Colombia: Higher external debt increasing Colombia’s vulnerability to tighter financial conditions

- Protests and low popularity are hindering new President Duque’s policies.

- Political violence risks are resurfacing due to the fragility of the peace deal with the FARC and stalled peace talks with the ELN.

- The fiscal position is constrained by domestic pressures and external shocks.

- Higher external debt represents an increasing risk amid less-favourable global financial conditions.

- Increased vulnerability has led Credendo to downgrade Colombia’s MLT political risk to 5/7.

No grace period for the new President

President Duque, who has been in office for more than six months now, has been having a tough mandate. Although his rule is a continuation of the policies launched under the previous government, his mandate has been marked by recurrent protests, a failure to implement a bold tax reform and declining popularity. Moreover, Colombia’s most significant political achievement of recent decades, namely the 2016 peace deal with the FARC, is facing headwinds. The FARC is indeed blaming Mr Duque for not enforcing the terms of the peace agreement as the reintegration of former rebels has yet to be formalised, while they are facing an increasing number of murders. Therefore, unless those problems are tackled, the peace agreement could remain fragile as the return of former rebels to criminality highlights.

Despite the peace agreement with the FARC, the level of political violence risk remains in category 4/7 as the ELN (National Liberation Army), known for being the most significant guerrilla group of the current time, frequently attacks oil pipelines in remote areas and recently perpetrated a major attack against a police academy in Bogota, killing 21. Since then, President Duque has urged Cuba to capture and extradite ELN peace negotiators, which Havana refuses to do. Hence, peace talks with the ELN are expected to stall for an extended period. In the coming months, in line with his anti-drug policy, Mr Duque seems likely to maintain a hard stance towards the ELN, which could allow him to raise badly needed support from a shocked population at the cost of internal stability. However, this could be a risky bet as the latest polls still show that the majority of the population continues to support a peaceful approach to the ELN.

In addition to domestic security risks, Colombia has to cope with the highest inflow of refugees – 1 million – from instable neighbour Venezuela. This influx is causing social instability in border areas. It has also contributed to strained relations between Mr Duque and his counterpart, President Maduro, as the former has joined most South American countries in calling for a change of regime in Venezuela.

Higher external debt amid tighter global financial conditions resulting in an MLT downgrade to 5/7

As a net oil exporter, Colombia’s economic outlook remains driven by the oil price. The drop in oil prices led to an increased fiscal deficit of more than 3% of GDP in the period 2015-18. Earlier projections of a substantial fiscal deficit reduction for the coming years were probably too optimistic after the President’s attempt to push through a significant tax reform foundered in Congress. The diluted version of the tax reform was implemented in January and combined corporate tax cuts and tax increases on high incomes. It is expected to deliver only a moderate cut in the fiscal deficit. Also, the future oil price could remain at lower levels than initially forecast (i.e. close to USD 70 a barrel), whereas the large inflow of Venezuelan migrants in the country represents a non-negligible fiscal burden (estimated at an annual cost of 0.5% of GDP). Over the years, deeper fiscal deficits have led to an increase in public debt from 37.8% of GDP in 2013 to 50.6% in 2015. Since then, this ratio has remained roughly constant thanks to robust GDP growth. At the same time, the government has increasingly borrowed externally over recent years. Hence, the external share of public debt rose sharply from 40% in 2013 to an expected level of 60% in 2018. This build-up in external debt has caused the steady deterioration of the country’s financial situation and increased the refinancing risks.

Colombia has benefited from a strong inflow of capital in the period since the financial crisis. This has mainly come in the form of FDI and portfolio investments (until 2015). While FDI inflows have been relatively stable, portfolio inflows have fluctuated strongly. Besides those capital inflows, increased lending has also played a role in funding the current account deficit, which deteriorated sharply to a record high of 6.4% of GDP in 2015 amid low oil prices. Since then, it has steadily narrowed to an estimated 2.6% in 2018, a level where it is forecast to stabilise in the coming years.

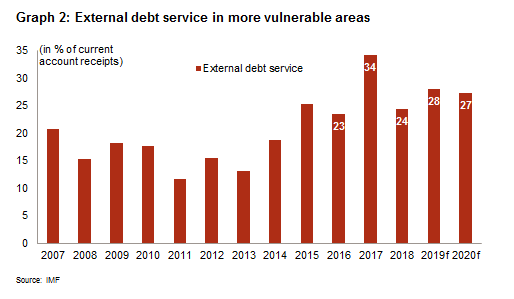

External debt almost doubled from 25.7% of GDP in 2013 (or 130% of total current account receipts) to 49.6% (almost 270% of current account receipts) in 2016. Thereafter, it dropped slightly (46.6% of GDP) but has remained high vis-à-vis total current account receipts (around 230% in 2018). The downward trend of those ratios is expected to be slow in the MLT. The external debt build-up resulted in a higher external debt service close to 25% of total current account receipts at the end of 2018. In its 2018 Article IV report, the IMF forecast a slow upward trend in the coming years, which would not materialise in the event of sharp deterioration of global financial conditions, particularly higher interest rates. The expected weakening of US and global economic activity nevertheless makes such projections uncertain.

All in all, in recent years, the sharp increase in external debt, to finance recurring fiscal deficits or resulting from enhanced private borrowing on the international financial markets, has progressively made the country more vulnerable. Therefore, given the government’s difficulties in reaching its fiscal targets and the less-supportive external economic (the latest forecasts of average GDP growth above 3.5% in the MLT could prove to be too optimistic), trade and financial context, Credendo has decided to downgrade the country from 4/7 to 5/7.

Analyst: Raphaël Cecchi – r.cecchi@credendo.com