Lithium sector: High lithium prices do not dampen demand but increase risk

Lithium price

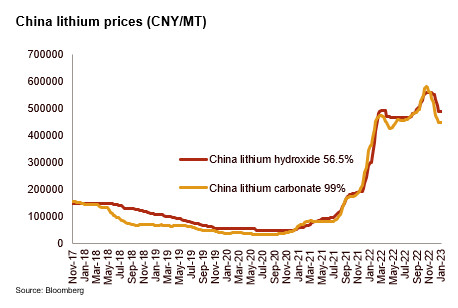

Lithium prices rose strongly in 2022 and started to decline in December 2022. The rise was not directly related to the Russian invasion of Ukraine, but rather to an undersupplied market with high demand. Between the end of November 2022 (record high) and mid-January 2023, on the back of Covid-19-related uncertainties in China, the price of lithium hydroxide fell by 13% and the price of lithium carbonate fell by 20% (23% since the peak of early November). Nevertheless, the long-term drivers of lithium price have remained intact, offering a price floor that is expected to remain above historical average in spite of the numerous global ongoing lithium mining projects (see graph below).

Lithium demand

According to the US Geological Survey (USGS), in 2022, batteries dominated the global end-use markets, absorbing 74% of the global lithium production. Indeed, the main driver behind lithium demand is the global transition towards a greener economy. China, the USA and the EU have all planned to decarbonise their economy, betting on electric vehicles (EV) and renewables, among others. Hence, sales of EV are expected to almost triple from 2021 to 2026, according to Fitch Solutions estimates. China, which accounted for about half of EV global sales in 2021, may triple its EV sales by 2026, and could thus have to gain market share abroad to absorb excess capacity. Sales in Germany (10% of overall sales in 2021, second behind China) are expected to double over the same period. The world’s top 10 countries in terms of EV sales should follow the same pattern, except Norway, which has already a high utilisation rate. Alongside EV, demand for lithium from renewable sources should also support part of the increase in global demand for lithium.

Lithium production

Australia is expected to remain the largest producer of mined lithium by 2026, but its share in global production is expected to decrease in 2026, according to Fitch Solutions. Chile and China are expected to increase their production over the next five years. American production is expected to increase as well (more than tenfold), but the USA remains a small player with less than 10% of global production expected in 2026. However, the market share of lithium mine production and lithium processing have to be differentiated. Although Australia, Chile and Argentina have the largest share of lithium mining production, China stands out as a key player in terms of lithium processing, with 80% of global capacities.

Regarding lithium reserves in 2022, Chile led the race, with 41% of proven global reserves. Australia and Argentina also stood on the podium, with 25% and 10% respectively. China held 7%, according to the USGS. Together they accounted for more than 80% of the reserves and will therefore have an important role to play in the future. Regarding identified lithium resources, Bolivia had the biggest reserves with 21 million tonnes, ahead of Argentina (19 million) and Chile (about 10 million). The other identified resources lied in Australia (7 million), China (5 million), Congo (3 million) and several other countries. Bolivia recently became the centre of attention as the Bolivian government launched a tender for the extraction of lithium. Four Chinese companies, one Russian company and one American company were in the race. The competition was not only technical, but also geopolitical. The consortium led by Chinese battery giant CATL ultimately won on 20 January 2023. Although it requires several years for a mine to be operational, this extends the grip of Chinese companies on the world's lithium reserves.

EV batteries production

Regarding the manufacturing of EV batteries, China is the global leader in terms of sales and production. Sales in China in 2022 accounted for 72% of EV battery global sales – but this share is expected to decrease over time. Regarding producing companies, despite the USA and the EU’s ambition to become key players, Asian companies dominate the market – the top 10 producers are all Asian. China’s market share is 56% (see image below), with CATL and BYD alone reaching almost 50%. However, we can assume that – all else being equal – the shares of Chinese manufacturers should decrease over time, even though Asia would remain a dominant player, given the political support and huge investments the USA and European companies are benefiting from. Bloomberg estimates that the USA and the EU should invest USD 87 billion and USD 102 billion respectively, just to meet domestic demand.

Risks and outlook

The lithium sector (and the downstream sectors) is much more than just a matter of technology and environmental awareness. Whoever controls the lithium supply chain, from its extraction to its transformation, will have a comparative advantage and global geopolitical weight. This is where the first risk comes from. In the past, authorities already intervened to limit external competition or to favour a sector (e.g. the CHIPS act under Biden or the widespread exclusion of Huawei from auctions of countries wanting to deploy 5G). More recently, in November 2022, the Canadian government asked three Chinese companies (Ultra Lithium, Lithium Chile and Power Metals Corp) to withdraw their investments from three Canadian mining companies listed on the Toronto Stock Exchange, increasing tensions with Beijing. In addition, to keep competition at bay, the USA recently passed the Inflation Reduction Act (IRA), which makes the USA more attractive for battery and EV construction. The European Union responded with the Net-Zero Industry Act.

The second risk is related to the environment. While Western companies in Western countries are following lengthy processes to ensure no environmental damage is caused by the extraction or the supply of metals, China turns to countries with laxer regulatory frames. Extracting lithium is very polluting, water intensive and requires the construction of a lot of infrastructure, in areas which, although often desert, can be protected or contain protected elements ( e.g. Nevada in the USA).

The third risk is the inflationary pressure. All sectors, but most specifically raw materials needed to manufacture batteries (lithium, cobalt, nickel), face inflationary pressure. This is an additional challenge for the automotive industry, often blamed for its expensive EV batteries slowing the large-scale adoption of EV. This inflationary pressure also risks watering down the importance of the investments made by manufacturers and countries.

Finally, any protectionist measure or geopolitical event could lead to supply chain disruptions or shortages, as shown by the war in Ukraine.

Analyst: Matthieu Depreter – m.depreter@credendo.com