a very delicate situation given its dependence on the US and Iran, and the growing Iranian influence in the country’s politics and institutions. A key strategic risk for Iraq is the access to its foreign exchange reserves as they are partially stored at the US Federal Reserve. Even before the Hamas-Israel conflict, the US authorities were already restricting transfers of foreign exchange reserves to Iraq and banned several banks from conducting operations in USD to curb suspicious financial flows to Iran and Syria. The outbreak of the conflict complicates Iraq’s challenging balancing act between the two archrivals. The heightened regional tensions and attacks on US assets by Iran-backed groups in Iraq could shift US-Iraq relations. This could expose Iraq, among others, to additional and more severe sanctions and more restricted access to its foreign exchange reserves.

- Kyrgyzstan: downgrade from 5/7 to 6/7

Credendo decided to downgrade Kyrgyzstan’s short-term political risk to category 6/7 amid heightened liquidity pressure. Despite a decline in gold exports and lower private transfers (remittances), current account receipts are expected to increase in 2023 amid an increase in bilateral trade with Russia and higher tourism receipts. The current account deficit is expected to narrow as of this year but still stay large (estimated at 20% of GDP in 2023). In this context, the foreign exchange reserves have been under pressure as the central bank used them to avoid large exchange rate fluctuations. On the positive side, foreign exchange reserves have increased recently (see graph). Moreover, the country’s liquidity position is likely to further improve as of next year, as the current account deficit should continue to sharply decline to about 6% of GDP.

Despite this expected improvement, the rating’s downgrade to category 6/7 was decided based on risks related to US sanctions. Given the rising bilateral trade with Russia (see graph), the US has already imposed sanctions on Kyrgyz companies that help to circumvent Western sanctions on Russia. Looking forward, more and broader sanctions might be imposed.

- Senegal: downgrade from 4/7 to 5/7

Senegal’s short-term political risk classification is downgraded from 4/7 to 5/7, the standard ST political risk classification for WAEMU (West African Economic and Monetary Union) member states. The downgrade is mainly caused by ongoing pressure on Senegal’s liquidity level due to worsened terms of trade. Export revenues are expected to increase by 40% in 2024 thanks to oil and gas production finally coming online. Even so, large financing gaps are still expected to emerge on the external balance of payments. This would be a result of sharp falls in foreign direct investments and portfolio investment inflows. Therefore, pressure on liquidity is only expected to increase in 2024. Also, this year’s eruption of deadly unrest and protests against political convictions in the run-up to the February 2024 elections, has negatively impacted economic growth projections for next year.