Kenya: Current crisis comes on top of longer-term debt sustainability concerns

While Kenya is one of the countries that responded quickly to the current pandemic by implementing a lockdown, the ongoing crisis is expected to have a large impact, even as the number of recorded covid-19 cases remains limited. The main issue is that this crisis comes when debt sustainability has already been under pressure for some time. This has been mainly caused by years of fiscal slippages, extensive external borrowing and underperforming exports. In response to this evolution, Credendo has decided to downgrade its medium- to long-term political risk classification to category 7. This follows the downgrade of the short-term political risk classification to category 6 in April due to a worsening liquidity position caused by the covid-19 economic crisis. This publication highlights some of the issues the Kenyan economy has been facing over the last few years and how the sudden and large economic crisis has worsened the situation.

Large-scale investment projects and Big Four Agenda

As part of its development strategy, Kenya has been investing heavily in large-scale infrastructure projects. The most prominent one has been the standard-gauge railway connecting Nairobi to the port of Mombasa. The Mombasa port expansion and the development of numerous roads and power plants are other examples. Most of these projects were launched between 2008 and 2016 and led to large public borrowing, external imbalances, a rapid increase in the external and public debt levels and an increase of the debt service. Since President Kenyatta’s second term started in 2017, the development strategy has focused on the ‘Big Four Agenda’, a programme promising affordable housing, food security, healthcare and an expansion of the manufacturing sector. However, this programme has also been associated with large public deficits.

Covid-19 expected to worsen the recurring fiscal shortages

The impact of the investment and subsequent social welfare programmes has been significant on public finances. Since 2008, the overall fiscal deficit has risen and averaged 7.5% of GDP in the last 7 years. This is mainly due to the investment and development projects combined with other fiscal slippages. In the last few years, Kenya consistently committed to reducing its fiscal deficit in the framework of stand-by agreements with the IMF. However, these promises did not materialise, as highlighted in graph 1. For example, in February 2017, the government pledged to reduce the fiscal deficit to less than 4% of GDP by the end of 2019 – it was still around 8% of GDP when the deadline passed. The fiscal slippages seem to have been one of the factors (together with the interest rate cap) that led to an expiration of the latest stand-by agreement with the IMF. Thus, it is currently forecasted that the deficit will stay at around the same level as in 2019. However, as tax revenue is expected to be significantly lower and as expenditure is expected to rise, a further widening in the fiscal deficit is increasingly likely.

As a result of the historic fiscal slippages, the public debt-to-GDP ratio has increased although at a more modest pace given the strong GDP growth. Kenya’s public debt level was around 44% of GDP in 2014 (250% of public revenues) and rose to above 60% of GDP in 2019 (more than 340% of public revenues). For a lower middle-income country such as Kenya, this is a high level, especially as about 60% of the public debt is financed externally and as interest payments accounted for more than 20% of public revenues in 2019 (up from 13% in 2013). On the back of the current crisis, the debt-to-GDP level is expected to rise to around 70% of GDP (or around 370% of public revenue) by the end of 2021.

Persistent macroeconomic imbalances

Over the last two decades, Kenya’s current account balance has been consistently in deficit (which has averaged around 7% of GDP since 2008, when the largest investment projects started). On the import side, this can be explained by the import of capital goods needed for the execution of the infrastructure projects. On the export side, exports have been affected by multiple idiosyncratic shocks such as repeated droughts, which have impacted the important agricultural exports, as well as terrorist attacks, which squeezed tourism receipts. Additionally, it seems that exports have also suffered from delays in the implementation of the infrastructure projects and that, when part of the infrastructure was completed, bottlenecks remained and made it difficult to use the already completed infrastructure. The covid-19 crisis represents a significant demand shock, impacting the demand for exports and the remittance flows towards Kenya and largely affecting the tourism sector. Aside from this shock, the country is also suffering from a locust plague that is impacting its agricultural exports. However, the current forecast projects the current account deficit to remain roughly at the same level as in 2019, as exports and imports are expected to be equally compressed. Imports are indeed expected to drop amid lower imports of capital goods and of oil due to lower oil prices.

Increasingly expensive debt build-up as a main source of concern

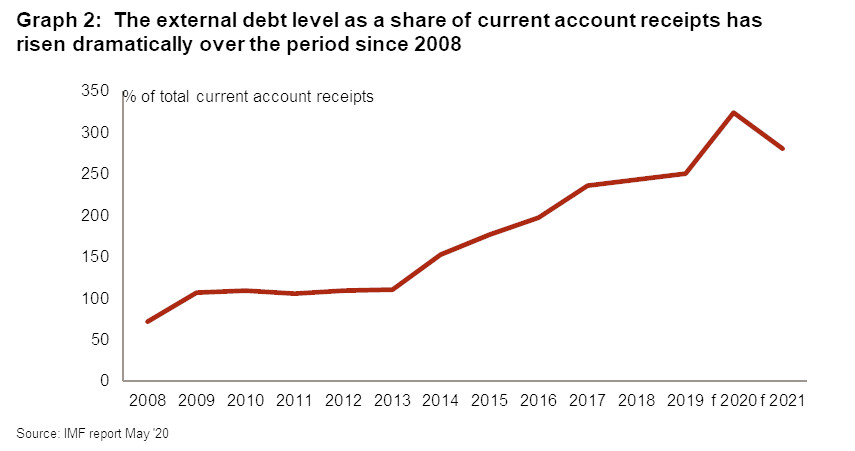

Over the past years, Kenya has attracted relatively low amounts of foreign direct investments and has therefore financed a large part of its current account deficit with debt, creating inflows which led to a significant external debt build-up. Indeed, on a net basis, since 2008, less than 20% of the current account deficit has been funded through foreign investments, while 75% has been funded through lending (with the difference being made up by portfolio investments). The main issue is that external debt has therefore risen more strongly and more rapidly than the current account receipts. This indicates that the investment projects have not generated enough current account receipts. Hence, the external debt-to-current account receipts ratio has increased strongly. While at the start of Kenya’s extensive infrastructure development plan in 2008, the external debt stood at less than 100% of current account receipts, it rapidly rose to more than 200% in 2016. Since then, it has further risen to 250% in 2019, a high level. On top of that, as the covid-19 pandemic is expected to have a very strong negative impact on Kenya’s current account receipts, the external debt-to-foreign earnings ratio is expected to rise to more than 320% this year and should decrease to around 280% in 2021, under the assumption that the covid-19 pandemic wanes rapidly. Moreover, the short-term external debt is also very high. As an evident result of this high external debt level, the yearly debt service has risen significantly. In the last four years, Kenya spent a large share of its current account receipts in servicing its external debt and, in the coming years, debt service is expected to remain at this high level. In particular, large external repayments are due as of 2024. In light of the current covid-19 crisis, this represents a significant challenge, as the tighter global financial conditions for emerging markets makes borrowing on global financial markets virtually impossible.

Analyst: Jan-Pieter Laleman – jp.laleman@credendo.com