Argentina: One of the severest droughts in two decades is on the cards and could hinder access to foreign exchange

Event

Argentina is going through a fifth month of drought, with little to no rain, as a consequence of La Niña phenomenon. Typically, the Pacific Ocean naturally cycles between El Niño and La Niña conditions, which have wide-ranging impacts, affecting patterns of rainfall, flooding and drought around the Pacific Rim. La Niña normally occurs every three to five years, but it can occasionally occur over successive years. Scientific research suggests that climate change is currently favouring La Niña events, which is bad news for South America, as it triggers drought conditions already for the third year in a row. In Argentina, the harvest export earnings of soybean, corn and wheat of the upcoming summer months would normally alleviate pressure on the tight liquidity situation of the country. However, the ongoing drought is already clearly affecting the planting season. Hence, as this episode of drought is expected to be one of the severest in the last 20 years, it will likely lead to significantly lower current account revenues in the coming months.

Impact

Argentina faces a very tight liquidity situation due to its commitment to an overvalued currency peg. The Argentine peso (ARS) has devaluated by 60% since the beginning of the year. The official exchange rate is 167 ARS to 1 US dollar (USD) (on 30 November), while the parallel black market rate is 313 ARS to 1 USD (cf. graph 1). Although the currency peg is unsustainable, the current unorthodox and populist government is unlikely to float the exchange rate in the coming year. Annual inflation is very high at 88% (end of October 2022) and regularly fuels unrest. Moreover, while presidential and parliamentary elections are planned to be held next year, the influence of unorthodox fractions in the government is clearly rising.

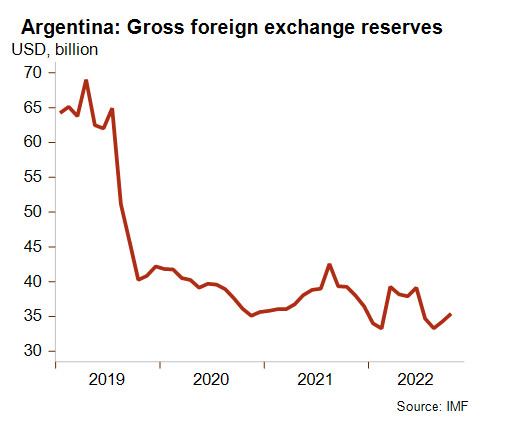

Historically high energy prices already weighed on the liquidity situation of the country in the past year, as Argentina is a net fuel importer. Due to the tight liquidity situation, the Central Bank of Argentina has regularly deepened its capital controls since March 2022 in order to slow down the negative trend in the gross foreign exchange reserves (see graph 2). However, the protracted drought is likely to place additional downward pressure on foreign exchange reserves in the coming months.

Finding additional external financing to maintain the overvalued currency peg and avoid foreign exchange shortages will be difficult. A 30-month IMF programme of USD 44 billion was signed in March 2022 and provides the country with vital liquidity, as Argentina is shut off from financial markets. That being said, quarterly disbursements (last on 7 October) are mainly used to pay back a previous IMF loan of USD 50 billion. An increase of the IMF programme seems unlikely as Argentina is already IMF’s biggest debtor and the current loan is already very high at about 1000% of quota (normally a country can borrow up to 435% of its quota). Moreover, China is already providing vital financing through a foreign currency swap line of about USD 19 billion (already taken into account in the gross foreign exchange reserves).

Given the current drought, the willingness to keep an overvalued currency peg and the slim possibilities of additional external financing, tighter currency controls or foreign exchange shortages can be expected in the coming months. In this overall context, Argentina’s medium- to long-term political risk rating remains in category 7/7. Moreover, the outlook is negative for the short-term political risk rating (6/7).

Analyst: Jolyn Debuysscher – J.Debuysscher@credendo.com