Taiwan: Preserving LT stability will be more challenging as Taiwan faces rising political uncertainty and China’s slowdown

Stability to prevail despite heightened tensions with China

Political tensions are expected to stay at more elevated levels until at least next January’s 2020 national elections. While it enjoys a comfortable majority in Parliament, the ruling Democratic Progressive Party (DPP) suffered a heavy defeat in last November’s local elections against the opposition pro-Beijing and pro-unification Kuomintang (KMT), particularly in large cities. As a result of a vote that firstly sanctioned the government economic and energy policies, the less popular President, Ms Tsai Ing-wen, resigned as party leader. National polls promise to be contested next year with the KMT appearing to be the favourite to retake control of Parliament, whereas the presidential vote is more uncertain. The population will again have to choose between the potentially more unstable DPP’s pro-independence stance and the KMT’s pro-Beijing policies. Whatever the winner, what is clear is that a broad majority of the population wants to stick to the peaceful and pragmatic sovereignty status quo of a “One China policy”. This allows them to prevent the risk of a war with China while enjoying autonomy and democracy. The problem, however, is that Beijing sees this situation as only temporary.

In the next 12 months, bilateral relations are likely to remain conflictual. President Tsai, who relies on a population – especially the youth, as the 2014 sunflower student movement showed – which feels increasingly less Chinese and more Taiwanese, is expected to continue her policy of distancing the island from mainland China by diversifying export markets (e.g. Japan, India, ASEAN countries) and strengthening relations with the USA as a partner and umbrella. This is especially true as China has tightened its approach to Taiwan under the defiant rule of Ms Tsai, who does not recognise the “One China principle” from the “1992 consensus” and is opposed to Beijing’s prospect of “One country, two systems”, as used in Hong Kong and Macao. Since 2016 and the DPP’s historic landslide electoral victory, Taiwan has been facing growing economic and military pressures and diplomatic isolation. Beijing has indeed restricted flows of Chinese tourists – by far the main source of visitors – to Taiwan, put pressure on the last few countries recognising Taiwan to stop their diplomatic relations with the island, obstructed Taiwan’s participation on the international stage and increased military exercises across the Taiwan Strait.

The 2020 elections and the US and Chinese position will shape the MLT political risk outlook

In this context, needless to say, the outcome of the 2020 elections will matter a lot for the MLT outlook: either a KMT victory allowing a gradual normalisation of relations (i.e. starting with a return to the “1992 consensus”) and enhanced cooperation with Beijing, or a DPP victory facing China’s more assertive stance and growing military power. Xi Jinping’s recent statement that the goal is eventual – and long-term – reunification as part of China’s future rejuvenation highlights that future relations will inevitably continue to blow hot and cold given the Taiwanese aspirations for the status quo. Meanwhile, and beyond 2020, China is expected to increase its political influence and cooperation in districts where KMT recently won the elections and increase investments there.

Of course, the outlook will also greatly depend on the USA as a stability factor or tension trigger. Under Mr Trump’s administration, which recognises the “One China principle”, bilateral relations are at their best in years. Increased arms sales and the approved Taiwan Travel Act allowing reciprocal visits of high-level officials underscore this. In the future, depending on the US administration in charge after 2020, Taiwan could be a collateral victim of the US-China trade war and fight for global economic supremacy as regional tensions are expected to increase as a result in the South China Sea and Taiwan Strait. All in all, though political risks have gradually increased since 2016, making a clash less unlikely, the status quo around Taiwan’s sovereignty remains the dominant scenario in the MLT.

An economy vulnerable to a US-China trade war and Chinese slowdown

Besides the strained political climate with China, Taiwan sees clouds gathering over its economy. It is facing the indirect negative economic impact from the trade war between the USA and China, and is vulnerable to a Chinese slowdown. Taiwan’s highly open economy is indeed driven by exports and is much exposed to external shocks, particularly those harming China, its primary trade and economic partner. The Taiwanese economy is specialised in manufacturing intermediate goods and is highly integrated in the global value chain. It is harmed by US tariffs hitting China by having the highest GDP in the value added exported by China to the USA, and more generally, it is the most exposed Asian country (over an equivalent of 8% of GDP, according to the OECD) when it comes to contributing to value added in Chinese exports to all markets. Therefore, exports went down in the last two months of 2018, especially electronic goods. In 2019, given the potentially higher US tariffs (from 10 to 25%) on possibly all Chinese exports in a context of less supportive global demand, the negative trend will continue through reduced Chinese demand for Taiwanese goods, which will weigh on Taiwan’s GDP growth.

