Timor-Leste: Challenging outlook for the oil- and gas-reliant economy facing rapid reserve depletion

Event

In April, José Ramos-Horta was elected president after peaceful elections. His success was boosted by the support of the country’s most influential political person, i.e. opposition leader and former PM Xanana Gusmão. Parliamentary elections, scheduled in 2023, might be held earlier. If elected, and he is a likely winner, Gusmão would put the emphasis on oil and gas expansion and large-scale infrastructure development. During the celebration of Timor-Leste’s 20th anniversary and his first speech as new president, Ramos-Horta announced that some of those projects might involve China as he is keen on further strengthening their bilateral ties. Exports to China have been steadily increasing over the past decade and economic cooperation is expected to deepen amid the Belt and Road Initiative (BRI). Moreover, under Ramos-Horta’s presidency, Timor-Leste might join the ASEAN as from 2023.

Impact

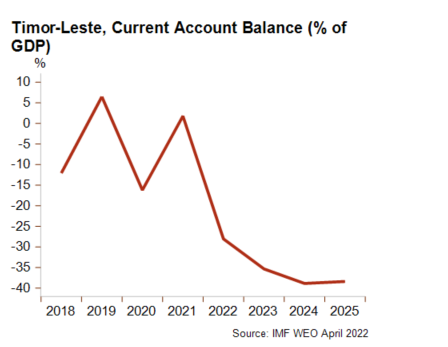

After the abrupt Covid-19 shock in 2020, the country’s macroeconomic fundamentals sharply improved in 2021 on the back of rising oil and gas prices. In 2022, economic recovery is continuing, driven by construction spending and even higher oil and gas prices. As the depletion of Timor-Leste’s existing reserves is now expected to be spread until around 2025, high prices will keep supporting the economy in the next years. However, only moderate real GDP growth (close to 2%) is expected this year as it is constrained. Indeed, the decreasing hydrocarbon output partly offsets the benefit from high prices and brings total exports to lower levels this year and next. Moreover, high commodity prices are fuelling inflation pressures in spite of the use of the US dollar as legal tender and as a result of inflation buffer. The inflation rate has been on a constant upward trend this year and reached 7.4% in May. This may contribute to slow down economic activity and consumer confidence, whereas high food prices could increase the risk of social protests in a poor country. Besides, higher imports, combined with falling hydrocarbon export volumes, will sharply deepen the current account deficit, from 2.7% of GDP in 2021 to 33.6% of GDP this year. It will probably worsen further in the coming years, when oil and gas reserves near full depletion.

The same negative evolution will be also observed for public finances. Indeed, with oil and gas government revenues – the largely dominant source of revenues – on a structural decline and high spending, combined with foreign loans, to finance public investment projects, the fiscal deficit has been in huge double-digit over more than the past decade and is forecast to widen to a level above 40% as from 2023. Fortunately, the government can count on significant withdrawals from its large Petroleum Fund (PF) to finance its ambitious spending plans. This reliance will grow further in the coming years until new sources of revenues are developed. Although the PF amounted to nearly 1000% of GDP in 2020, the accelerating withdrawals could bring it close to depletion by 2033.

The risk outlook remains clouded by the absence of solid alternative current account receipts to the hydrocarbon fields. On the one side, given the still relatively underdeveloped non-oil sector, the authorities put the emphasis on agriculture and infrastructure projects as main current and future growth drivers. On the other side, the potential future Gusmão’s government commits to expand the oil and gas industry. Nevertheless, the potential development of the Greater Sunrise oil and gas fields still looks uncertain and far – not before 2030 – due to financing gaps and blocked talks with Australia on a production-sharing agreement. Therefore, to reduce economic vulnerability and mitigate the oil curse, notably regarding the management of public finances and the quality of the institutions, economic diversification beyond fossil fuels remains crucial to ensure the country’s economic sustainability in the long-term and generate enough jobs to a very young population. The oil and gas industry brings indeed a low contribution to local employment. Future cooperation with China will be also closely monitored. Not only on the economic front, driven by BRI projects, with probable China’s first loans to Timor-Leste, but also when it comes to intensifying geopolitical games in the region. Indeed, as seen in several Pacific islands, small countries in the region are increasingly the object of more attention for security and other forms of cooperation, as China, the USA, Australia and other states are fighting for influence to improve their geostrategic position and defend their regional interests.

In the near term, Credendo’s political risk ratings are expected to be stable whereas the business environment risk rating has a cautiously positive outlook.

Analyst: Raphaël Cecchi – r.cecchi@credendo.com