Steel sector: Steel price on the decline amid stagnant steel demand in China and lower iron ore price

Steel price started to decline

Key material in the manufacturing sector, steel barely suffered from the drop in demand in 2020 following the Covid-19 pandemic. As it can be seen in Graph 1, prices started to rise at the end of 2020 and skyrocketed in 2021. The main reasons for this movement are to be found, on the one hand, in the lower production given the pandemic-led restrictions and, on the other hand, in the unexpectedly strong demand in China manufacturing sector.

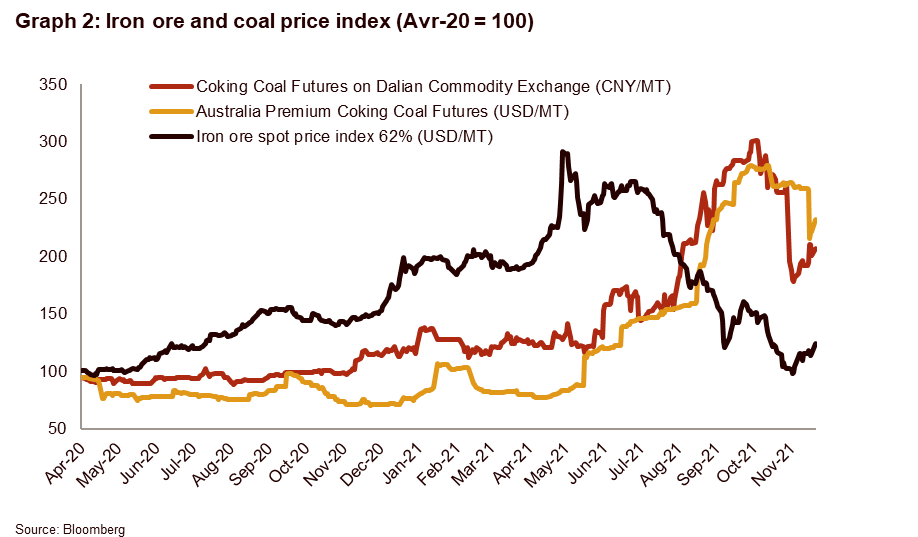

Steel prices were also supported by high iron ore and cocking coal prices (key inputs in the steelmaking process) that reached record highs in 2021 (+ 90% y/y). However, since then, steel prices are dropping: -8% by the end of November. In the meantime, iron ore price declined but remains at an historically high level – around 96 USD/MT on average for the first week of December – which is above the 3-years average price of the pre-pandemic level, but below the 2020 average price (see Graph 2). Cocking coal price in China is also dropping – but still very high in comparison to previous years. Logically, when the two major inputs of the steelmaking process increase in such a significant way, the reduction trims company margins. Over recent years, the volatility of the price of these two key inputs represents a risk for the sector. However, low production costs in some countries can mitigate the risk for producers located in these countries.

A demand-driven sector

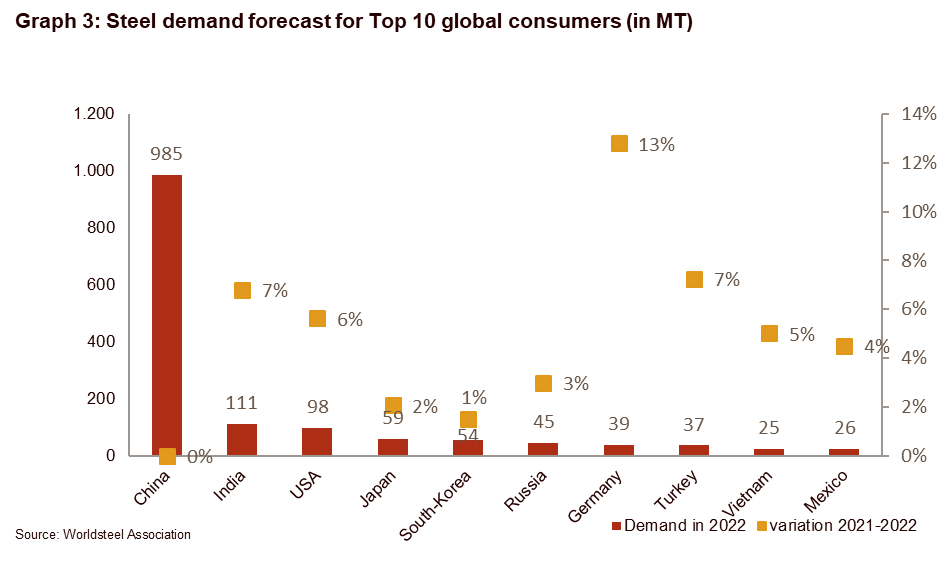

The steel sector is a demand-driven sector. This means that an (unexpected) variation in demand can lead to significant price movements, while production is in principle more stable. In fact, China has a very large role in global demand, since the country consumes the majority of steel produced in the world. Hence, lower Chinese demand for steel usually leads to lower steel prices, even if local differences in prices exist depending on the region and the type of steel. The main risk impacting the steel sector is therefore its heavy dependence on Chinese demand. The latter is influenced by policy put in place by the Chinese authorities. In early December, China’s Politburo announced a loosening of tight policies, which are hitting the property sector, as the Politburo wants to prevent a sector crash and socio-economic instability. It should result in a moderate momentum, at best, for the real estate sector in 2022. This could also translate into higher demand for steel, which would be welcome given the oversupply in the domestic market, and likely to stay so next year.

Globally speaking, the demand for steel is expected to increase steadily over the coming years, driven by demand from the construction, machinery and automotive sectors. The expected rebound in the automotive sector is particularly positive for sales in the steel sector, as it is the second sector in terms of steel consumption, but also because the steel consumed is of high added value (and therefore high margin for steel producers). However, in Europe and Japan, the recovery of the automotive sector could take years before reaching pre-pandemic production volumes, which should temporarily cap the recovery. Consequently, a lower than expected recovery in the automotive sector could hamper demand for steel.

According to the World Steel Association, October 2021 steel forecast, Chinese steel demand is expected to remain stable in 2022, although recent measures announced by the Chinese Government could lead to a slight increase in demand. All in all, global demand is expected to grow slightly in 2022.

Finally, the rise of global protectionism in the steel sector could be an opportunity, at global level, for domestic manufacturers, who would see foreign competition reduce. However, this is a threat to countries with a positive trade balance, such as Japan, Russia and South Korea. To illustrate, in January 2026, the European Union will fully implement the Carbon Border Tax that could result in a drop in steel imports into the EU (unless paying high entry taxes), hitting exporters of steel to the EU, amongst others. Protectionism should therefore be considered a significant risk for companies relying on external markets.

China dominates production

Global production is led by China, which produced 56.5% of global production in 2020. Even this year – a challenging year for global steelmakers – Chinese producers increased their production by 5.2%, while Indian production (second in the world, far behind China that produces approximately ten times more) fell by 10.6%. In 2021, Japanese production fell by 16.2%. In 2022, expected global production should return to pre-crisis level, according to data from IHS Markit.

Conclusion

In 2022, steel demand is expected to grow slightly worldwide, while the market is likely to remain oversupplied. The biggest risk for steel producers remains a drop in demand from China and its related downward impact on steel prices. In addition, risks arise from the input price volatility and the trade tensions (in particular the development of China-US relations and tensions between China and Australia, as well as adoption of new protectionist measures). All in all, steel prices are likely to continue to fall along with the drop in iron ore prices but remain elevated compared to their historical level.

Analyst: Matthieu Depreter – m.depreter@credendo.com