Kenya: Successful Eurobond removes looming repayment threat, though longer-term risks remain

Event

On 12 February, Kenya tapped the international bond market to raise cash and buy back a 10-year Eurobond of USD 2 billion that matures in June this year. The USD 1.5 billion bond, which will mature in 2031, was oversubscribed four times. While the 10.375% yield at issue was lower than the expected 11%, it was substantially higher than Kenya’s last bond issue in 2021, which offered a 6.3% yield. Though that bond’s longer maturity and a different inflationary environment make direct comparison difficult.

The unexpected issuance defied earlier expectations that the National Treasury of Kenya would finance the planned buyback using foreign exchange reserves or loans from multilateral lenders. The successful Eurobond of USD 2.6 billion issued by Côte d’Ivoire in January probably encouraged Kenya to take advantage of potentially more favourable – albeit still costly – rates in the external bond market.

Impact

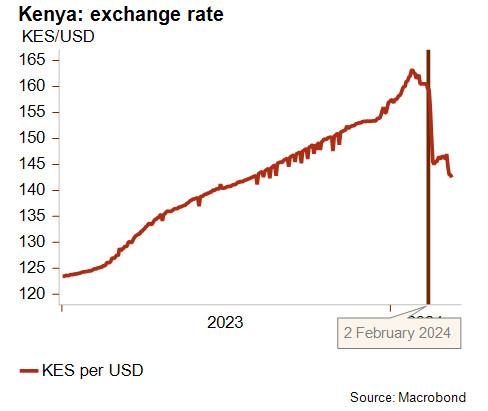

The success of the Eurobond had an immediate impact on the Kenyan shilling’s exchange rate and the currency appreciated more than 9% over the course of several days. The fear that foreign exchange reserves would be used to repay the Eurobond maturing in June had pushed the shilling into depreciation against the US dollar in the last months.

Central bank policy was probably a contributing factor in the shilling’s recent appreciation. Inflation is close to a two-year low thanks to the central bank’s strict monetary policy. In February, it dropped to 6.3% year-on-year as the monetary policy committee of the Central Bank of Kenya (CBK) increased the policy rate from 12.5% to 13%.

Removing the risk around the looming Eurobond repayment of June 2024 has decreased the threat of a sovereign default or a balance of payment crisis in the next year. The evolution of Kenya’s foreign exchange reserves remains a concern though, with the IMF providing necessary liquidity as recently as in January and a USD 624.5 million disbursement. Import cover is around 3.5 months, which is below the 4.5 months cover recommended by the East Africa Community (EAC). Hence, Credendo’s short-term political risk rating remains stable in category 5/7.

Yields for longer-dated Kenyan dollar debt also declined following the Eurobond issue. This demonstrates that markets believe that Kenya’s medium-term debt sustainability has improved. But the issues that are plaguing the Kenyan economy remain present. Persistent government deficits have led to a climbing public debt above 70% of GDP in 2023, with public interest payments weighing down nearly 30% of government revenues. The current government’s path to fiscal consolidation, combined with robust economic growth of at least 5% in 2024 and in the medium to long term, is expected to decrease public debt again in GDP terms starting in 2025. Another persistent risk is that external debt has grown considerably faster than the country’s export base. Servicing the external debt took up close to 20% of export revenues in 2023. According to the IMF and World Bank debt sustainability analysis, Kenya is at a high risk of external debt distress and at a high overall risk of debt distress. Credendo’s medium- to long-term political risk rating will therefore remain in category 7/7 for the time being.

Analyst: Jonathan Schotte – j.schotte@credendo.com