Brazil and Argentina: Current drought is affecting agricultural production and exports, as well as electricity generation

Drought affects agri-business sector in Brazil and Argentina

A very severe drought is affecting central and southern Brazil (including the states of Minas Gerais, São Paulo, Paraná and Mato Grosso do Sul), an area approximately corresponding to the Paraná River Basin. Lack of precipitation across the area has led to the current dry conditions, and La Niña could bring more dry conditions later this year, or even extend the current drought until the first quarter of 2022. The drought is likely to have a negative impact on general soil conditions and water availability for a long time. Therefore, Brazilian authorities have declared a drought emergency for the Paraná Basin and all sectors affected by the drought in the region until November 2021.

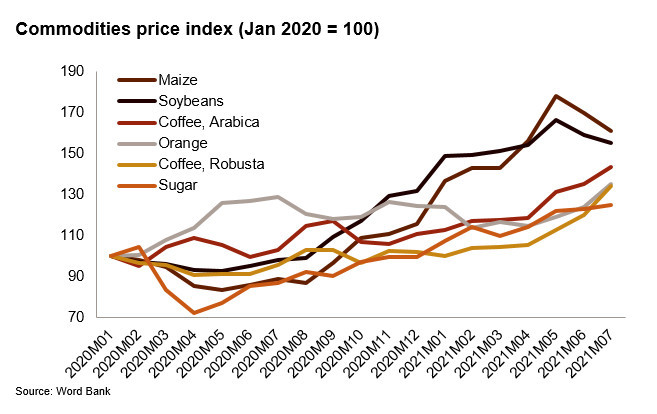

The situation affects most crops in the region. Production of sugarcane, corn, orange and coffee has already been reportedly badly affected and lowered. In some regions, coffee production as a whole is at risk. This drive prices up, fuelling inflation. Considering the importance of Brazil in the global commodities market, it pushes prices higher at a global level. Also, given the importance of grains for livestock feed, the grain price increase leads to higher costs for livestock farmers. Moreover, as 65% of electricity is generated from hydropower, the drought is also affecting power generation, forcing a switch to the more expensive thermal electricity generation. According to estimates, this pushed up electricity end-user prices by about 40%. This general price increase could spread to farmers and consumers in Brazil.

In addition to the drought, which put coffee trees under heat stress, the freezing temperatures in July have increased the risks of even lower coffee production for 2022-2023, and made prices soar. Coffee buyers are concerned that many farmers and exporters will default on their delivery contracts.

As for soybeans – another major crop for the country – the almost completed 2020/2021 crop showed no production drop. On the contrary, Brazilian soybean production should reach a record high as higher prices pushed farmers to extend the planted areas. The outlook is favourable with the USDA forecasting the 2021/2022 planted area to increase by nearly 5%. The larger area for 2021/2022 is expected to result in record production yet again.

The drought does not only affect Brazil. In Argentina, the water of the Paraná River is at a historically low level, affecting the transport of agricultural goods. In fact, 80% of Argentina's agricultural exports pass through this river. This results in increasing transport costs and therefore complicates exporters’ logistics. In addition, just like in Brazil, the drought is affecting electricity production.

Analyst: Florence Thiery – f.thiery@credendo.com; Matthieu Depreter – m.depreter@credendo.com