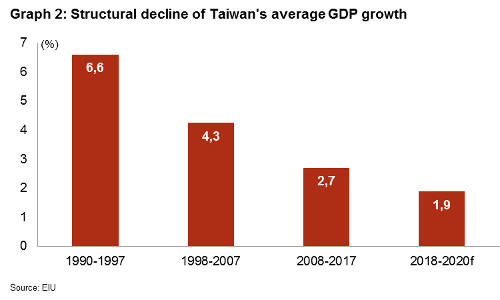

In addition, the rapid ageing of the Taiwanese population and a stubbornly high household debt (86% of GDP in 2017, i.e. only below South Korea in Asia) will be a drag on future private consumption. Hence, real GDP growth forecasts have been cut to around 2% and 1% in 2019 and 2020 respectively, down from 2.6% in 2018 and 3.1% in 2017.

The Chinese slowdown is affecting Taiwan’s economy through its over-reliance on China (45% of goods exports if we include Hong Kong). Its MLT growth potential – much reduced since the 2008 crisis – could therefore be curtailed unless deep structural adjustments are made.

This particularly assumes product diversification (away from the dominant electronics industry, where regional competition is fierce) and geographic diversification, which is what the current administration has been doing since 2016. An emphasis should also be placed on addressing the structural lack of innovation. Such processes will take time. Meanwhile, dependence on China will inevitably remain high.

External shocks will bite but strong fundamentals will cushion their impact

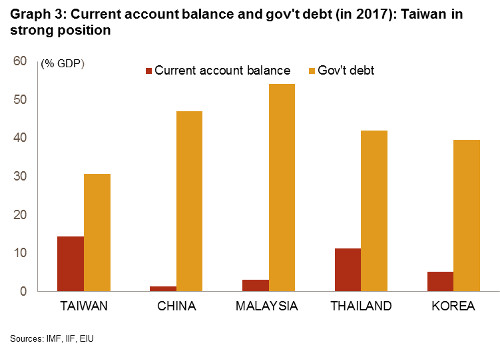

Although Chinese shocks will hit Taiwan’s economy, firstly at trade level, its robust fundamentals will help mitigate them. This is true for its very large current account surplus (close to 13% of GDP in 2018), which is expected to decrease gradually in the MLT but still stay in a solid double-digit region. Exports, especially from the key electronics sector, are likely to grow at a weaker pace – in addition to weaker revenues from Chinese tourists – and imports increase as a result of higher infrastructure investment-related goods.

After a positive 2018, foreign-exchange reserves have remained at record levels, allowing nearly 15 months of import cover. They amount to more than twice the sustainable external debt (34% of GDP in 2018), which make Taiwan a solid net external creditor. Therefore, despite an external debt predominantly of short-term maturity, huge foreign-exchange reserves will mitigate risks related to tighter global financing conditions. External debt is forecast to remain stable in future.

Sound public finances are extra buffers. Public debt is low at around 30% of GDP and fiscal deficit, expected at a small 0.7% of GDP in 2018, is forecast to rise slowly on the back of higher spending related to the ageing population and the government’s four-year “Forward-looking Infrastructure Construction Project”. To finance the extra expenditure, tax measures are planned to rebalance the fiscal system and increase government revenue. The authorities will thus use fiscal space to stimulate a slowing economy. At the same time, the economy benefits from a loose monetary policy with a persisting low Central Bank interest rate (1.37% since mid-2016). This is explained by enduring low inflation (1.5% at the end of 2018) and favourable lower oil prices for a net oil importer like Taiwan. Those conditions could remain similar this year given the less upbeat external environment and the end of the US Fed’s rate increase cycle. The rather stable economic picture and strong fundamentals explain the high stability of the New Taiwan dollar over the past years. The currency’s soft depreciation of a few % against the US dollar in 2018 largely resulted from a strong US dollar and economy. Future evolution is rather uncertain in the face of headwinds, from a slowing Taiwanese economy to a potentially weakening US dollar.

Political risk rating: stable outlook for now

Looking ahead, China’s slowdown and trade war with the USA will inevitably harm Taiwan’s economy, which is already confronted with the ageing problem. In this more uncertain and less supportive environment, continuing structural adjustments will be essential if Taiwan wants to pursue a successful path. This is a central risk factor as important as the uncertainty regarding the political situation, Taiwan’s future status and relations with China. At this stage and in spite of increased political risks, Credendo is keeping Taiwan in the lowest political risk category, 1/7 (for the ST and MLT classifications), as stability remains the dominant scenario. A downgrade of the MLT political risk nevertheless cannot be ruled out if the DPP wins the 2020 elections, with a likely continued negative impact on political risk and stability.

Analyst: Raphaël Cecchi – r.cecchi@credendo.com