India: Despite a weakening economic momentum, India looks confidently at the future

Event

Less than one year before the general elections, India, under premiership of Narendra Modi, remains in good economic shape. After having recorded 7.2% growth in FY2022 (which ended in April 2023), GDP is still expected to rise by 6% this FY2023. Even though it is on a slowing mode, the economy is expected to be the fastest from the G20 in 2023 in a context of weakening global economy.

Impact

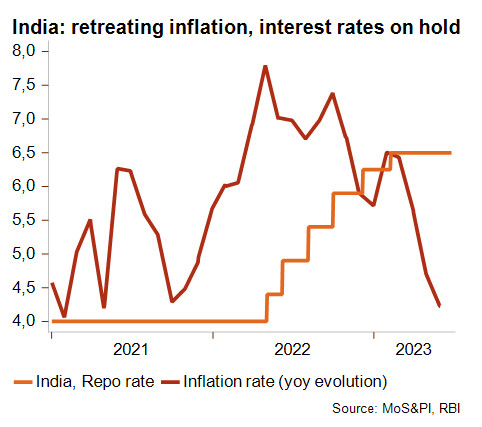

Domestic economic conditions have been stabilising or improving. On the back of lower fuel and food prices, inflation has gradually eased since February, falling to 4.3% in May, i.e. the lowest level since April 2021. This has allowed the Reserve Bank of India to pause its tighter monetary policy, with stabilising policy interest rates at 6.5%.

That being said, risks from a weaker monsoon and El Nino’s impact on agriculture production could fuel inflation pressures in the coming months again. The government’s worries about food production issues have recently resulted in the setting of limits on wheat volumes retailers are allowed to store. Next year’s elections probably also play a role in the government’s precautionary policies. Though his BJP party was defeated in a recent state election (Karnataka), and while food prices remain a traditional risk for any incumbent PM, Narendra Modi is largely favourite to succeed himself next year and rule the country for a third five-year mandate. Besides a strong economy, Modi will capitalise on India’s G20 presidency to enhance his position by bringing India to the fore and strengthening the country’s status as an influential global player. Adopting a neutral position towards developed and developing countries also confers valuable advantages to India’s economic outlook. For example, oil imports from Russia have soared under Western sanctions, whereas Modi reached landmark trade and investment agreements (including technological transfers) with the USA during his state visit in the USA.

Moreover, India continues to benefit from global supply chain diversification in the manufacturing sector, as a result of rising geopolitical risks between the USA and China. Hence, FDI are forecast to increase substantially in the future and will thus help improve India’s balance of payments. This positive contribution will add to the reduction of the current account deficit (from 2.6% of GDP in FY2022 to 2.2% in FY2023). Indeed, moderating food and fuel imports, weaker domestic demand, stronger workers’ remittances and services exports are expected to more than offset the slowing exports of goods. Those developments could support somewhat the Indian rupee, which has showed more resilience over the past nine months. Still, the currency remains historically low against the US dollar and could face further depreciating pressures in 2024.

Credendo’s short-term risk ratings are stable. The short-term political risk is solidly in category 2/7 thanks to strong liquidity and an improving outlook for foreign exchange reserves (currently equal to 6 months of import cover). The business environment risk is expected to remain in the moderate risk category D/G in a context of economic slowdown, weaker inflation and a stabilising rupee.

Analyst: Raphaël Cecchi – r.cecchi@credendo.com