Commercial risk: Various downgrades amid sharp deterioration of economic activity

Since it was publicly revealed by China that a new virus was affecting its population (around 20 January), the contamination has rapidly spread to Europe first and to many other countries worldwide afterwards. As a result, many countries have announced confinement measures (lockdown, travel restrictions, border closures, curfew, etc.). More than a quarter of the world population is affected by such quarantine measures. Such measures, while effective in combating covid-19, undermine economic growth and business conditions as highlighted by the example of China. Given the magnitude of the containment measures, economic forecasts are subject to review and the world economy is likely to enter into recession this year. Indeed, at least in the short term, the economic activity has decreased drastically worldwide amid a drop in business and consumer confidence, supply chain disruptions, restriction on the movement of persons – and to a lesser extent – of goods and a large drop in financial markets.

At the same time, commodity prices have been put under pressure amid a large drop in the economic activity worldwide. This is even more pronounced for oil prices that have been hit - both by a demand and a supply shock. Indeed, on 6 March, the OPEC+ group failed to agree on further supply cuts and Saudi Arabia thereafter decided to launch a price war by cutting its own crude oil price and raising production. As a result, oil prices tumbled down to below USD 25 for the Brent barrel (USD 23.03 per barrel on 29 March), the lowest level since 2002. Given that the supply glut is a strategic decision and that demand remains impacted by a paralysis in transport worldwide and a slowdown in global activity, oil prices are expected to remain low for several months. Those commodity shocks will harm many commodity exporters in the coming months.

Countries not (yet) affected by the virus could suffer from spillover effects as their economy is likely to be hampered by one or more of the following transmission channels: drop in commodity prices, drop in tourism revenues, drop in remittances, drop in external demand, sharp deterioration of global financial conditions and supply chain disruption and border closures. There are also large differences between countries in their ability to deal with the crisis. Some countries have room for fiscal and/or monetary stimuli, and others don’t. It is evident that in the latter group the impact on the economy will be larger. In this context, it is worth noting that an exceptionally large number of countries are simultaneously requesting assistance from the IMF through their financial emergency tool (the Rapid Credit Facility). Kyrgyzstan was the first country to get access to the Rapid Credit Facility.

As a result of this large shock, Credendo reviewed its classifications for commercial risk taking into account the countries specific characteristics, such as direct impact of covid-19, reliance on oil and tourism, trade openness and domestic and external buffers. On the one hand, Credendo considered the direct impact of the shock on key drivers that influence its commercial risk classification such as economic growth, access to credit and lending cost and exchange rate evolution. On the other hand, the countries’ resilience and thus their ability to withstand the current shock was also taken into account. As a result, commercial risk classifications of a large number of countries have been downgraded as highlighted in the maps below.

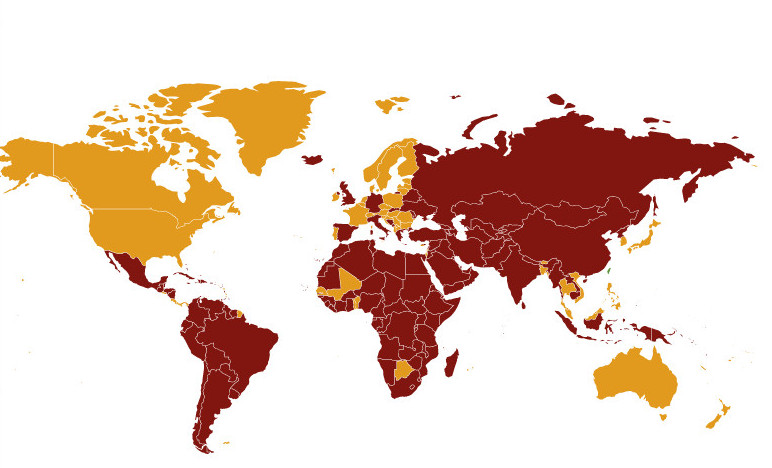

Commercial risk as of 1 March, 2020:

Commercial risk as of 1 April, 2020: