Thailand: The return of Chinese tourists will boost Thailand’s economy

share article

Event

China’s reopening is expected to have a booming impact on tourism in Asia. As a major tourism destination in the region, Thailand might be the first beneficiary and see its economic performance further improve in 2023, amid a weaker global economic environment.

Impact

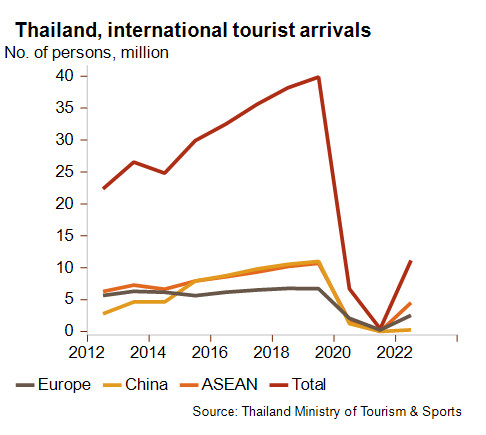

Tourism is a major sector of Thailand’s economy. Prior to Covid-19, it generated more than 17% of the current account receipts and employed 20% of the population. The sector is expected to underpin the country’s good macroeconomic fundamentals, despite the deteriorating global economic environment. While the industry was still in limbo in 2021 due to the Covid-19 pandemic, the gradual and partial recovery in tourism observed in 2022 is expected to accelerate this year (albeit still far from its pre-Covid-19 levels). This projection largely rests on one factor: Chinese tourists. Following the lifting of travel restrictions and China’s border reopening, a wave of Chinese tourists is expected to spread across Asia, especially in Thailand. Indeed, in 2019, Thailand was the favourite destination of Chinese tourists; they accounted for more than 25% of Thailand’s total visitors.

This would be a boon to Thailand in a year where Western demand for Thai manufactured exports is expected to sharply slow down. The reopening of China, Thailand’s second export market before Covid-19, could nevertheless partially offset this impact. Therefore, Thailand’s economy is expected to see a further improvement of its economic activity. In January, the IMF expected Thailand’s growth to pick up to 3.7% this year (from 3.2% in 2022). The main risk to the tourism outlook could come from the general elections next May if the outcome is contested and leads to protests against the military-backed regime that has been in place since 2014.

An economic strengthening would further increase resilience and confidence in the outlook and government policies. This is highlighted by a strong baht. The Thai currency has appreciated by 5% against the US dollar over the past 12 months, making it the most resilient currency in Asia.

Improved tourism prospects are also expected to enable the current account balance to return into surplus this year, as it has mostly been the case this century. It might contribute to reverse the annual decline in foreign exchange reserves of the past two years. In the end of 2022, their volume covered less than 7 months of imports, which represents a nine-year low.

In addition to the weakening external demand, the persisting war in Ukraine is another downside risk to the outlook, as it will continue to swell import costs and fuel energy inflation pressures. In 2022, inflation reached an average of 6.3%. However, it has been slowing over the past months to 5% in January on the back of moderating energy prices and the Bank of Thailand’s monetary tightening. Interest rates have been raised several times since August, reaching 1.5% at the end of January, with the aim of bringing inflation in the 1 to 3% range. The boost from Chinese tourism could slow down the gradual inflation moderation during the year.

Based on those various risk factors and expected economic developments, the outlook for Credendo’s short-term political risk and business environment risk ratings is positive.

Analyst: Raphaël Cecchi – r.cecchi@credendo.com