Business environment risk: The energy crisis in the EU is pushing ratings on a downgrade trajectory

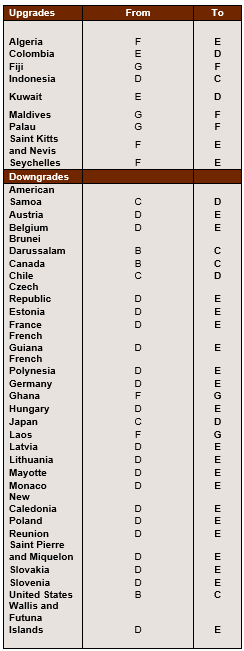

In the framework of its regular review of business environment risk classifications, Credendo has upgraded 8 countries and downgraded 28 others. Downgrades largely dominate on the back of a weakening global economy and high inflation. EU countries are particularly hit as the energy crisis could soon lead to a recession.

Algeria: upgrade from category F/G to E/G

Algeria’s business environment has improved significantly, driven by the high oil and gas prices of the past months. Given the country’s economic and financial reliance on the hydrocarbon sector (which amounted to around 16% of GDP in 2019), evolutions in this sector influence Algeria’s macroeconomic trends very heavily. The multiyear high hydrocarbon prices of the past year and the surge of prices following the war in Ukraine have therefore supported the rapid recovery of the country. Similarly, public finances and external balances have also improved. For instance, after almost a decade of deficits, a current account surplus is projected this year, inverting years of foreign exchange reserves erosion. Another positive development from which the country is expected to benefit, is the EU’s push for energy diversification in response to the war in Ukraine.

Despite those positive developments for the country, the business environment is clouded by important downside risks. Algeria, as well as other countries in North Africa, is experiencing important inflationary pressures (which amounted to 10% year-on-year in June) that could prompt the Bank of Algeria to raise interest rates. Such a move could lead to an economic slowdown. Moreover, the risk of global slowdown and recession/slowdown risks in major markets such as the USA, China and the EU are exerting negative pressure on oil prices. Additional declines in oil prices could invert the positive economic trends given the lack of structural macroeconomic reforms. Indeed, the dependency on the hydrocarbon sector remains a structural weakness for Algeria, exposing the country to the volatility in global energy markets.

Indonesia: upgrade from category D/G to C/G

So far, the Indonesian economy has been performing strongly this year, which has led to an upgrade of the business environment risk to C/G. Commodity exports (notably coal, palm oil and nickel) have indeed been booming because of high prices, whereas the improved Covid-19 situation has boosted private consumption. As a result, GDP growth is expected to reach 5.3% in 2022 and could fluctuate around 5% next year. This forecast is nevertheless clouded by an upward trend in inflation (4.6% in August) and the central bank’s ongoing monetary tightening. In addition, slowing global economic growth is likely to affect commodity prices and the demand for manufactured goods, and, as a result, Indonesian exports. However, in spite of a gradually deteriorating short-term outlook, Indonesia’s high economic resilience is likely to persist on the back of a current account surplus and a diversified economy. This could continue to limit depreciation pressures on the relatively resilient rupiah against the US dollar (-5% between January and mid-September 2022). Political stability and responsible economic policy decisions by the government (e.g. the recent sharp cut in fuel subsidies) should also contribute to support economic activity in troubled times.

Many EU countries: downgrades from category D/G to E/G

Russia’s invasion of Ukraine and its consequences on the energy market have derailed the fragile recovery that the EU region was benefitting from in the aftermath of Covid-19. In a context of already high inflation and ongoing supply chain disruptions, progressive cuts of Russian gas deliveries to the EU have led to gas and electricity prices reaching record highs in some countries and to mounting fears of gas shortages this winter. Russian gas supplies, which previously amounted to about 40% of the gas consumption of the region, have been cut by 80% since the onset of the war. Germany, Italy and Central Europe (Czech Republic, Slovakia and Hungary) are projected to be the most affected as they are very dependent on Russian gas, whereas the transmission of alternative sources of gas via pipeline is not without difficulty because of bottlenecks. Additionally, high inflation is weighing on consumer confidence through its impact on real wages that will consequently affect consumer spending. Risks of a recession in the short-term are mounting and affect the business environment risk. The magnitude of the downturn/recession will depend on various factors such as the support measures put in place by the EU and by national authorities, and the winter conditions and gas supplies given their impact on gas prices. As a result, the bulk of business environment risk classifications is downgraded in the EU region, including the following countries likely to be most severely affected by high energy prices or possible gas shortages: Belgium, Czech Republic, Estonia, France, Germany, Hungary, Latvia, Lithuania, Monaco, Poland, Slovakia and Slovenia.