Vietnam: Strongly performing economy to face headwinds from global slowdown and inflation pressures

Event

Until now, in 2022, the Vietnamese economy has been stubbornly performing well. Strong manufactured goods exports, production relocation away from China and consumption recovery, eased by contained inflation and the lifting of Covid-19 mobility restrictions, largely explain Vietnam’s recent economic performance. Hence, the IMF has revised up its real GDP growth forecasts for 2022 to 7%, i.e. well above the expected 4.4% rate for the Asian region.

Impact

Against all odds, Vietnam is showing continued impressive economic robustness. While the country was among the rare countries to record positive real GDP growth during the first year of the pandemic thanks to booming exports of IT products, it suffered from a sharper Covid-19 wave in 2021 (and its associated lockdowns), which led to a relatively low 2.6% growth. In 2022, however, the economy has become again a bright spot in the region thanks to broad-based strong performance, particularly in the export sector and the manufacturing industry. This is even more stunning in a context of persisting global supply chain disruptions. Such a positive outcome can be explained by the benefits of the trend of relocating some foreign investments in manufacturing (such as electronics) away from China, due to rising geopolitical risks and China’s zero-Covid policy. This first concerns Chinese investors, but also investors from the USA, the EU, Japan and some other Asian countries. Vietnam is thus increasingly appearing as a new manufacturing hub in the region (India is another country about to reap such benefits), even though it does not threaten China’s world factory position at all due to obvious scale differences. Heightened public spending in infrastructure projects have also supported the economic activity in 2022, which is expected to continue over the next year.

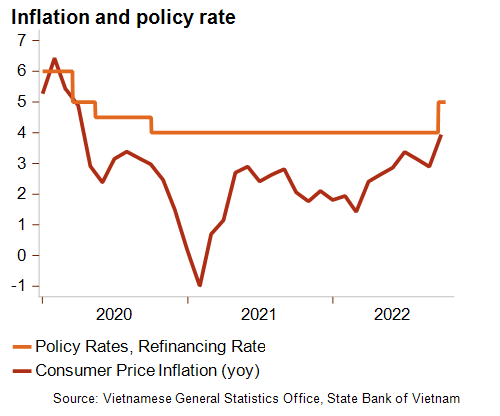

Looking ahead, the outlook is clouded by rising headwinds. The global economic slowdown – driven by China’s sharp economic weakening, US slowdown and a probable EU recession – and inflation pressures are the two main factors driving a deterioration in growth forecasts (+6.1%) for 2023. Inflation has remained relatively contained so far, but it accelerated in September to 3.9% (see graph), which may indicate higher pressures in the coming months amid rising imports of capital inputs and persisting high commodity prices. Still, those pressures may be mitigated by a relatively stable dong, thanks to Vietnam’s attractive investment place and current account surplus. During the first nine months of this year, the dong only depreciated by 4.4% against a much strengthened US dollar. This stability is also resulting from the State Bank of Vietnam (SBV)’s use of foreign exchange reserves. Moreover, the SBV is expected to use its interest rates to support the dong in order to limit future inflation pressures in a global monetary tightening climate, as illustrated by the 1% hike in refinancing rate (raised to 5%) in last September. The potential further weakening of the Chinese Renminbi in the short term could nevertheless add downward pressures on Asian currencies and make the monetary policy more complicated, notably in the very open Vietnamese economy where authorities will be torn between GDP growth and inflation goals.

In this context, Credendo’s short-term ratings could be under pressure in 2023, particularly the business environment risk (C/G) due to rising inflation, depreciating pressures on the dong and moderating GDP growth. As for the short-term political risk (2/7), Vietnam’s external liquidity has been hit by a gradual decline in foreign exchange reserves since the beginning of 2022. This negative trend may continue due to the slowing global economy, rising imports and potential future currency interventions.

Analyst: Raphaël Cecchi – r.cecchi@credendo.com