Steel sector: Steel prices have soared on the back of increased Chinese demand

Sharp increase in steel prices

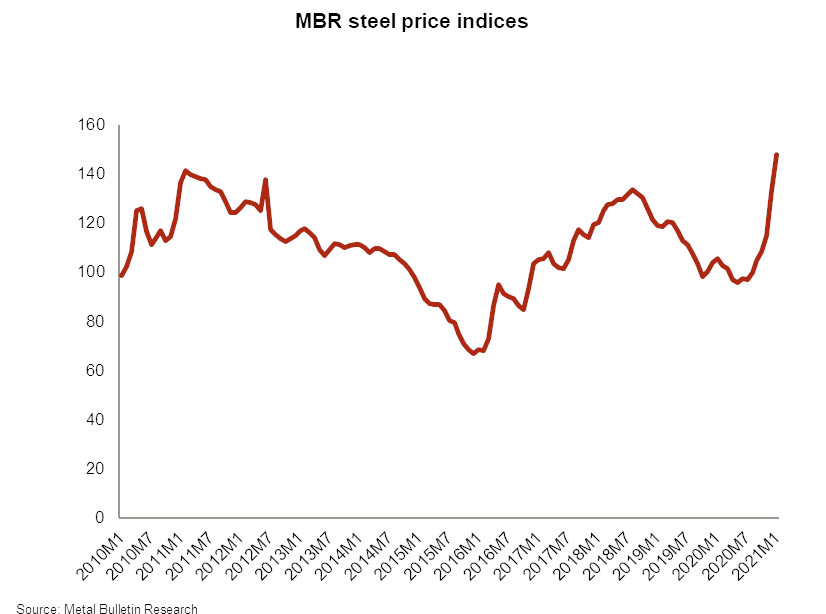

After almost two years of decline, steel prices have risen sharply in recent months. If we look at the steel price index1, we see that the level of January 2021 is 40% higher than that of January 2020. The main reasons for this movement are to be found on the one hand in the restricted production growth and on the other hand in the increased Chinese demand. The increase in the iron ore price also supports this rise in steel prices, although it makes a dent in the margins of companies that could not pass on the cost increase to their clients.

Although global steel production fell by only 1% in 2020 compared to 2019, this figure hides many disparities among the different regions in the world. In fact, the production in the European Union fell by more than 15% annually in 2020, as that of the NAFTA region. In the C.I.S., the fall in production was less severe (- 9% in 2020), in part thanks to the demand from China. In Asia and Oceania, the evolution of annual production is positive (+ 2.1%), mainly thanks to China (the first world producer, with + 6% year-over-year in 2020) that offsets the drop in Indian production (the second one, with - 11% in 2020). In all these regions, steel production is expected to rise in 2021, but not enough to reach the pre-crisis levels (with the exception of China, whose annual production has kept growing for years).

Resilient demand for steel in the short term

Global demand, for its part, followed an opposite path, mainly due to the resumption of activities in China (whose average imports in 2020 increased by 65% with respect to those in 2019), supported by massive investments in infrastructure (steel-intensive), even though other major economies slowed down. This shows the first risk underlying the steel market, namely its heavy dependence on Chinese demand.

The demand for steel in China is expected to slowly decrease over time since the property sector (which accounts for about 35% of the domestic steel consumption) is likely to slow down. In the longer term, the government’s willingness to turn to a service-oriented economy, putting infrastructure work aside, will also lead to lower demand of steel in China. This decrease in domestic demand combined with domestic production capacities steadily growing should put more steel on the global market, leading to higher exports and putting pressure on global steel prices. Hence, even if steel prices are expected to remain elevated in the coming months, they are likely to decrease at the end of the year and in 2022.

Main risks facing the steel sector

The biggest risk for companies engaged in the steel-making industry is a sudden drop in demand from China, which will possibly happen again, leading to a lower steel price. Besides, overall steel production is expected to grow faster than consumption, putting downward pressure on the price of steel. In addition, the historically high iron ore price reduces the margins of the firms that do not manage to pass the increase in cost on to their clients – although we expect the iron ore price to slightly decrease over time. Another factor to watch is the development of the China-US relations, which could also have an impact on the prices. Finally, any delay in vaccination campaigns or the unexpected spread of Covid-19 variants could also derail the demand for steel, eventually weighing on prices.

Analyst: Matthieu Depreter – m.depreter@credendo.com

1 The MBR steel price index is the computed average of the MBR steel flat products price index and the MBR steel long products price index, supplied by Metal Bulletin Research.