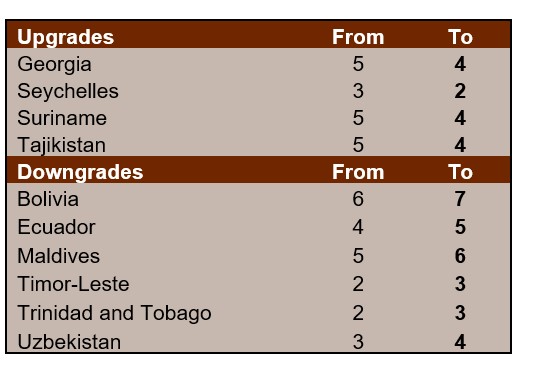

Short-term political risk: four countries upgraded, six downgraded

In the framework of its regular review of short-term (ST) political risk, Credendo has upgraded four countries and downgraded six countries.

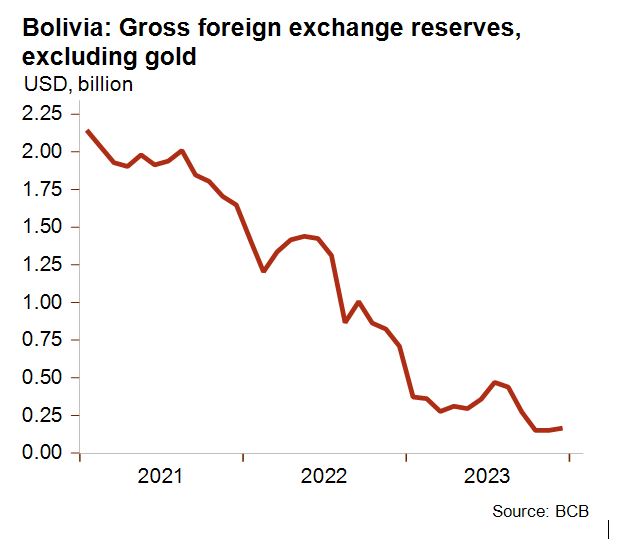

Bolivia: downgrade from 6/7 to 7/7

Foreign exchange reserves have dropped to dangerously low levels: barely covering a couple of weeks of import in December 2023 (see graph below). This level is too low to sustain the overvalued boliviano's peg to the US dollar, but the Bolivian government recently confirmed its firm commitment to its peg until at least the 2025 general election. As a result, foreign exchange shortages have been reported in recent weeks and are likely to persist in the future. While some economic reforms were announced in the end of February, including the liberalisation of certain exports and a decrease in fuel subsidies, these reforms are not expected to significantly improve the liquidity situation as long as there is no devaluation of the exchange rate and given decreasing hydrocarbon production and exports (due to underinvestment in the past decades). The situation is further complicated by the effective split in the ruling left-wing party “Movimiento al Socialismo” (MAS) between supporters of the pragmatic President Arce (in office since 2020) and those who are loyal to radical party leader Morales (president in 2006-2019). As a result, neither group has enough votes in Congress to pass legislation, resulting into a gridlock. Consequently, the approval for multilateral loans (which would provide necessary liquidity) has been delayed for months. Moreover, given the split in the MAS party and the high polarisation, severe protests have erupted, which regularly bring the whole economy at a halt, further straining liquidity. In the run-up to the elections of next year, more and severe unrest can be expected. In this context, the risks for a full-blown currency or balance-of-payments crisis is high. That being said, if the government would decide to leave its peg and implement further macroeconomic reforms, the country would see its liquidity situation quickly improve. Given the above reasons, Credendo decided to downgrade the short-term political risk of Bolivia to category 7/7, the second downgrade of the country in one year.

Maldives: downgrade from 5/7 to 6/7

The Maldives rely largely on tourism and benefited from record seasons in the past two years. 2024 is expected to confirm this positive trend, with higher tourist arrivals. However, foreign exchange reserves have been on a downward trend throughout 2023, leading to shortages of US dollars. Several factors explain this evolution. Liquidity has been under pressure, from more expensive fuel imports (since the beginning of the war in Ukraine) and heightened imports of capital goods linked to various projects. The resulting widened current account deficit has put pressure on the local currency (rufiyaa) and led the central bank to use foreign currency to stabilise it. Additional negative pressures have come from shorter holiday stays and the flight of several travel agencies to fiscally more favourable destinations. Moreover, the external debt service, although expected to decrease this year compared to 2023, is roughly around the level of foreign exchange reserves, hindering importers from accessing foreign currency. As a result, a black market has developed. In this context, with foreign exchange reserves equivalent to just one year of import cover in January and given the expected pursuit of currency support, liquidity pressures are likely to persist in the coming months, justifying a downgrade to category 6/7.

Georgia: upgrade from 5/7 to 4/7

Credendo decided to upgrade Georgia’s short-term political risk rating to 4/7 as relations between Georgia and Russia improve. Moreover, Georgia was granted the EU candidate status in December 2023. On the economic side, gross foreign exchange reserves are high, despite a recent drop. Current account receipts have increased sharply, and figures of the first three quarters of 2023 show that the current account deficit narrowed in 2023.