Drought in Europe: Agricultural yield, inland waterway transport and power generation severely affected

Event

An exceptionally warm and dry summer in the Northern Hemisphere has caused severe drought in many European countries. According to a preliminary study by the Joint Research Centre (JRC) of the European Commission, this summer’s drought in Europe could be the worst in 500 years. Many countries have been affected, among which Belgium, France, Germany, Hungary, Italy, Ireland, the Netherlands, Portugal, Romania, the UK and Ukraine with extreme conditions lasting for several weeks, or even months depending on the country. The latest map of the Combined Drought Indicator (including the first ten days of August) shows that 47% of Europe is in warning conditions and 17% in alert conditions.

Impact

Besides tragedies caused by wildfires and population displacement, these severe meteorological conditions have impacted several sectors in Europe, especially the agricultural sector, which is being hit hard.

The lack of water (due to little rainfall, low levels of rivers and low groundwater levels) and the rationalisation of its usage lead to summer crop production losses. According to the JRC, EU crops should be 16% lower this year than the five-year average for grain maize, 15% lower for soybean and 12% lower for sunflowers. Wheat and barley are expected to be less affected.

In Romania – the second-largest European producer of corn and oilseeds – 75% of the territory is affected by high temperatures and droughts. At the end of July, Romanian wheat and corn production was 33% and 46% lower respectively than in July last year. In France – Europe’s top wheat producer – wheat harvest data suggest production declined by 7%, just like in Italy where the Po Valley represents 40% of national wheat production.

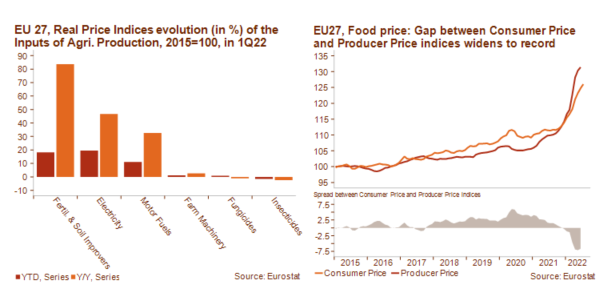

This drop in production could cause cash flow problems for producers, while their input costs are soaring (see left-hand graph). European producer costs are increasing faster than consumer prices, which means that producer margins are falling (see right-hand graph). It is a safe bet that some producers will not have enough money or funding for the upcoming season that begins with seeding in October.

While crop prices were on the decline after reaching record highs as a result of the war in Ukraine, droughts and high temperatures could stop the price drop.

Commercial navigation is also affected by low water levels. On the Rhine – the key commercial waterway in Germany and the Netherlands – container ships are forced to transport only a fraction of their usual cargo, leading to severe delays in deliveries and higher transport costs. The coming weeks will be crucial as water levels normally keep decreasing until autumn. The shortages of vessels, required for the increased transport of coal driven by the country’s energy crisis, further exacerbate operational issues. These hurdles will particularly impact the chemical and steel industries, as they use the waterway a lot.

The drop in water levels also impacts the production of hydraulic and (the cooling system of) nuclear energy, making the dependence on gas – whose price is reaching record highs – even more important.

In Norway, for example, water in hydropower reservoirs, which are responsible for about 90% of Norway’s electricity, has dropped to its lowest point in 25 years. This has prompted hydroelectric producers to cut generation to conserve water, and the country, which usually exports about 20% of its production, has imposed power export controls, adding to the stress of the regional energy crisis.

Analysts: Florence Thiéry – f.thiery@credendo.com; Matthieu Depreter – m.depreter@credendo.com