Argentina: Economic malaise is intensifying as currency is trapped in a severe negative spiral amid political and economic uncertainty

Event

On 13 August, the primary elections were held in Argentina. These elections are often referred to as the dress rehearsal of the national presidential elections (in October) and are a more reliable indicator for the popularity of the presidential candidates than polls. Far-right and radical outsider candidate Javier Milei obtained the most votes. Opposition party candidate Patricia Bullrich, a hard-line conservative, was second in the votes.

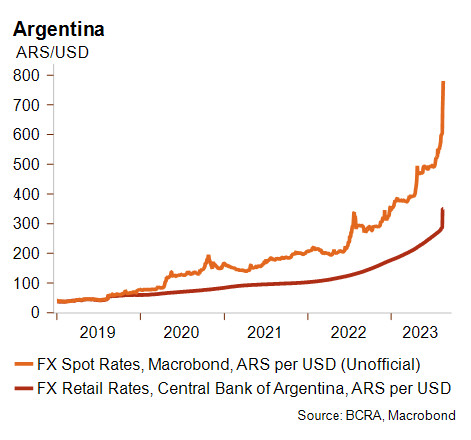

These results have sparked a sell-off of the Argentine peso and bonds on the financial markets following Javier Milei’s extreme campaigning remarks – also referred to as the Trump of Argentina – who said the central bank should be burned down for mismanaging the economy. Under huge pressure, the central bank of Argentina devalued its official currency by almost 20% in order to stem the jittery financial markets, though the currency still stands at less than half of the unofficial parallel market rate and continues to climb (see graph below). The central bank also tightened controls on access to the popular parallel currency market. However, pressure on the currency remains high and a further devaluation or a disorderly floating of the exchange rate is possible, though the current governing populist coalition Frente de Todos (FdT) will try to stave off a maxi-devaluation and is expected to continue to undertake unorthodox macroeconomic policies.

Impact

Javier Milei’s victory in the primary elections does not mean he will win the presidential elections in October. These are still wide open and a run-off election in November between Milei and Bullrich is not ruled out. A lot can still happen in the Argentine political landscape during the months leading up to the presidential elections. Moreover, Milei’s win might represent a protest vote given the current economic malaise. Argentina is likely heading to a recession of 2% this year, while annual inflation is very high at 113% (end of July 2023) and the recent devaluation is expected to push up inflation in the coming months.

Argentina also faces a very tight liquidity situation due to its commitment to an overvalued currency peg, while the worst drought in six decades has seriously hurt current account revenues as food is historically a major source of current account revenues and accounted for about half of current account revenues in the past years. Although the currency peg is unsustainable, the current unorthodox and populist government is unlikely to float the exchange rate before the presidential elections of October, as it would fuel inflation and unrest. Hence, unorthodox policies, such as further deepening the capital and currency controls to safeguard gross foreign exchange reserves (see graph below) or foreign exchange shortages, are likely in the coming months.

Foreign exchange reserves have already lost almost half of their value since the end of last year and stand at their lowest level in more than eight years (around three months of import cover in June 2023). The government has been seeking additional liquidity as Argentina is shut off from financial markets. For example, it tried unsuccessfully to bring forward its IMF disbursements to the end of June. Nevertheless, the government and the IMF announced in July a staff-level agreement that would free up access to disbursements if it is approved by the IMF Board on 23 August. However, even if these quarterly disbursements are approved (baseline scenario), they will mainly be used to pay back a previous IMF loan of USD 58 billion. The government is also negotiating (trade) financing with Brazil, Qatar, Russia and India. China is already providing vital financing through a foreign currency swap line of about USD 19 billion (already taken into account in the gross foreign exchange reserves). The Argentine government activated this currency swap, which is increasing the availability of CNY, in theory, but it is only meant to fast-track imported goods from China. Hence, Chinese exporters will likely be the only ones to benefit from the increasing availability of CNY as the currency swap is intended to stimulate trade between China and Argentina. Moreover, the activation of this currency swap will decrease foreign exchange reserves and further tighten the liquidity situation.

Looking ahead, there is some hope on the horizon. A stronger harvest is expected for next summer (October-May) as El Niño should bring more rainfall next year. Increasing demand for lithium for the green transition could also stimulate the economy (Argentina lies in the lithium triangle). Recent investments in the world’s second-largest field of shale gas could boost energy exports as well. However, it remains to be seen if the country will be able to make it to next year without falling into a huge economic crisis and/or a derailment of the IMF programme.

Given the decreasing foreign exchange reserves and the willingness to keep an overvalued currency peg, tighter currency controls or foreign exchange shortages can be expected in the coming months. In this overall context, Argentina’s medium- to long-term political risk rating remains in category 7/7. Moreover, the outlook is negative for the short-term political risk rating (6/7).

Analyst: Jolyn Debuysscher – J.Debuysscher@credendo.com