The Gambia: A positive outlook prevails amidst adverse global conditions

Event

Gambia continues on its path of economic recovery following a tough political transition, the Covid-19 pandemic and the indirect impact of the Russian invasion in Ukraine. This recovery justifies Credendo’s positive outlook for Gambia’s medium- to long-term political risk classification (in category 7/7 today) despite amplified risks stemming from foreign aid cuts and (geo)political tensions.

Impact

Economic growth is expected to reach 5.9% in 2025 and 5% in 2026. It is driven by the return of tourism to pre-pandemic levels and the National Development Plan (2023–2027), which focusses on priority sector investments (agriculture, telecom and construction) and climate change resilience. Inflation is set to drop to single digits this year (8.8%) and converge toward 5% as of next year, assuming an unchanged tight monetary policy stance and stable global food and energy prices. The cost of living in Gambia is highly exposed to fluctuations in global prices as the country is a net fuel and food importer.

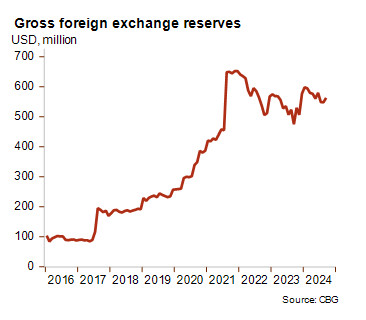

The current account deficit should continue to narrow over the coming years thanks to tourism revenues and remittances, while a gradual increase in FDI inflows should bolster the capital account. The foreign exchange market is functioning smoothly following a remarkable recovery from structurally weak liquidity under the former Jammeh regime. Foreign exchange reserves were at 4.5 months of import cover end 2024. This is an important representation of how structural reforms have been advancing in Gambia over the past years. Moreover, the exchange rate of the Gambian dalasi depreciated by an acceptable 7% against the US dollar in 2024.

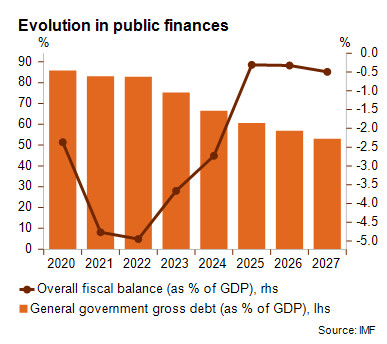

In 2017, newly elected President Barrow inherited unsustainable government debts from former President Jammeh (in power from 1996 until 2017), who was known for massive theft and embezzlement of government funds. The new administration was complimented for its democratic transition, the improvement of fiscal integrity and macroeconomic stability. However, in 2020, the country was confronted with the severe impact of Covid-19, resulting in an economic standstill and great financial pressure. To accommodate the most vulnerable countries like Gambia, a temporary debt moratorium under the DSSI (Debt Service Suspension Initiative) was granted by multiple creditors.

Since 2023, the economic recovery has really taken off. As a result, public finance figures display a structural positive turn, supported by a recovery in government revenues (tourism), while ambitious reforms and fiscal consolidation efforts secured substantial IMF support and paved the way for foreign investments (current IMF programme: January 2024–January 2027). Along with the recovery in government revenues, 2024 was a year of high expenditure as Gambia hosted the 15th Summit of the Organization of Islamic Cooperation (OIC) – the second largest intergovernmental organisation in the world – and provided financial emergency support to the National Water and Electricity Corporation (NAWEC) following a crisis in the power sector. The IMF still considers Gambia’s overall public debt distress risk to be high, yet deems it to be sustainable under a baseline scenario.

Nevertheless, external and domestic risks could weigh down the small nation’s outlook. There are important risks related to the country’s high reliance on grants and foreign donor support, which are affected by the American cuts in foreign aid and the downward revision of international solidarity-related budgets in favour of increased defence spending by traditional donor countries. In 2022, official development aid (ODA) amounted to 32% of Gambia’s payments for the imports of goods and services. Despite its high aid-dependency, Gambia’s reliance on US aid is below average compared to many other countries in the region. On the political front there are also important risks. President Adama Barrow has seen his popularity drop during his current (and second) term. A possible third term bid in the early 2026 elections might spark sharp resistance from civil society and opposition groups. Moreover, social unrest could be ignited by the high cost of living, which would be exacerbated in case electricity tariffs are increased as a response to the crisis in the power sector. Besides, electricity shortages are weighing down the manufacturing sector. Another risk stems from more frequent and severe natural disasters that could damage infrastructure and livelihoods and negatively affect economic growth and external and fiscal balances.

Credendo classifies Gambia in category 4/7 for short-term political risk with a stable outlook. For medium-to long-term political risk, Gambia is classified in category 7/7 with a positive outlook for an upgrade to category 6/7.

Analyst: Louise Van Cauwenbergh – l.vancauwenbergh@credendo.com