Argentina: Tenth sovereign debt default narrowly avoided thanks to new IMF programme, but foreign exchange shortages persist

Event

On 25 March, the IMF board approved a new IMF programme with a USD 45 billion loan for Argentina. It is the first deal with the IMF since the last programme – which represented the largest IMF loan ever – derailed in 2019. The loan came just in time for Argentina to repay an – already slightly delayed – debt of USD 2.8 billion with the IMF on 31 March. Without the new IMF deal, it was unlikely that Argentina would be able to honour this debt repayment and avoid a tenth sovereign debt default.

The IMF programme will guide policymaking until 2024 and will require – among other things – gradual fiscal consolidation, cutting of energy subsidies, resolving of external arrears and a gradual easing of foreign exchange controls. It remains to be seen whether the divided and populist government – facing elections next year – will be able to deliver on its unpopular commitments in the IMF programme. Hence, a derailment of the IMF programme and a new sovereign debt restructuring are still possible in the coming years.

Impact

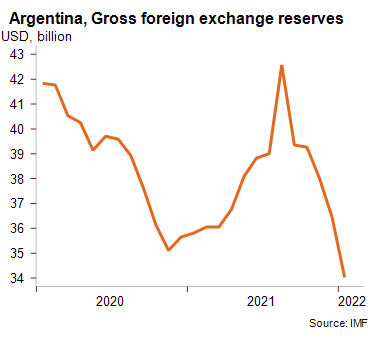

Despite the IMF loan, the pressure on foreign exchange availability will not be solved soon, considering Argentina’s large external debt repayments, its backlog in external arrears and its commitment to a currency peg. Hence, the government is seeking financing elsewhere (China, Russia and the Middle East) as the financial markets remain closed for the country despite the new IMF loan. Furthermore, a couple of weeks before the IMF programme was approved, the BCRA (Central Bank of Argentina) further tightened its foreign exchange controls. The new legislation appears to further restrict access to the official exchange market and add a higher level of bureaucracy for importers. The measure is likely to remain in place until the country has a more stable level of foreign reserves (see graph), which is unlikely before the end of the year.

The business environment risk remains very high (category G/G). The Argentine economy is in a stagflationary environment. It faces skyrocketing inflation (53% annually in February 2022) and rather low real GDP growth, forecasted between 3.5% and 4.5% in 2022 according to the IMF statement in March 2022. Considering the combination of downward pressure on the currency peg, tight currency controls and elevated indicators for the institutional framework, Argentine importers are facing a difficult business environment. Looking forward, the current sanctions on Russia are affecting energy prices (Argentina is a net oil importer) and will continue to push up inflation, while energy shortages are also possible. Furthermore, violent unrest and labour strikes are highly likely amid high inflation. Lower economic growth than currently forecasted is therefore very likely as well, even if the country is likely to benefit from the higher food prices.

In this overall context, Argentina’s MLT political risk rating remains in category 7/7. Moreover, the outlook is negative for the ST political risk rating (6/7) amid tightened currency controls.

Analyst: Jolyn Debuysscher – J.Debuysscher@credendo.com