Asia: Most business environment risk ratings remain stable as the Covid-19 Delta variant continues to hinder economic activity

Covid-19 Delta variant hampers Asia’s economic normalisation

In 2020, the Covid-19 pandemic led emerging and developing Asia into its first economic contraction ( 0.9%) in 60 years. However, as the region managed to largely contain the virus, it became the first to recover already around May 2020, on the back of booming manufacturing exports. This picture has changed since the 2nd half-year of 2021. Indeed, Covid-19 resurged due to the more contagious Delta variant, and this has harmed the region’s economic momentum. Although last July’s IMF forecasts put the region ahead as the fastest growing, by 7.5% in 2021 and 6.4% in 2022, those projections will probably be revised slightly downward. Asia’s worst Covid-19 wave (caused by the Delta variant) combined with slow vaccination – even though it has been accelerating over the past months in several countries – has indeed negatively impacted regional economic activity, as it has led to lockdown measures, persisting travel restrictions and global supply chain disruptions. Moreover, high energy prices (oil and gas) are harming economies in a region where the large majority of countries are net fuel importers. Additionally, the giant Indian and Chinese economies are experiencing shortages of coal – still the dominant fuel – as a result of insufficient storage, overly expensive imports and stricter restrictions on carbon emissions in China. All those factors are expected to affect GDP growth in the coming months.

Although real GDP growth is expected to continue to slow down, there are regional disparities, which are largely depending on the vaccination process and Covid-19 outbreaks. Faster vaccination could translate into stronger economic performances for small economies such as Singapore and Taiwan if some shortages (e.g. chips) are overcome. On the other hand, many ASEAN countries involved in supply chains, such as Thailand, Malaysia, the Philippines and Vietnam, are expected to experience a more pronounced downward revision in growth forecasts. Vietnam has been drawing attention over the past months as it was among the rare countries that managed to grow last year. That was until a Covid-19 surge in the country’s economic centre, Ho Chi Minh City, badly hit manufacturing exports and led to some temporary relocation of production outside the country, due to prolonged strict lockdowns. After a sharp year-on-year contraction in the third quarter, annual GDP growth might be moderate this year and barely exceed its 2020 level (i.e. +2.9%). Myanmar is a special case as the economy collapse could reach 18% this year due to the fallout of the February military coup and the deteriorating Covid-19 situation. As for China, in addition to the negative factors mentioned above, its economy could suffer from the impact of Evergrande’s tumble and its contagion of the already slowing, yet key real-estate sector. Given its economic weight and importance to the regional economy, China’s slowdown could harm the demand for other Asian exports. To mitigate the shock, Beijing could somewhat ease its policies in the near term. All in all, the Delta variant has shown that a zero-tolerance approach can be economically very painful, which could foster authorities in several Asian countries (such as Vietnam and Singapore) to eventually decide to learn how to live with Covid-19 in order to impose less stringent economic restrictions.

Upgrades in business environment risk ratings are delayed

In this economic context and unlike other regions, the number of upgrades was limited for Asia during Credendo’s latest review of business environment risk classifications. The decision to upgrade Bangladesh (from E/G to D/G), India (from F/G to E/G), Pakistan (F/G to E/G) and Indonesia (from E/G to D/G) was made on the back of improved economic activity (notably in Pakistan where containment measures were softer than in neighbouring India) and stabilising currencies (except in Pakistan). As in other parts of the world, inflation pressures will continue to be closely monitored. In Asia, current upward pressures due to high commodity (especially energy) and food prices (particularly in Pakistan) and global supply chain disruptions expected to persist in 2022, will face downward price pressure from slowing short-term GDP growth. Therefore, as long as inflation remains within an acceptable range, central banks are likely to delay interest rate increases and extend their accommodative monetary policy for part of 2022.

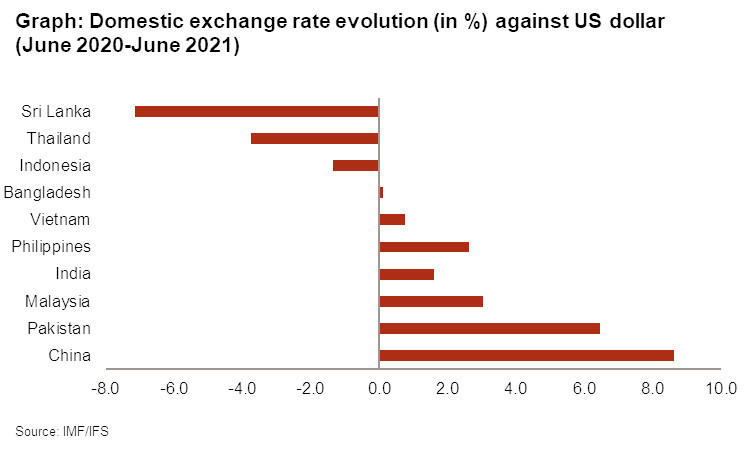

Currency evolution is a major factor for the cross-border business environment risk. As the above graph shows, main Asian currencies largely showed resilience during the pandemic between mid 2020 and mid-2021. However, a few have suffered since then, including the Thai baht, the Philippine peso and the Pakistani rupee, which have lost between 4 and 8% of their worth against the US dollar between July and September. The impact of the Covid-19 surge on economic activity and business sentiment, and for Pakistan also the impact of Afghanistan’s expected economic collapse, are among the primary reasons.

In the coming months, Asia’s business environment risk outlook will largely depend on the evolution of Covid-19, countries’ vaccination roll-out, global supply chain disruptions, high oil and gas prices and possibly also geopolitical and trade tensions between the US and China.

Analyst: Raphaël Cecchi – r.cecchi@credendo.com