Short-term political risk: Six countries downgraded, one country upgraded

In the framework of its regular review of short-term (ST) political risk, Credendo has downgraded five countries and upgraded one country.

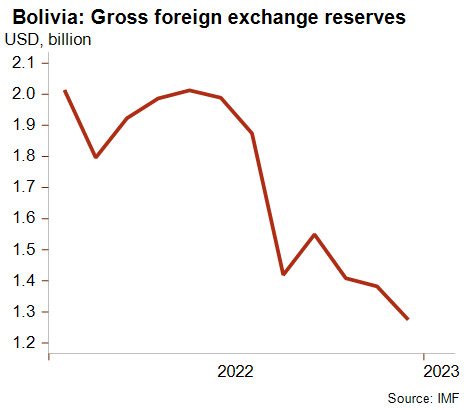

- Bolivia: downgrade from 4/7 to 5/7

Keeping the boliviano pegged to the US dollar has led to a rapid decrease in foreign exchange reserves in the past years. As a result, foreign exchange reserves stand at a low level (only covering one month of imports in December 2022). These low levels make the Andean country very vulnerable to confidence and external shocks. Mid-March, vulnerability to a confidence shock was illustrated by a run on the boliviano, triggered by rumours of a shortage of US dollars. Moreover, financial market access seems to be very restricted. As a result of the deteriorating liquidity, Credendo has decided to downgrade the country to category 5/7 from category 4/7. Further downgrades cannot be excluded in the future, depending on the macroeconomic policies of the government.

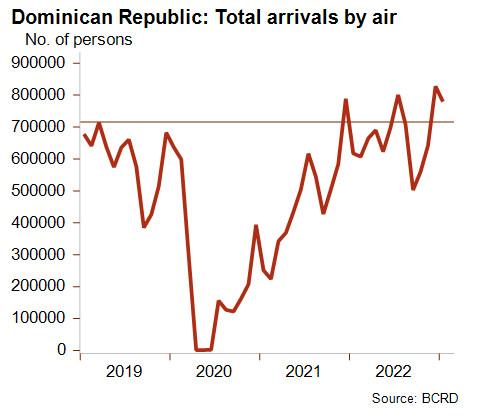

- Dominican Republic: upgrade from category 3/7 to 2/7

Tourist arrivals to this Caribbean island have skyrocketed since the dip in 2020, when international air traffic was curtailed due to the Covid-19 crisis (see graph below). Tourist arrivals are even higher today as they were before the pandemic. Given the high reliance on tourism (accounting for around a third of current account revenues before the Covid-19 crisis), current account revenues have been steadily increasing since 2020. Accordingly, nominal foreign exchange reserves have been rising and stand at around five months of import cover in January 2023. Moreover, the ratio of short-term external debt to current account revenues has been decreasing. Amid ameliorating liquidity indicators, Credendo decided to upgrade the Dominican Republic to category 2/7 from category 3/7.

- Moldova: downgrade from category 5/7 to 6/7

The Moldovan economy is hit hard by the fallouts from the war between Russia and Ukraine, notably amid a sharp increase in gas prices and disruption of energy supplies, which have led to a widening of the current account deficit. On the positive side, gross foreign exchange reserves are supported by the disbursement under the IMF support programme and financial support from the EU (partly in loans, which increases the external indebtedness). Despite the recent increase in foreign exchange reserves, Credendo decided to downgrade Moldova’s short-term political risk to category 6/7 as tensions with Russia are increasing in a country that is divided between a pro-Russian and pro-EU population. Given the ongoing war in Ukraine, the main fear is that the conflict will extend to Moldova. However, even though this scenario cannot be ruled out, it is unlikely to happen in the very short term as Russian troops are concentrating their efforts on Ukraine.

- Downgrade from 2/7 to 3/7 for Kazakhstan and downgrade from 4/7 to 5/7 for Kyrgyzstan

Goods export to Russia from Kyrgyzstan (right-hand side of the scale), Armenia, Kazakhstan and to a lesser extent Turkey has increased sharply (see graph below). In this context, it is increasingly likely that the USA and/or the EU will impose sanctions on entities that are circumventing or helping to circumvent western sanctions on Russia. Therefore, Credendo decided to downgrade the short-term political risk of Kazakhstan and Kyrgyzstan to category 3/7 and 5/7 respectively. For the time being, the short-term political risk classifications of Armenia and Turkey – in category 4/7 and 5/7 respectively – are being maintained but have a negative outlook.

Kazakhstan’s short-term political risk is supported by the low short-term external debt, the current account surplus and sufficient access to financial markets. The evolution of gross foreign exchange reserves is volatile (see graph below). Despite a sharp increase, they remain at a relatively low level (two months of imports covered in January 2023).

The sharp increase is partly explained by the high commodity prices and – to a lesser extent – by the influx of Russians (and their money) into Kazakhstan. Looking ahead, high reliance on commodities as a source of current account receipts (notably hydrocarbon) and the close link to the Russian economy are key vulnerabilities. Oil exports could be severely affected by a durable interruption of the oil pipeline of the Caspian Pipeline Consortium (CPC). The pipeline has been closed four times in 2022, highlighting that the Russian authorities can use it as political leverage. On the positive side, Kazakhstan could benefit from the relocation of firms seeking to maintain a presence in the region and from the creation of new trade routes (such as the Middle Corridor) aiming to bypass Russia.

In January 2022, huge protests took place following the increase in energy prices. Despite government efforts to address underling grievances, the risk of sudden eruption of social unrest remains, notably as inflation continues to increase and to put pressure on the cost of living.