Mongolia: Economic outlook for 2023 is uncertain and mainly dependent on China

share article

Event

Mongolia’s expected moderate real GDP growth (+2.5%) in 2022 – after a modest +1.6% in 2021 – is forecasted to accelerate to 5% in 2023. However, the latest IMF forecasts are uncertain as the main external factors behind this year’s subdued growth, namely China’s Covid containment measures, the weak economic momentum and inflation pressures, might persist next year.

Impact

China’s zero-Covid policy and sharply weaker economic activity have significantly hit landlocked Mongolia’s key exports to China because of land border closures, supply chains disruptions and poor (commodity) demand. Besides, Mongolia is suffering from inflation pressures, which are exacerbated by the impact the war in Ukraine is having on food and energy prices, and by the depreciation of the tugrik. So far, the latter has lost 18% of its value against the US dollar this year (data until 13 October), which has fuelled inflation as well. Depreciating pressures come not only from a strong US dollar, but also from a substantial widening of the country’s current account deficit from 12.8% of GDP in 2021 to an expected 20% in 2022. This deterioration is explained by the increase in imports, which is largely exceeding the jump in exports in value, as export volumes continue to drop this year as well. In response, the central bank has sharply tightened its monetary policy by doubling its policy rate to 12% this year, i.e. a five-year high. Further rate increases are not ruled out in the future. In this context and given the risk of – at best ¬– a slowly growing global economy putting downward pressures on global commodity demand and thus prices, Mongolia’s economic forecasts for 2023 are very uncertain as Mongolia remains very reliant on China and mining prices. Indeed, 75% of its exports go to China, whereas more than 60% of Mongolia’s imports come from China and Russia. Volatility in mining prices is one of several external shocks weighing on Mongolia’s economic prospects, as prices could be at lower levels in case of flat global growth next year. In those turbulent and uncertain times, Mongolia’s dependence on its neighbours and the extractive sector are again accentuating the country’s structural weaknesses. This is highlighted by tourism as well. The sector, seen as a source of economic diversification, remains virtually frozen as a result of China’s zero-Covid restrictions and the war in Ukraine (e.g. sanctions), and therefore continues to harm economic activity. Another growth driver, private consumption, is affected by high inflation after households had just welcomed the lifting of Covid-19 restrictions in early 2022.

On the positive side, the expansion of the giant Oyu Tolgoi copper mine is expected to move forward in 2023 after the government and project partners reached an agreement in January. This expansion is likely to support exports and real GDP growth. Moreover, Mongolia’s political situation has stabilised since the June 2021 elections with the ruling Mongolian People's Party enjoying parliamentary majority and in control of the presidency. In a context of heightened domestic stability, social protests fuelled by high living costs and unemployment appear as the main threat to stability in the short-term.

At an international level, the war in Ukraine has raised the country’s geopolitical dimensions as it finds itself in an in-between position between Russia and China on the one hand, and the West on the other hand. While western support to its democracy is expected to rise in the future, Mongolia is keen to continue reaping economic benefits from its transit position between its two giant neighbours, Russia and especially China, its dominant trade and investment partner. Mongolia is part of China’s BRI (Belt and Road Initiative) and agreed with Gazprom at the end of February to start building a pipeline (‘Power of Siberia 2’) between Russia and China as from 2024. While the pipeline would re-orient Russian gas sales away from European customers, it would allow Mongolia to perceive valuable transit fees. The financing has yet to be found though, but an oil pipeline is also said to be considered. Those economic projects might eventually increase further Mongolia’s economic vulnerability and dependence in the long term, especially given rising world geopolitical tensions.

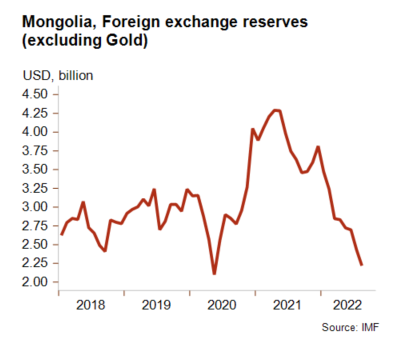

Credendo’s ST ratings have remained stable since 2021, mainly thanks to a slowly improving economic momentum driven by high mineral prices. However, the ST political risk (4/7) has a negative outlook. Indeed, liquidity risks have been on the rise this year, due to the steady collapse in foreign exchange reserves (-42% between January and August 2022), reflecting expensive imports and weaker export growth.

Analyst: Raphaël Cecchi – r.cecchi@credendo.com