Business environment risk: Twenty-four upgrades

In the framework of its regular review of business environment risk, Credendo upgraded 24 countries. During the second quarter, slightly improved growth expectations translated into a clear net upgrade trend, which especially benefited Europe and Asia.

Business environment risk

- Czech Republic: upgrade from E/G to D/G

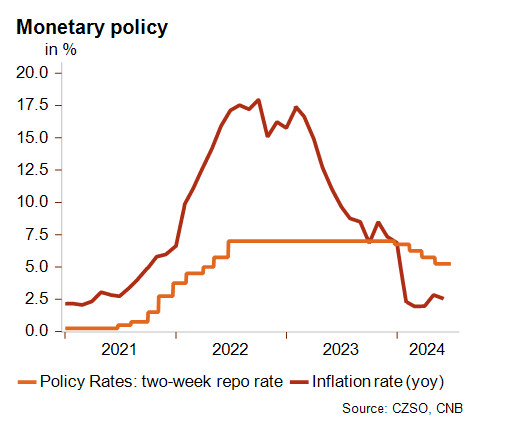

After recording a slight recession in 2023, the Czech Republic has observed a rebound in economic growth at the start of 2024. This rebound was mainly driven by lower borrowing costs and disinflation, which are supporting domestic demand. In December 2023, the board of the Czech National Bank (CNB) initiated a cycle of interest rate reductions (see graph below). By May 2024, the policy rate had been reduced to 5.25% after two consecutive cuts of 50 basis points in March and May 2024. Significant improvement has been made in managing inflation. The inflation rate, which exceeded 6.8% at the end of 2023, substantially decreased to 2% by March 2024, thereby testifying a return to more economic stability. These positive developments justify the upgrade in the business environment risk rating from E/G to D/G.

- Malaysia: upgrade from C/G to B/G

After a sharp post-Covid recovery (+8.7%), GDP growth markedly declined in 2023 (+3.7%). The drop partly reflected exports suffering from the global economic slowdown and weakening key US and EU markets. Since then, a rebound has been underway as the surge in exports of electronics, a major sector, benefits Malaysia’s export-led economy. Moreover, consumer demand is strengthened by easing inflation to 1.8% in the first quarter whereas the central bank intends to keep interest rates unchanged at 3%. For the year 2024, GDP growth is expected to pick up to 4.4% and stabilise at this level next year. The improving economic activity, lowering financial costs and relative currency stability over the past year on the back of a rising current account surplus, have led to an upgrade of the business environment risk from C/G to B/G. Looking ahead, Malaysia is among the Asian countries expected to reap benefits from friendshoring investments and shifting global supply chains (the country is welcoming more Chinese companies). On the other hand, the Malaysian open economy will have to cope with rising geopolitical tensions and global protectionism.