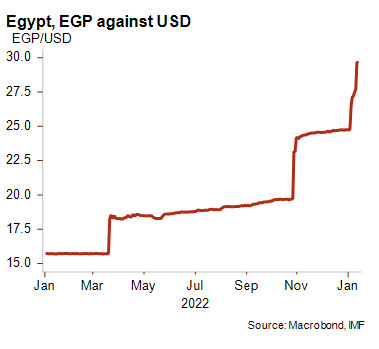

Egypt: Steady depreciation of Egyptian pound continues

Event

In January, the Egyptian pound (EGP) tumbled, falling by 7.3% in just one day on 11 January 2023. The currency has depreciated, following the Egyptian authorities’ decision in October to move to a more flexible exchange rate in line with the requirements of the recently approved IMF agreement.

Impact

Since last year, Egypt – a large food importer – has been confronted with significant external shocks, provoked by the fallouts from the war in Ukraine and the ongoing tightening of the global financial conditions. As a result, Egypt has experienced significant balance of payments pressures given large outflows of foreign capital and a rise in the import bill. Moreover, in light of the central bank’s efforts to maintain exchange rate stability, the foreign exchange reserves came under additional pressure. To stem this pressure, the authorities imposed a series of measures. One of these measures was to restrict imports by requiring letters of credit.

In this context, the IMF programme and the shift to a more flexible exchange rate are very welcome developments as they are expected to ease foreign exchange pressures. The announced phase-out of import restrictions is also positive news since these restrictions have led to an accumulation of external payment delays. These developments support the short-term political risk, which is currently classified in category 5/7 with a negative outlook given the high uncertainty.

However, in the short term the depreciation is also adding to inflationary pressures (24.5% YoY in December) and is expected to increase the cost of reimbursing debt denominated in foreign currency in local currency terms. This is weighing on the business environment risk, which is classified in category G/G. Moreover, sharp inflation pressure is likely to increase social discontent.

Analyst: Andres Hernandez Cardona – a.hernandezcardona@credendo.com